Intelligent Monitoring Group ($IMB.AX) FY 2024 Update

Even though there is occasionally cause for clarification or criticism, the company is overall developing better than planned.

First of all, the disclaimer: I am invested in Intelligent Monitoring Group ($IMB.AX). Nothing I write should be considered investment advice.

I will mostly limit my update to what is genuinely new and where there is room for clarification. For those who are not familiar with IMG, you can read my write-up here. Much of what I am communicating is tentative, as I still have some unanswered questions, which I expect to resolve soon. I will publish an update or edit afterwards.

No red flags regarding the integration

The biggest risk I mentioned in my write-up was the integration of the acquisitions. This is something the company, and especially CEO Dennison Hambling, is well aware of, as he has repeatedly brought it up. It's all the more interesting now to see that he is describing the company as being in a 'calm place' in this context:

At present, there are no negative signs regarding the integration of the acquisitions. This is also reflected in the better-than-expected figures, which are consistently above or at the upper end of the guidance or pro forma EBITDA. I usually avoid using this term, but so far, they have clearly been conservative in their estimates. There have been no negative surprises in this regard.

Dennison Hambling also mentioned just a few days ago that, while they remain open to acquisitions, they do not consider themselves a roll-up.

The guidance for FY 2025 is set to be released at the AGM in October. However, based on the statement in the press release, it can already be assumed that this year's results will surpass those of the previous year. Based on the company’s recent comments, I suspect that the 'customer discussions' are primarily related to the commercial segment, which could result in significant increases in both revenue and profitability.

Early trading in the new financial year has been above the “upgraded” proforma level of EBITDA ($40.2m) with a number of positive significant customer discussions occurring. The company expects to give FY25 earnings guidance at its AGM in October.

IMB Annual Result Market Release

What's new?

At the Coffee Microcaps Morning Meeting, I asked Dennison Hambling about both the churn rate and the organic residential customer acquisition cost (CAC). Business relationships with corporate customers typically last 10–15 years. According to him, the gross churn rate in the residential segment is 10%. Most cancellations are usually due to customer relocations. A third of those customers immediately renew the service in their new home. Therefore, I don’t think this is an area that requires particular attention.

He was unable to answer the question regarding the CAC (yet). I understand this, as the acquisitions and the very different approaches to customer acquisition make it difficult to provide a clear answer. He plans to revisit this next year when they have more data to provide a meaningful response.

What I generally like and notice is that their presentations are increasingly tailored to outsiders and shareholders. Special effects are not only mentioned but also explained. Some might consider this unnecessary detail, but given this, and their frequent communication through various channels (there isn’t a month where they don’t present or release new details somewhere), I see a clear intention to communicate a message to the market that could indeed impact the stock price.

Especially since 47% of the shares are held by one investor and 9.6% by another, I at least recognize that they are not ignoring or forgetting minority shareholders. Of course, this alone doesn’t fully protect against the potential exploitation by majority shareholders, which is something I always keep in mind when investing in companies with this ownership structure.

CapEx in 2024 was higher than originally expected, at 18.5 million AUD. The majority of this, as communicated, was due to the transition of medical alarm products from 3G to 4G. With the remaining approximately 4.6 million AUD required for the transition in New Zealand, this special expenditure should be completed.

For the first time, the company also disclosed how many customers are being added to the residential segment of the monitoring services. An additional 200 customers per month doesn’t seem like much to me, but until now, much of this has been handled by technicians. With the increased use of DIY kits, the number should rise significantly.

Open questions

It is questionable to me how, and even more so whether, the wholesale monitoring is included in the 200 customers per month. Based on my current understanding, customers from this segment are not included, as it was explicitly mentioned in the residential segment that the customers are generated through in-house technicians and DIY, which should fall under 'Direct Services.'

What is also noteworthy is that they emphasize having a new focus on 'wholesale monitoring only.' Unfortunately, the Annual Report does not shed light on what this entails. However, it would not surprise me if, in the future, the installation of cameras and other equipment becomes less significant and IMG focuses even more on recurring revenues from the respective contracts.

What surprised me were the figures for D&A (Depreciation and Amortization). In my write-up, I had estimated Maintenance CapEx (MCX) to be between 8.8 and 3.5 million AUD, as a significant portion of the amortization came from customer contracts, which are essentially one-time effects from acquisitions that do not affect cash flow. After Dennison Hambling provided more details on Maintenance CapEx in a meeting, I concluded that we are closer to 3 million AUD.

