Intelligent Monitoring Group Limited ($IMB.AX) - An Australian security roll-up with recurring revenues at 5x Fwd P/E

An undiscovered stock whose earnings figures are heavily distorted by several one-off effects and in which an activist holds 58%.

First of all, the disclaimer: I am invested in $IMB.AX shares and bought my first shares at AUD 0.34 at the end of May. Nothing I write should be taken as investment advice.

Ticker: $IMB.AX

Price: $0.34 AUD

Shares outstanding fully diluted: 330 million

Market cap: AUD 82 Million , AUD 112 implied market cap

Enterprise value: AUD 187 Million

The Company

As I go through all the Australian stocks from A to Z, I had to get to "I" to click “buy significantly.

Intelligent Monitoring Group is Australia's largest home and business security company with 200,000 customers. Its business activities are spread across three different divisions:

Ongoing services:

Can be considered the core activity of the company. Over 200,000 businesses, homes and customers are guarded via the company's monitored security services or other security services. The company also uses wholesalers to provide services that will eventually be delivered directly by IMG to the customers. This segment generates monthly recurring revenue of around AUD 6.5 million.

One-off services:

Sales that are only of short duration such as alarm system services or maintenance activities.

Equipment sales:

The name says it all. The sale of cameras, sensors, video doorbells, etc. In my opinion, the sale of the equipment is only a means to an end in order to sell the ongoing services.

The last available detailed figures for the individual sources of revenue are the half-year figures as at December 31, 2023. However, several acquisitions have been made since then, which have already significantly changed the picture.

