I first published this idea on my personal blog on April 7, 2023 and bought my first shares at USD 14.25. After I closed my blog, I moved all blog posts to substack.

I sold all my shares at prices between USD 30.90 and USD 36.20 in December, 2023.

First of all, the disclaimer: I am invested in the JAKKS Pacific stock ($JAKK). Nothing I write should be considered investment advice.

A few months ago I shared my Jakks Pacific idea. A lot has happened since then and at the latest after yesterday's publication of the figures it is time for an update.

Sales and profit

Especially with Jakks Pacific, I don't put much stock in the estimates, because in the past they were very far from reality and also only a few analysts cover the stock. In terms of sales, Jakks was in line with expectations, and in terms of profit, it was even significantly higher, but as I said, let's not put too much stock in it.

When you first look at the development of sales and EBIT, you might initially be disappointed by the significant decline. Sales fell by 24%, EBIT by as much as 30%. However, it should be borne in mind that the company is heavily dependent on individual releases of games, movies, etc., for which Jakks Pacific then produces the corresponding merchandise. Sales therefore fluctuate very strongly during the year

CEO Stephen Berman said in the subsequent earnings call that last year they also had the experience that their distributors had filled up their warehouses relatively early in the year, because they feared that there would be distortions within the supply chain, i.e. the sales occurred earlier at Jakks. Now, he says, things are back to near-normal levels, which is why he expects bigger sales in the second half of the year. From many years of (negative) experience, I usually don't put too much stock in such statements, but at least it seems conclusive. By the way, compared to Q2-2021, sales were 40% higher. Possibly a small indicator for Q3

What was pleasing to see was a continuation of the trend towards a higher gross margin, which at 30.7% was even significantly higher than the 27.6% in the previous year. By comparison, the figure for 2019 was 18.6%.

However, salaries must also be paid in 'weaker' quarters. This is especially true for SG&A. This is then also the simple explanation for a lower EBIT

Adjusted EBITDA and net income

From many years of experience on Twitter, I know that many people get angry when they read the word "Adjusted" in connection with earnings figures. I take a more differentiated view. Not every adjustment makes the numbers look better, and as investors we also receive valuable information regarding potential one-off effects. In addition, it is always worth looking at the last 12 months (TTM) for Jakks Pacific and not just a single quarter because of the fluctuating sales.

When jumping from net income to EBITDA, the valuation allowance should be taken into account in any case. This is a one-time effect. The same applies to the change in fair value of preferred stock. These effects are not operationally justified and I therefore consider an adjustment to be useful in order to provide a view of the 'real' operational strength. However, we should deduct the stock-based compensation again. So after adjusting for this effect, we get TTM adjusted EBITDA of 59.89 million.

Debt completely paid off - view of the balance sheet

When looking at the balance sheet, it is again positively noticeable what was already communicated a few weeks ago on the part of the company: Jakks Pacific is completely debt-free. The term loan, which had a negative impact in the past quarters with 11% interest, is now completely paid off. The cash position also remains at a very solid level of $32.23 million

Fair value of prefs

Yesterday I also received some questions about the fair value of the preferred shares. There was a significant write-up of the liability by 6 million in the last quarter. I, too, first had to understand the reason for this. In the end, however, the solution seems to be easier than initially thought.

Since the prefs are valued using a DCF model, the corresponding discount rate would have to have gone down accordingly due to the repayment of the term loan with its 11% interest, resulting in a write-up in value

The increased interest in preferred shares on the part of many investors can be explained by the fact that they represent the last obstacle before a potential payment of dividends or buybacks. As can be seen in the excerpt above, the fair value can also be affected by an event that increases the probability of payment. Here, I wasn't 100% sure at first if I had missed something in the call, but apparently it's really only due to the discount rate.

Current Valuation

If we now look at the current valuation on an EV/FCF basis, I tend to also include the unpaid dividends to the preferred share holders in the enterprise value, as it is capital that is due to the respective beneficiaries and has not yet been repaid to them, i.e. a similar situation as with loans. Ignoring mezzanine capital such as preferred shares is definitely the wrong option.

