First of all, the disclaimer: I am invested in IRIDEX ($IRIX). Nothing I write should be considered investment advice. I bought my first shares at USD 0.89.

Ticker: IRIX

Price: USD 1.35

Shares Outstanding: 16.79 million

Fully diluted: 22.75 million

Market Cap: USD 22.66 million

Market Cap fully diluted: USD 30.71 million

Enterprise Value: USD 24.60 million

Just to be clear, this is a turnaround play. I have no idea how things will look long term, and honestly, I don’t really care currently. Right now, the downside seems pretty limited, and there are a bunch of opportunities that could lead to better margins.

This is a simple, no-frills pitch covering the key points. Feel free to explore further.

The Company

Iridex operates three types of laser consoles used to treat sight-threatening eye conditions, including glaucoma and retinal diseases.

They got the following product lines:

Glaucoma: The primary system for treating glaucoma is the Cyclo G6® laser console with MicroPulse® technology. This product line could be considered a rising star, despite having faced a period of challenging market conditions.

Medical Retina: This line includess IQ 532, IQ 577, and PASCAL systems, all equipped with MicroPulse technology. These versatile lasers also support glaucoma treatments like trabeculoplasty, iridotomy, iridectomy, and PSLT.

Surgical Retina: Their surgical retina line includes OcuLight TX and SLx (with MicroPulse), commonly used in vitrectomy procedures for conditions like diabetic retinopathy, macular holes, and retinal tears or detachments

They follow a razor-blade model, generating recurring revenue from probe sales in their glaucoma and surgical retina segments.

They sell primarily through a direct sales force in the US and Germany, and via distributors elsewhere. Revenue remains largely US-driven.

The Financials

Iridex has a long history of operating losses and has never truly been cash-flow positive (excluding working capital changes). There are signs this could improve, but for now, let’s stick to the current financials.

A long history of negative cash flows inevitably led to a declining cash position, prompting an agreement with Topcon on March 2, 2021. Iridex acquired assets from a Topcon subsidiary, including rights to the PASCAL product, while granting Topcon distribution rights for Iridex’s glaucoma and retina products in select markets outside the U.S. As part of the deal, Iridex also raised USD 10 million by selling 1.62 million shares to Topcon. The net proceeds to Iridex of these transactions was USD 19.5 million.

What initially seemed like a solid deal and healthy cash cushion proved to be just a short-term relief, as the cash position quickly shrank again.

The uptick in the cash position at the end of Q1 wasn’t driven by operating cash flow or working capital changes, but once again by a deal with a strategic investor.

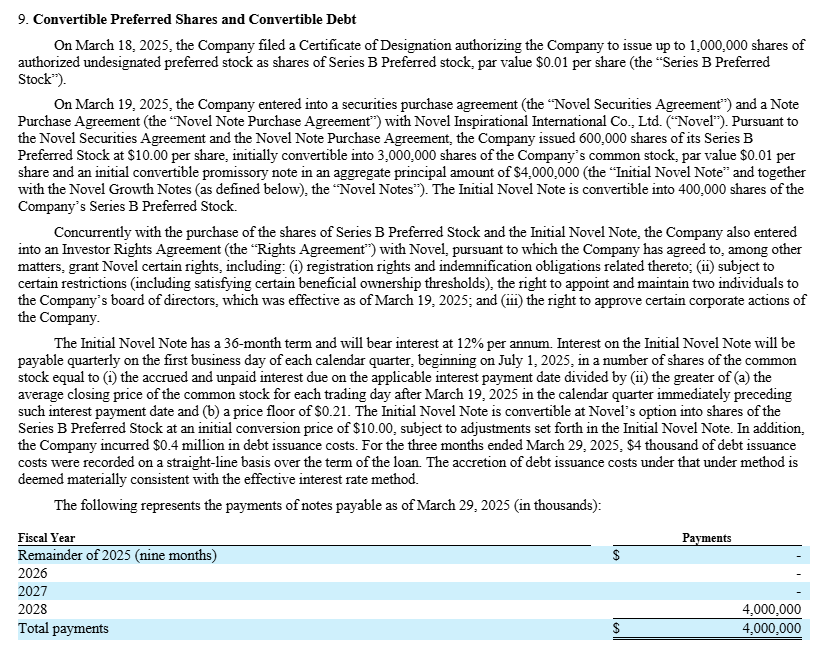

Following a strategic review and CEO change, Iridex secured USD 10 million in fresh capital from Novel Inspiration: USD 6 million in preferred stock and USD 4 million in convertible notes, effectively priced at USD 2 per share if converted. The notes carry a 12% interest rate, paid quarterly in common stock.