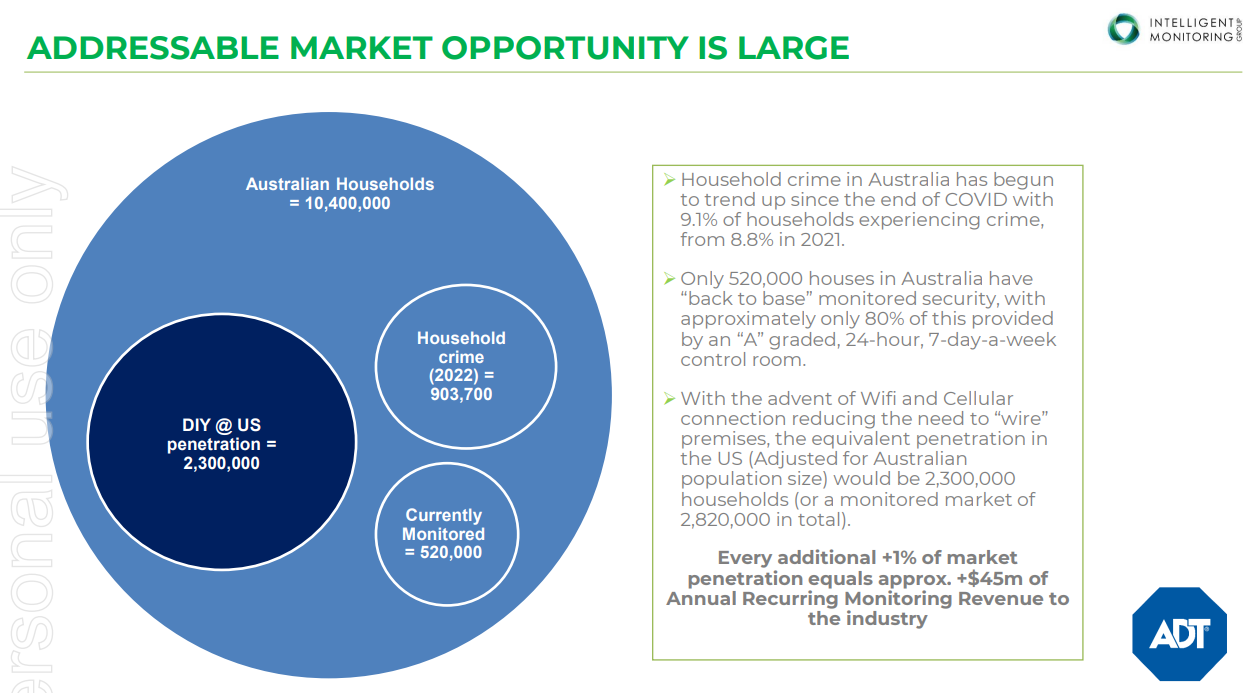

From the company's perspective, the monitored security market is set to grow strongly in both the business and household segments, generating further recurring revenues for the company. While 9.1% of Australian households were the target of a household crime from 2021 to 2022 according to IMG, only 5% have a monitored security solution, which is significantly less than in the US, where 23% use such a service, while there were significantly fewer burglaries, attempted burglaries and thefts from vehicles than in Australia, at least according to these statistics compared to those of the Australian Bureau of Statistics.

The company sees growth potential not only in this area, but also in the "Care" segment, which is aimed at supporting older people with emergency buttons, fall sensors, etc.

The Financials

Both the income and the cash flow statement are affected by the acquisitions in several respects and distort the picture considerably. Here, too, I am using the latest detailed figures from the half-year report, as the picture is constantly changing and the full-year figures from June last year no longer have much to do with the current reality.

Income Statement

Unsurprisingly, the strong growth in revenue was not generated organically, but through several smaller and one large acquisition.

The acquisitions not only added debt, which is reflected in high interest payments, but also resulted in impairments and integration costs. In addition, there was a further negative one-off effect from the sale of a company acquired in 2022, which performed worse than expected. After deducting these expenses and amortization of AUD 2.632 million, which relate purely to customer contracts and therefore cannot be classified as maintenance CapEx, the adjusted EBT for the first half of the year was AUD 4.15 million.

As mentioned, this picture has already changed again.On May 28, the company announced two further acquisitions that are to be financed via a capital raise. In connection with this, the company published a presentation containing pro forma guidance for 2024, which treats the acquisitions as if they had already been made on July 1, 2023.

Based on this, this would result in an adj. EBITDA of 39.2 million, which, even including the one-offs and the loss from discontinued operations, would lead to an NPAT of 9.7. After adjusting for both components, the NPAT would be 19.1 million with an implied market cap of 112 million after the capital raise. According to the company, the tax losses of 22.5 million should lead to significantly reduced taxes over the next 3-5 years, which explains the 0 million taxes in the calculation.

Cash Flow

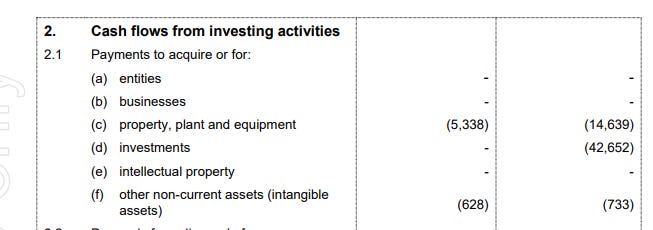

Several aspects must also be taken into account when looking at the cash flow. According to the latest 4C dated April 30, which is a mixture of a trading update and a reduced quarterly report in the form of a cash flow statement, the company generated an operating cash flow of 5.25 million. However, 5.3 million was spent on CapEx.

In general, the very high CapEx expenses are noticeable here, although these are currently significantly higher due to a special effect. Of the aforementioned 5.3 million CapEx, 4.6 million is due to the special effect of the Medical Alarm products.

There were also significant shifts in working capital due to the ADT acquisition, but these should finally be reversed in FY Q3.

The company has published a calculation of FCF for the half-year figures that adjusts for one-offs and working capital increases (changes in working capital are rarely reported with the half-year figures in Australia). Taking these aspects into account, the company arrives at an FCF of 11.9 million for the first half of the year.

Balance Sheet

The latest available balance sheet is also that of the half-year figures and already shows that the picture has changed as a result of the acquisition of ADT, even if a large part of this is not permanent.

What is striking is the now clearly positive net working capital. According to the company's statements, this should be reduced, but I have not found any statement that indicates that net working capital will be permanently negative in the future.