Based on these assumptions, the enterprise value is $177.81 million

When calculating the FCF, it requires a bit more 'finesse'. Jakks does not provide us with a cash flow statement, so we have to help ourselves. Based on the balance sheet items, we can calculate the cash flow without shifts in working capital. After deducting the shifts and adjusting for SBC, this results in FCF of 5 million for the last quarter. This is nothing that would initially make investors jump for joy, but again, it makes sense to look at a whole year

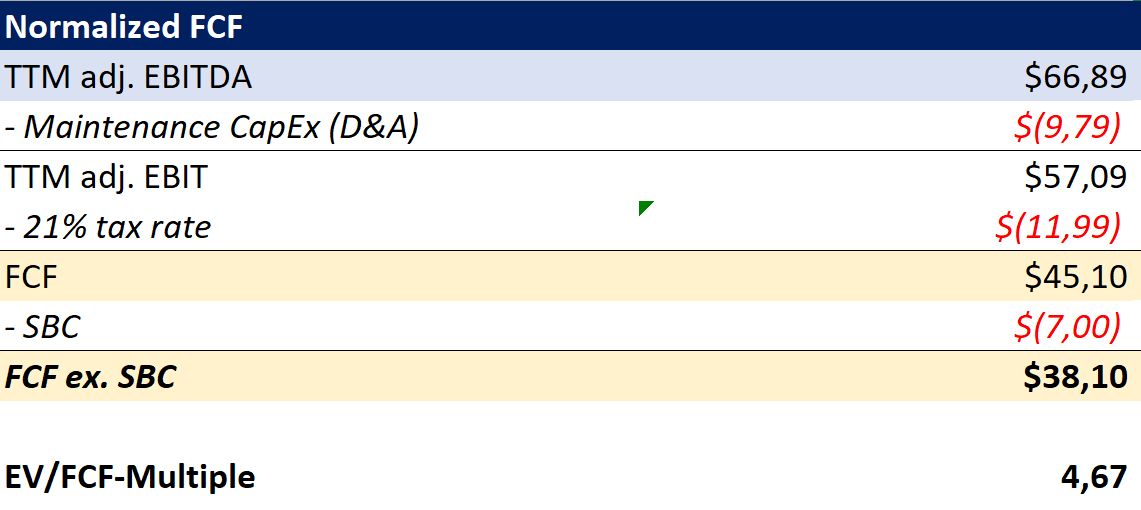

Normalized free cash flow

It is always best to calculate free cash flow on a normalized basis, i.e. to exclude current one-off effects. We do not rely on management's statements regarding a possibly better second half of the year, as we prefer to take a conservative view. Based on adjusted EBITDA on a 12-month basis, we obtain a normalized FCF for the last 12 months of $38.1 million and thus a 4.67 x EV/FCF multiple. Still a very low figure with a chance for better numbers in the second half

Expectations for the near future

Jakks Pacific is currently debt-free, but the executives said in the call that it is not their approach to run the company debt-free, which also makes economic and shareholder sense in the very least cases. Precisely for this reason, however, the question now arises: Where to put the cash flows?

Regarding capital allocation, unfortunately no questions were asked in the call and my mail to CFO John Kimble in this regard has not been answered so far. Should I receive an answer, I will share the content on Twitter.

My fear at the moment is that they prefer acquisitions over a buyback of the prefs and subsequent dividends and/or buybacks of the common stock. Based on the current multiples at which Jakks is trading, I can't imagine that an acquisition will generate shareholder value. Especially not in the short term. For the investment case it is quite relevant that the shareholders participate in the earnings.

Conclusion

Overall, the quarter was in line with expectations and the option for an improvement in the third quarter is not bad. Now that the term loan has been paid off, the way is clear for a buyback of the preferred shares. However, given the current cash position and the foreseeable working capital requirements, I do not expect to see this until Q4-2023 at the earliest.

I remain invested and added 50% to my position ahead of the numbers at prices around $18.