Some of the proceeds were used to retire existing convertible notes.

As part of the deal, Novel gained the right to appoint two board members, one of whom was former CEO William Moore, reportedly the one who brought Novel to the table. Additionally, Romeo Dizon, who previously held the CFO role and worked for the company from 2008 to 2020, was reappointed CFO.

USD 10 million in convertible preferred stock and notes, with interest payable in common stock, initially sounds highly dilutive, and I believe both will likely be converted over time. That’s why I included the full potential dilution in my fully diluted share count when calculating enterprise value, rather than treating the notes or prefs as debt. If fully converted to common stock, both instruments would add 5 million shares.

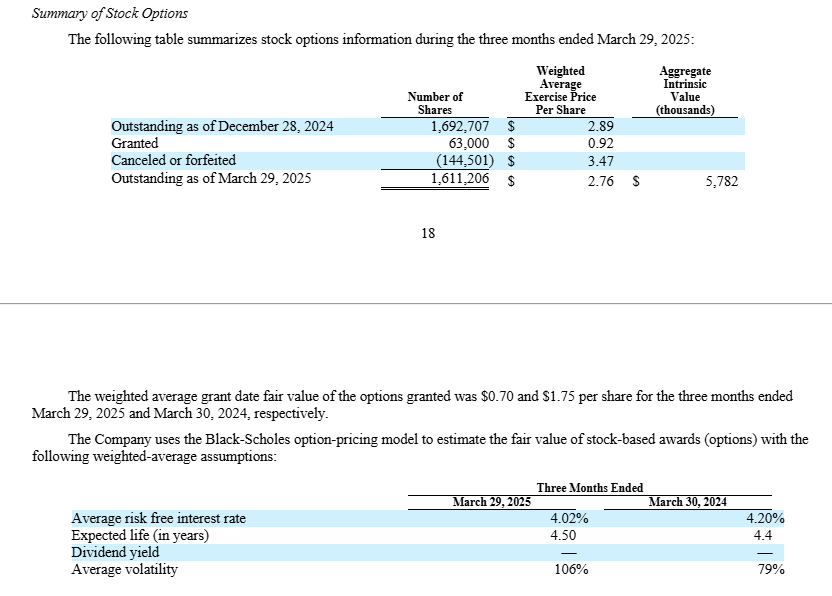

The options are deeply out of the money, so I didn’t include them in the share count or the cash position.

I included the outstanding RSUs and the annual interest payment on the convertible notes, calculated in common stock at the current share price, resulting in a fully diluted share count of 22.75 million.

You should be aware that Novel has the right to purchase additional convertible promissory notes with a total principal amount of up to $10,000,000. These 'Growth Notes' may be issued in three installments, with one-third becoming issuable on each annual anniversary of March 19, 2025. However, without shareholder approval, Novel is not permitted to own more than 19.99% of the outstanding common stock.

The Investment Case

Although the company originally initiated a strategic review with potential plans to sell parts or all of the business, that path now seems either abandoned or deprioritized.

I mean we're not in the same place we were back in Q4 where we were low on cash. We're in a much better cash position now, but of course, any offer that was brought before the company if it made sense for the shareholders, the Board of Directors would consider it.

Patrick Mercer, CEO - Special Call

Now the opposite seems the case. The company wants to keep all their product lines and plans to acquire a complementary product or company. William Moore brought Novel in as a strategic investor to pursue this goal.