The high level of debt is due to the ADT acquisition in August 2023. At first glance, the conditions appear anything but favorable and also leave out the aspect that zero exercise price warrants were issued to Tor for 7.5% of the equity. However, it was communicated from the beginning that it should rather be understood as short-term financing that enables the acquisition, but should be refinanced early after deleveraging and through the effect of the acquisitions on the earnings figures in FY 2025.

The high PPE is also noticeable, which is not broken down in more detail but is presumably mainly due to Medical Alarm Products in view of the high WIP share. These are to be expensed in future and no longer capitalized. PPE will therefore gradually disappear from the balance sheet.

Acquisitions

The acquisitions tell us a lot about the company's past objectives and what we can expect in the future.

AIS was acquired in February 2022 for 5 million. This resulted in the acquisition of 4,500 customers that generated recurring revenues. The EBITDA multiple was not disclosed. This company was sold again in H2 CY 2023 at a loss of 1.27 million. What sounds like a pure failure, however, was also accompanied by a 10-year contract, which includes IMG taking over the monitoring of the buyer's customers and thus making a positive contribution to EBITDA.

Mammoth Technology was acquired in June 2022 for 4 million. The company's CEO, Robert Hilton, also received 2 million in performance rights and continues to work for IMG as an Executive Director to this day. At that time, IMG and Mammoth already had a strategic partnership. Mammoth produced a range of connected security products which it sold to retail and wholesale customers. The intention behind the acquisition was obviously cross-selling. At the time of the acquisition, Mammoth had a negative EBITDA of 0.3 million. The purchase of AIS and Mammoth was financed with a 10 million capital raise.

In January 2023, IMG bought one of its wholesale customers, Monitored 24/7, for 0.3 million, which was 3 times EBITDA. The intention behind this was apparently to gain more direct access to Western Australia (WA).

In April 2023, Bellrock's entire customer base was acquired. 1100 customers attributable to monitored services and 20 guarding customers. The purchase price was 0.42 million and the acquisition was expected to generate 1.4 million in additional revenue and 0.3 million in recurring EBITDA. As with Monitored 24/7, the acquisition was financed from cash on hand.

In June 2023, the largest and most significant acquisition to date took place. In accordance with the increase in pro forma guidance from 5.4 million to 24.8 million, it appears that around 2.3 x EBITDA was paid. Normalized Group EBITDA after synergies of 31 million was forecast for FY 2024. The acquisition was financed through debt. 80 million was raised under the aforementioned conditions to finance the takeover and repay the existing debt. The acquisition transformed IMG from the third largest monitoring services provider to the largest in the ANZ market. Relevant metrics shifted as a result of the acquisition. EV/EBITDA fell from 8.1 to 3.2, net debt/EBITDA from 5.4 to 2.2.

According to management, the company is also focusing primarily on ADT's DIY offering, as there was also an increasing labor shortage in the installation sector in Australia. After this acquisition, 45% of monitoring revenues came from the houshold sector, 45% from business premises and 10% from medical centers. The intention to revive ADT Commercial, which represents the commercial installation and service business, also appears to be going much better than planned. This is a perfect example of how the business grows organically. Which becomes even more impressive when you consider that, according to the company presentation, 66% of the service and sales team is still tied up in the transition from 3G to 4G.

In October 2023, 3,100 security monitoring customers were acquired in New Zealand for $NZ 290 per customer.The lowest price per customer to date.

In May 2024, Adeva Home Solutions via its subsidiary Mammoth Security for 2.5 million. 0.5 million in cash and 2 million in shares in Mammoth (12.6% stake).The acquisition is expected to generate 9 million in revenue and 0.8 million in EBITDA in FY 2025, representing a 2.8 x multiple.The main intention behind this was probably to quickly expand the technical workforce.

Finally, the takeover of AAG and ACG announced on May 28. Whereas before Adeva, the focus of acquisitions was primarily on expanding monitored services or the technical product range, the current focus appears to be clearly on expanding the technical workforce. According to the company's statements, IMG was recently supply constrained in this respect. Both companies will be acquired for a total of 15.9 million and are expected to contribute 5.7 million EBITDA. The acquisition is to be financed by a capital raise of 19.3 million, which also includes working capital requirements.