Looking at the breakdown now, however, three components qualify as maintenance: 'Business depreciation,' 'lease depreciation,' and 'subscriber assets.' The latter is undoubtedly increased due to the transition from 3G to 4G, but this doesn’t guarantee that a similar transition won’t occur in the future, and of course, they are also subject to wear and tear. From a very conservative perspective, one would have to assume 6.7 million AUD as MCX. However, after a brief contact with the management, I concluded that 1 to 1.5 million AUD for the subscriber assets is a realistic long-term estimate. I expect to be able to assess this point more confidently soon.

I don’t want to be too picky about this aspect. The medical alarm products evidently generate a high return and have been identified in the past as a segment with significant growth potential. The new partnership with NDIS highlights that the potential application field is also very broad and that IMG is capable of forming new partnerships.

Additionally, it is possible that there are currently leased buildings that will not permanently belong to the company. At least, it seemed that way at one point during the Coffee Microcap Morning Meeting. I will inquire further about this as well.

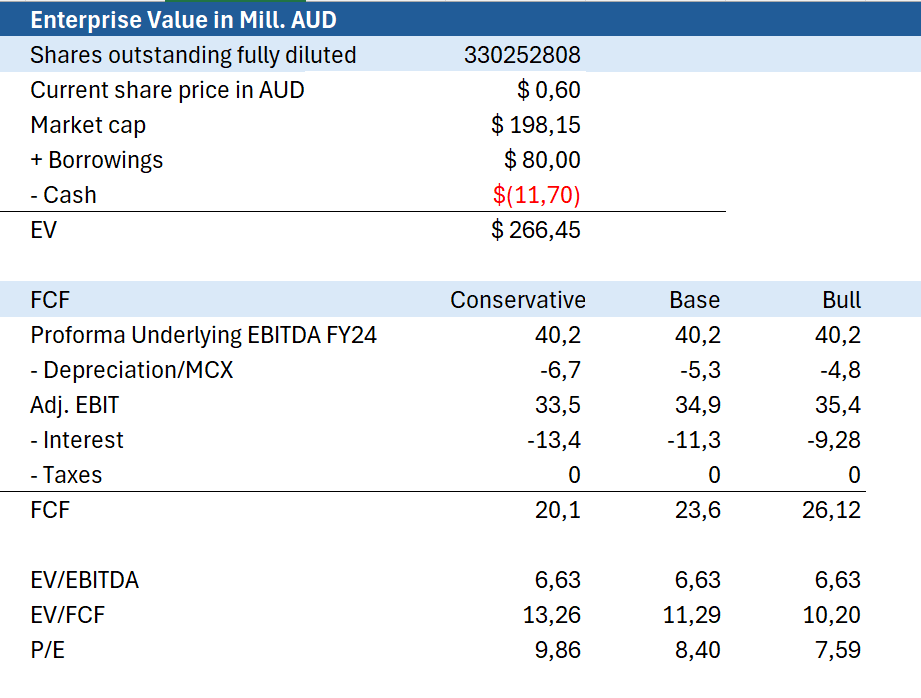

Nevertheless, based on the current information, I will adjust my calculations:

I did not subtract the SBC (Stock-Based Compensation) from the EBITDA but rather considered the shares on a fully diluted basis. It should be noted that the EBITDA can at best be considered preliminary and that the official guidance, according to the latest communication, will very likely be set above this.

Conclusion

I am currently very satisfied with the company's development. None of the unanswered questions cast doubt on the case as a whole. On the contrary, some of the questions are related to specific growth measures.

CEO Dennison Hambling has confirmed the key aspects at critical points. From my perspective, these include the strong cash flow for 2025, reasons for optimism regarding refinancing, the robustness of the business model even in challenging macro phases (see New Zealand), and the fact that the gearing is expected to remain at a level of 1.5 to 1.7. I conclude that the cash flow will soon lead to dividends or buybacks as planned, provided there are no additional acquisitions in the meantime. These acquisitions seem to be integrating very well, although it is still too early to make a final judgment.

Along with the high proportion of recurring revenues (6.8 million per month), the strong return-driven ownership structure, and a management team that has been very reliable so far, I continue to see significant potential here. Based on the pro forma EBITDA of 40.2 and an EV/EBITDA of 10, there is an upside of 68.4%. If we receive a higher guidance at the AGM, a significantly higher upside is likely.

Thanks for the write-up.

Fyi, a short (6 min) management FY24 commentary is also https://youtu.be/EuDfsSUcRIw

Thanks for joining the session and sharing the recording on the YouTube channel.