We are -- one of the reasons we came to -- one of the things we liked about working with Novel on the transaction is they had a shared strategy. And one of those strategies where we were open to folding other companies into IRIDEX, bringing those assets in-house.

Patrick Mercer, CEO - Special Call

The special call also provided some insight into potential acquisition targets.

We expect this effort will involve pursuing some small accretive acquisitions, and this thinking is the rationale for Novel having negotiated the ability to invest an additional $10 million in the company.

The first $10 million is intended to be more than sufficient for the company's normal operations given its new financial discipline.

William M. Moore, Director - Special Call

Now, some of you might think I’ve lost my mind and wonder what happened to the overly skeptical investor who usually questions any M&A deal valued at half the company’s current market cap. Rest assured, that skeptic is still very much here. There’s a reason I began the 'Investment Case' section with the M&A aspect: it’s the part I’m most skeptical about and, in my view, the only meaningful argument against the case, at least in the short term. I just wanted to make sure everyone is fully aware of that. I’ll come back to that later.

Let’s now look at the aspects that, from my perspective, point toward a successful turnaround.

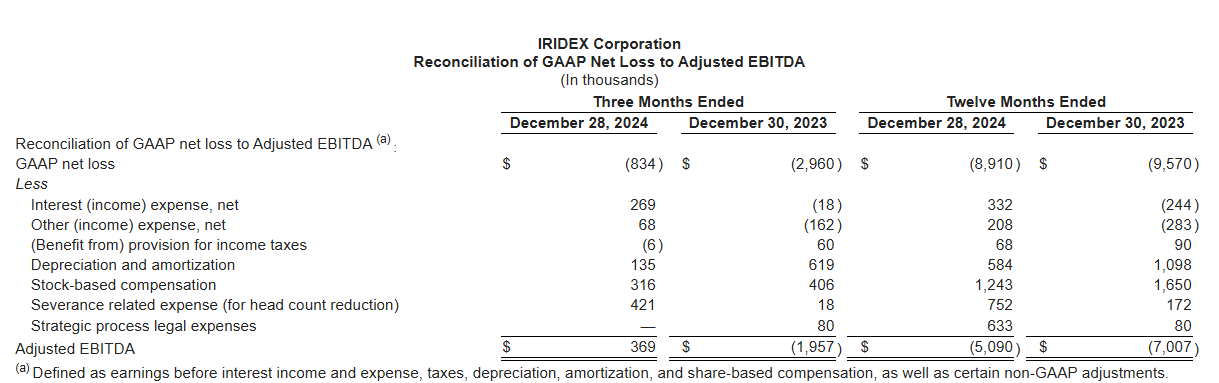

The evidence is simple: take a look at Q4 2024…

…and Q1 2025.

Two consecutive quarters of positive adjusted EBITDA after years of losses could be an early sign of a successful turnaround. From here, it’s our job to evaluate whether this momentum is sustainable, whether it signals the start of a broader initiative, and whether it comes at the expense of the company’s core operations. So, what changed?