The acquisitions show that they are both strategic in nature, when they want to gain a foothold in regions where they were previously underrepresented, but also tactical, when they make acquisitions that appear opportune due to supply constraints as a result of the labor shortage. I expect acquisitions to decline in the near future or to be more opportunistic in nature, as the company is now both vertically integrated and represented in all relevant regions. I expect organic growth to increase once the transition phase at ADT is complete.

The latest acquisitions should not distract from what the company is actually after in my opinion: increasing recurring revenues from monitored security services. In this respect, both the emphasis on opportunities from DIY and the takeover of installation companies are a means to an end. From today's perspective, the takeovers appear to be clearly value-generating and not value-destroying.

What has not yet been said

Another aspect that immediately caught my attention is ownership. 63% of the shares are in the hands of insiders, 58% in the hands of an activist investor, who I believe can be described as the architect of today's IMG. Peter Kennan joined the board in 2020, played a leading role in refinancing the company several times, replaced the CEO in 2021 and has been non-executive chairman of the board since then.

Since then, he has not only co-underwritten several capital increases, but also offered to sub-underwrite the balance from a capital raise. For example, for the 15 million in June 2023. Apart from the capital increases, he also bought 1.27 million in December 2023 at significantly higher prices on the open market. Practically the entire share price increase in December is attributable to him.

Peter Kennan is the founder of Black Crane Capital. A fund that describes itself as an activist deep value fund. Given its history, this is quite understandable. His blog entry on deep value investing probably says the most about how Kennan thinks

The Executive Director, Dennison Hambling, can probably also be described as someone who has at least heard the word capital allocation in his career to date. By the way, he bought AUD 21,000 worth of shares on the day the capital increase was announced.

Robert Hilton completes the team with operational experience

I find it difficult to assess a management from a distance, but at least in the case of Peter Kennan, some of his past successes suggest that he knows when to buy. A clearly return-oriented majority shareholder who is not afraid to subscribe to capital increases and just a few months ago increased his stake in an illiquid stock at higher prices on the open market? I have seen worse setups. I think a sale to PE is anything but unlikely in the long term.

What happens next?

The current cash flow is to be used for deleveraging to 1.5 x EBITDA in order to subsequently finance the high-interest debt more cheaply. According to the latest communication from the company, the excess capital will then be used for dividends and/or buybacks.

Valuation

As Australia has largely implemented the IFRS standards with AAS, I do not include the leases in the enterprise value and consider the 0.99 million interest on the leases as normal interest on debt and the depreciation on ROU as part of the maintenance CapEx.

I have left the cash balance as it was according to the last 4C, although 19.3 million should come from the capital raise, while the acquisitions should only cost 15.9 million, as I don't know how much of the proceeds should be used in working capital.

In the share count I have included all outstanding warrants and options as well as the capital raise of 60 million new shares, which gives me an implied market cap of 112 million.

I have taken the company's pro forma guidance for underlying EBITDA as the basis for the FCF. I then assumed a conservative scenario, a more realistic scenario and a optimistic scenario.

In the conservative scenario, I have assumed the 8.8 million from the company forecast as maintenance capex, although I have several indications that this figure is significantly lower. CapEx expenses are currently very high temporarily due to the switch from 3G to 4G, which will change after CY Q3.

It is quite obvious that the company has included the de facto amortization in its depreciation forecast, as this amounts to 2.8 million out of a total of 4.26 million in the half-year figures. Given that they have included the entire 4.3 million D&A from the half-year figures in the presentation as depreciation.

Of the amortization, 2.6 million was amortization from customer contracts, which are fully amortized at some point and are not operationally related and therefore cannot be considered maintenance CapEx. This was after the ADT acquisition, but before the recently announced acquisitions. The Medical Alarm Products alone, which are currently generating high CapEx, do not result in such high depreciation. None of the PPE items actually qualify for such high depreciation in combination with the stated useful lives from the annual report. Since amortization is included, the estimate of 8 million CapEx for maintenance is clearly too conservative. I therefore assume a maintenance CapEx of 3.5m in both the base and bull scenarios based on the PPE positions including WIP.

In the conservative scenario, I have taken into account both the leasing interest and interest on the facility, which is currently fully drawn and consists of 10% cash interest and 5% PIK. This is very unlikely to last, as it has already been announced that the interest is to be refinanced and IMG currently does not have a high leverage and further deleveraging is planned before refinancing. I have therefore assumed 10% interest on the total amount currently outstanding + 0.99m leasing interest. In the base scenario, I have taken the company's guidance of 11.3m as a basis.

I have not assumed taxes in either scenario as the company has communicated that their NOLs should be enough to offset 3 to 5 years of profits.

I may be biased, but at least the base scenario actually seems realistic to me, as there are other aspects such as the announced reduction in working capital, which will very likely be used to reduce debt. In addition, after the synergies that have already become visible in FY 2024, a further 3.3 million are planned in FY 2025 from the acquisition of ADT.

Upside

If we were to ask the company what an appropriate multiple is, they would answer 10 x EBITDA. From today's perspective, that would be an upside of 186%.

When looking for suitable peers, I couldn't find any that are public in the ANZ market. All the other international companies I found were almost all either very small (< 10 MM MC) or not profitable (Irisity AB). However, $SECU.V is not completely unknown in the micro cap space, has similar operations but much lower margins and currently trades at around 10.3 x EV/ adj. EBITDA and 15 x adj. net income. The company seems to me to be a suitable peer. This would result in an upside of 197% or 226% depending on which multiple you think makes more sense. As deleveraging is planned, this will result in a higher equity value in the medium term.

Apart from a peer analysis, I think at least a 10 x multiple is fair. IMG operates in a growing market, is more asset-light than it may initially appear and has a very high proportion of recurring revenues. Therefore, if the company were to move to buybacks or dividends at some point as announced, it would already be able to pay dividends on a normalized basis that translate into a 20% dividend yield. If the company proves that it can also grow organically and increase its recurring share, I believe significantly higher multiples are justified.

Downside

For me, the downside comes from one aspect in particular and that is the acquisitions. To put it mildly, there is a lot going on at IMG at the moment. Several takeovers, the sale of a less successful takeover, a temporary sharp increase in CapEx, resulting in difficult to read maintenance CapEx. This means that, on the one hand, the actual earnings power is not yet fully clear and, on the other hand, the more recent acquisitions in particular offer potential for negative surprises during integration.

A further risk may arise from ownership, as the company is de facto controlled by one man who can theoretically ignore the wishes of minority shareholders. If dividends were to be paid out in FY 2025, this would at least be an indicator to the contrary. Most of the time, with such concentrated ownerships, I would like to rule out the possibility that the majority shareholder wants to build a legacy and, based on Peter Kennan's CV, I would not think so. I think he is primarily return driven, but again, I may be biased here.

Why this opportunity exists

First of all, there are only two relevant reports for Australian shares that are processed by screeners. The half-year report and the annual report. A lot has changed at IMG since the half-year figures and the company screens much worse than it should. For example, TIKR shows LTM FCF at -11.5 million and net income at -11.6 million. If you go to the ASX website, it becomes all the more apparent how far the 'visible' figures on the relevant pages lag behind reality:

Furthermore, I could find exactly 0 write-ups. Neither in the Micro Cap Club, VIC nor on Substack. There are no threads or relevant tweets on Twitter. Just one guy who put EBITDA in relation to market capitalization and rightfully got 0 favs for it and a better known investor who asked a year ago if anyone had ever looked at the stock. The current situation has therefore tended to go unnoticed.

Conclusion

I have made this share my third-largest position in the portfolio. For me, the downside is primarily limited to the execution risk, but the most recently reported results tend to indicate that the integration of the acquisitions will succeed and that the company could act as the most important player in a growing market.

Nice write up. Good to see foreign investors looking at ASX microcap stocks.

Nice writeup. Any thoughts on the past and probable future dilution? It's above 30% per yr for the last few years.