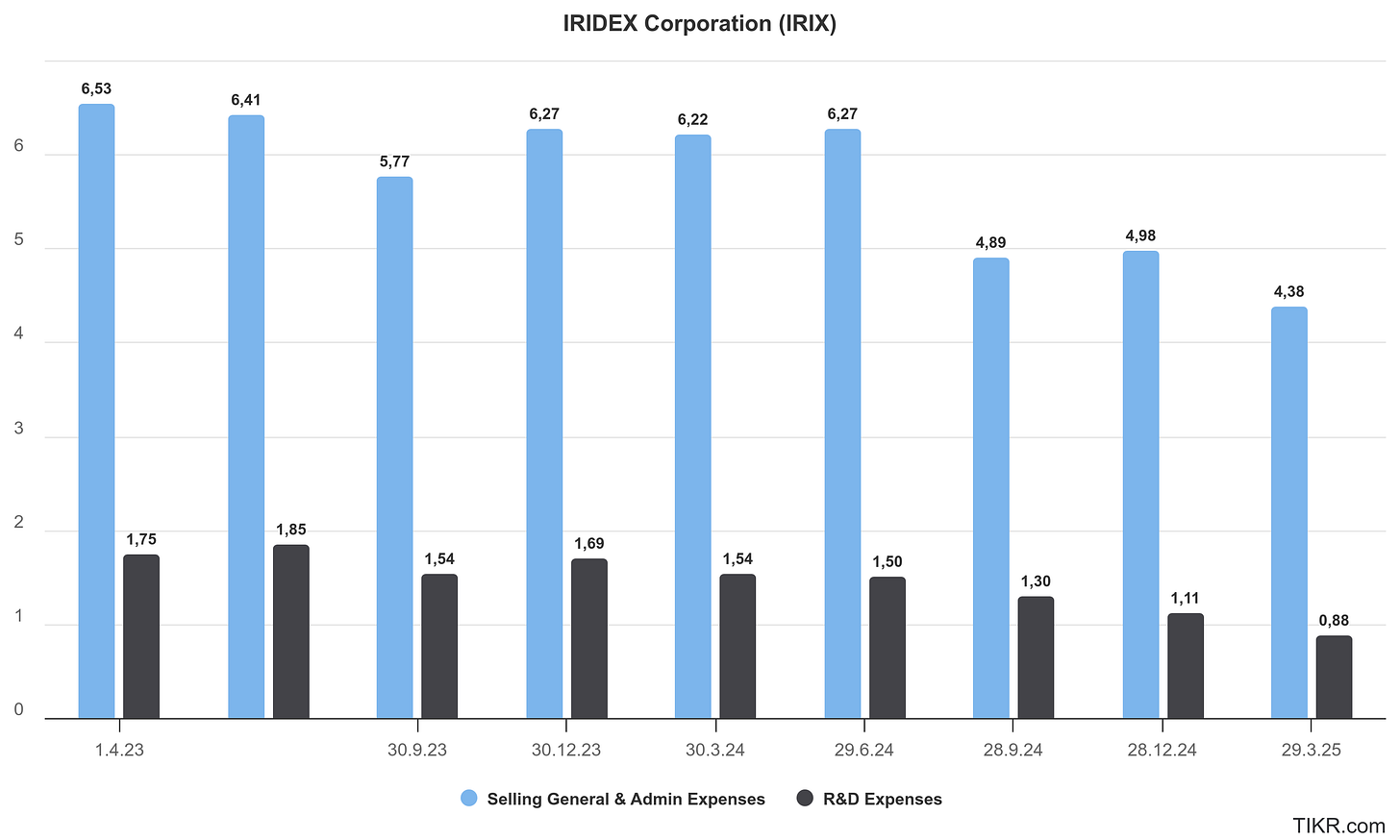

Since the second half of 2024, the company has taken meaningful steps toward cost-cutting.

The most apparent cost-cutting so far has occurred in Sales & Marketing expenses, which dropped from $16.2 million in 2023 to $12.6 million in 2024. The most significant driver of this reduction was a cut in headcount. Naturally, one should remain skeptical when a company trims its sales force to improve adjusted EBITDA such moves can backfire if they hurt long-term growth. However, we’ve seen similar actions work elsewhere, like at $COV.V, where the CEO built a more effective team by removing underperformers. In Iridex’s case specifically, there are good reasons why the company ramped up its sales force in the past and why scaling it back now may be the right move.

…we made a bet on our glaucoma business last year and earlier. And in '23, we hired a bunch of salespeople. We went and tried to grow that business, and we weren't successful. We didn't have some of our ducks in a row as far as what setting should be used and we had to take another look at that. We've improved that.

Patrick Mercer, CEO - Special Call

One of my investor friends is always skeptical when a company increases its sales force and I never really understood why. More salespeople should mean more sales and more profit, right? But after seeing so many cases where expanding the sales team actually hurt profitability, not just in the short term, I now understand his point much better. In Iridex’s case, there was also a specific reason why it wasn’t the right time to aggressively push the glaucoma business. That situation has changed, but for now, let’s stay focused on the cost-cutting efforts.

In the Q4 2024 earnings call, Patrick Mercer stated that the focus for 2025 is on reducing manufacturing costs and increasing product supply capacity. In my view, there are some obvious low-hanging fruits here. The company is still manufacturing lasers in Mountain View, California, arguably one of the most expensive places to produce what are essentially commodity products. It’s likely that the new management team will address and change this.

And the other part is we're on a path to move the company up substantially in revenue, not just a slow growth, but what will happen in the first phases that we're dealing with is Patrick will work with getting this outsourcing done.

William M. Moore, Director - Special Call

Another area of cost-cutting has been R&D. While this could potentially impact the company in the long term, financial discipline appears to be the current priority. For now, it's likely that R&D efforts will focus only on products that are close to market or backed by external funding, with little appetite for entirely new initiatives.

So cost-cutting is one thing, but Moore also spoke about increasing revenue. After years of essentially flat performance, once you average out a few temporary spikes, what actually supports that claim?

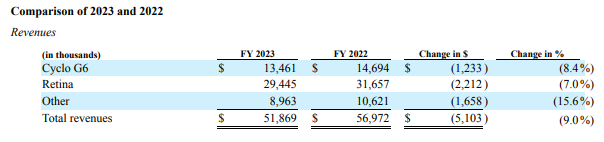

In 2023, Medicare contractors proposed limiting reimbursement for key glaucoma procedures. Initially, it was unclear whether Iridex’s Cyclo G6 MicroPulse treatment, a form of transscleral cyclophotocoagulation, would be affected. In November 2023, Iridex announced it had successfully appealed the proposed restrictive LCDs, and in December 2023, all five Medicare Administrative Contractors (MACs) retired the draft policies before they could take effect, thereby retaining full patient access to MicroPulse TLT. Given the uncertainty surrounding reimbursement, it’s likely that Cyclo G6 system and probe sales were negatively impacted. After several years of year-over-year growth, Cyclo G6 revenues declined from $14.7 million to $13.5 million.

In November 2024, Iridex confirmed that the new LCD had gone into effect. Given the reimbursement limitations placed on Micro-Invasive Glaucoma Surgery (MIGS) procedures, this will very likely strengthen the relative position of their MicroPulse TLT treatment.

The Company has previously reported that it believes the reimbursement limitations created by the new LCD has potential to significantly increase physician interest in and use of Iridex’s advanced laser-based treatments for glaucoma.

The new LCD clarifies that treatments performed using Iridex’s laser consoles and probes are not MIGS procedures, and thus, Iridex’s Cyclo G6® product family is unaffected by the new reimbursement limitations. Iridex’s proprietary MicroPulse® and Continuous Wave laser therapies for glaucoma have been adopted by physicians around the globe as effective tools for managing and slowing the progression of glaucoma.

[…]

“In addition to creating some reimbursement advantages for Iridex’s glaucoma treatments in the United States, the LCD creates opportunity to capture more physician attention to the significant clinical benefits of our products, particularly MicroPulse Transscleral Laser Therapy (MPTLT),” said Kevin LaMarche, Iridex’s Senior Director of Clinical Affairs. “Our laser procedures are noninvasive, repeatable, and can be utilized to treat patients across a far broader range of glaucoma’s progression, whether before, after, or even coincident to MIGS procedures.”

GlobeNewswire - Iridex Comments on Changing Glaucoma Reimbursement Landscape

The company recently announced the publication of a peer-reviewed study supporting its claims about the effectiveness of MicroPulse TLT.

It’s also worth noting that Patrick Mercer, the new CEO and former COO, pointed to another factor that may have impacted the performance of the Cyclo G6

We didn't have some of our ducks in a row as far as what setting should be used and we had to take another look at that. We've improved that.

We now have settings that work and show efficacy in the marketplace. And we have -- with the new LCD and our new focus on looking at the post-MIGS category and being used earlier in the continuum of care for glaucoma, we really do believe that's the growth side of our business, and we should see that growth continue.

Patrick Mercer, CEO - Special Call

It’s too early to tell whether he’s right about the growth trajectory. Sales cycles are long, but the company did report growth in both system and probe sales in Q1. Given the improved reimbursement environment, it would be surprising if they weren’t able to benefit from it.

Given all the ongoing cost-cutting measures and the potential for increased revenue, I was somewhat surprised by the 2025 guidance. Adjusting for working capital, Q1 was essentially cash flow breakeven, and adjusted EBITDA has been positive for two consecutive quarters. I see little reason why that should reverse. Revenue should also trend upward, as Cyclo G6 sales are expected to recover, and management has guided for growth in retina revenues, even though Q1 was slightly down.

The Company plans to achieve cash flow breakeven and positive adjusted EBITDA in 2025 on revenue generation consistent with 2024.

GlobeNewswire - Iridex Reports First Quarter 2025 Financial Results

The guidance doesn’t make much sense to me, based on what I know about the company and its current competitive environment. With a new CEO and CFO in place, both emphasizing financial discipline, it seems likely they’re trying to establish a culture of underpromising and overdelivering. We’ll find out soon enough when the Q2 results are released. I expect another quarter of positive adjusted EBITDA and revenues at least in line with the same period last year.

Now that we’re talking about the ‘new’ management, let me highlight a few points I’m still skeptical about. One concern is that the new CEO was promoted from within, he previously served as COO, so one could argue he was part of the problems created by the prior leadership. That said, I haven’t seen anything so far that warrants criticism.

Another concern is whether it was wise to lay off a significant portion of the sales team just as the reimbursement environment has turned favorable for the glaucoma portfolio, especially given that management repeatedly emphasizes the need to educate customers on the value of their products.

An equally important focus is ensuring we fully capitalize on the opportunities created by the LCD implemented in November 2024, which has significantly altered the landscape for physicians by limiting the use cases for MIGS devices. While we won't return to the aggressive spending patterns of recent years, that's not my approach, I believe the LCD itself offers far greater value in terms of driving opportunity for IRIDEX than any market spin could, and we are starting to see utilization increase as a result.

Patrick Mercer, CEO - Q4 2024 Earnings Call

And finally, let’s return to the M&A topic. Management stated they’re looking for targets that can be easily integrated and offer synergies with their existing customer base. So I’d be surprised if they acquired an early-stage startup lacking regulatory approvals. William Moore mentioned the possibility of an acquisition at 1x revenue, but I doubt that was a serious remark. In reality, it might be challenging to find a medtech company available at that valuation, especially with only $10 million in additional financing. A capital raise is definitely not off the table, but I’d be surprised if they pursued one before the share price climbs back above $2, the level at which Novel made its initial $10 million investment.

Valuation

It would be easy to throw shiny revenue-multiple-based price targets on the two segments, one operating in a mature market (retina), and the other with potential to become a rising star (glaucoma). But honestly, that’s not what this story is about right now. And when I say 'now,' I’m referring to the next two to three quarters. The company first needs to prove it can generate positive cash flow and deliver consistent revenue growth. Only then will the market start to trust the turnaround and allow them to raise capital at a more attractive valuation.

That said, the sector is known for high acquisition multiples. Lensar, a company developing laser treatments for cataracts, so within the same industry, was recently acquired at 8x revenue, despite being only marginally adjusted EBITDA profitable. However, that company was growing much faster, so I wouldn’t expect Iridex to command a multiple anywhere near that level. In any case, I don’t see EV/EBITDA as the right metric to value Iridex, since a strategic acquirer would likely cut a significant portion of operating expenses from day one.

Management has hinted at ongoing consolidation in the industry during recent calls, but for now, there’s no indication that they’re actively pursuing a sale. The near-term focus should be clear: complete the turnaround and rebuild shareholder trust.

Conclusion

It’s always the same with cases like this: you look like a genius if it works, and like a fool if it doesn’t. It’s a bit like Schrödinger’s cat, I’m both a fool and a genius at the same time, and we won’t know which until management lets us look inside the box.

For the past few years, I’ve focused on opportunities with limited downside and meaningful short-term optionality and at its current valuation, Iridex fits that profile for me, given the visibility around cost-cutting measures and the favorable competitive environment.