I first published this idea on my personal blog on September 4, 2023 and bought my first shares at CAD 8.44. After I closed my blog, I moved all blog posts to substack.

First of all, the disclaimer: I am invested in Medical Facilities Corp stock ($DR.TO). Nothing I write should be considered investment advice.

When a non-cyclical stock with strong operating margins trades at 3.5 times EV/EBITDA, there is usually a good reason for it. This is also the case here. Medical Facilities stock is not an entirely easy investment case to understand. However, those with a bit of patience will have the opportunity to benefit from a management team that is clearly focused on increasing shareholder value and is currently selling non-core assets in a big way and buying back its own shares while also paying dividends.

The company

Medical Facilties Corp stock may be listed on the Toronto Stock Exchange, but it operates surgical clinics in the United States. The Company derives its revenues from fees charged to patients or their insurance companies for the use of its facilities, care, etc. At the time of this writing, the company has majority interests in three specialty surgical clinics and one ambulatory surgery center. In addition, there are other smaller minority interests. I emphasize the form of participation here because the company operates the clinics in cooperation with physicians who also have shares in the respective clinics, which is quite relevant for understanding the valuation. Consequently, MFC does not have any employed physicians, but provides them with the necessary operating rooms and accompanying services

The four majority-owned clinics specialize primarily in orthopedic procedures and perform well in the rankings of US News Health in the areas of artificial knee and hip joints as well as general patient satisfaction. It is therefore hardly surprising that the current management expects a further boost in case numbers due to the increasingly aging population. According to the government's CMS, annual spending on the healthcare sector is expected to continue to outpace GDP growth.

Medical Facilities' patients can be classified more in the high-paying range. At 52%, the majority of those treated have private insurance. Medicare is primarily aimed at older people and functions like a traditional health insurance policy, while Medicaid is more of a social welfare benefit.

The numbers - worth a second and third look

When looking at the figures, some sensitivity is definitely required on several successive levels in order not to draw the wrong conclusions. The constellation between MFC and the treating physicians in the respective hospitals is primarily responsible for this, but let's first look at the figures like those of any other company. As a basis for this, we take the annual figures for 2022 compared to 2021 in order to have a view of a full year. In the case of the balance sheet, however, the current one serves as a basis to illustrate the current valuation. The first thing to note here is that while MFC is listed in Canadian dollars, the numbers are reported in US dollars and thus are in USD for most screeners. This could also be one of many small reasons why this option exists. Not every screening tool can handle the conversion. To make the comparison easier, I always use the US figures in the following.

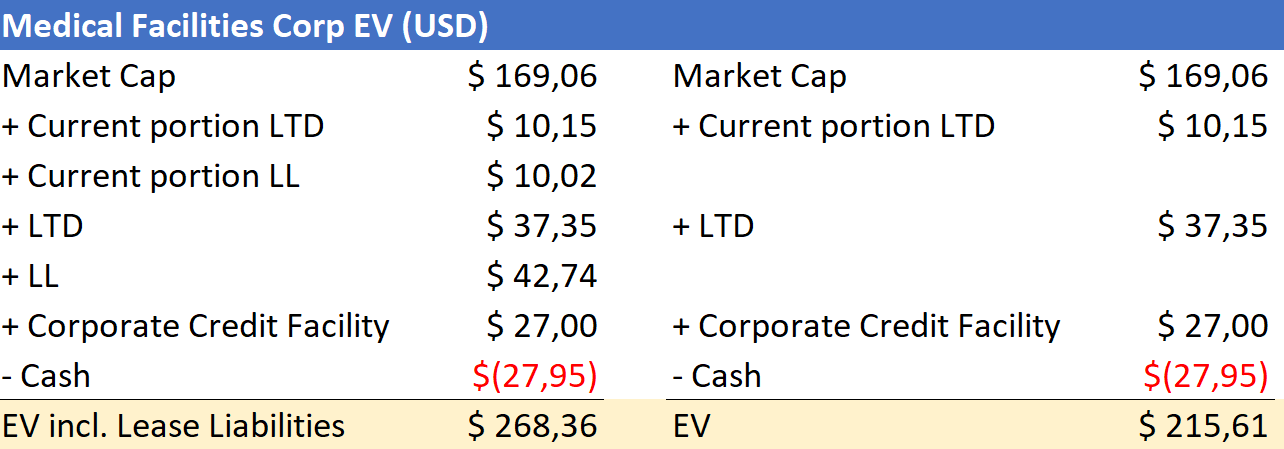

Current balance sheet and EV

Market capitalization at the time of this writing is $169 million. Since MFC reports in accordance with IFRS, we calculate the enterprise value (EV) below both with and without leases so as not to distort the picture in one direction or the other. You can then choose for yourself which option is more adequate. I have recently seen some examples where ignoring the leases made the difference between a bargain and a disaster, because the leases were either not considered at all or were only adjusted in the numerator but not in the denominator in an EV/FCF consideration.

In the case of long-term debts (LTD), it should be noted that these are held at the subsidiary level, i.e., at the individual hospitals owned by MFC together with the collaborating physicians. The Corporate Credit facility, on the other hand, is at the corporate level. Thus, MFC is the sole debtor here. We do not include the share of equity attributable to non-controlling interests (NCI), i.e. the physicians who have shares in the individual companies for the hospitals, in the EV because we can very clearly separate the cash flows attributable to MFC from the others on the basis of the detailed disclosures in the annual report

Incidentally, the "exchangeable interest liability" is attributable to the fact that the NCIs have the right to convert part of their shares into MFC shares. It is therefore not a 'real' interest-bearing liability. The proportion of shares potentially still to be converted can be seen in the "Summary of Facility information" shown at the beginning and currently ranges between 1 and 14%. However, some screening tools misinterpret this liability as Debt, as the distributions to this portion are labeled as Interest in the Income Statement. The enterprise value is therefore overstated by 38 million.

Net operating losses (NOL) are very low and are therefore not included below. We deduct the cash balance in full, although it could be noted here that part of the cash is needed to continue the business. However, I often find this consideration arbitrary and cumbersome, as it often makes comparability difficult. However, a discount may also be appropriate.

Taking all the above components into account, the EV is $216 million, or $268 million if the leases are included. However, you should not get too used to these figures.

Income Statement - Many one-offs

What catches the eye here when you first look at the income statement is that although hospital revenue has increased, total revenue is reduced by the negative "stimulus income". In addition, earnings per share are clearly negative and EBIT has fallen by more than half. However, due to some one-offs, the picture appear worse than it is.

The negative stimulus income is a classic one-time effect that will not occur again in this form. In the context of COVID-19, aid funds were provided to health care providers to cover eligible expenses, including lost revenue, attributable to COVID-19. Funds that are not used for eligible expenses and are not used for lost revenue must be repaid. Since then, some of the loans have been forgiven in this regard, while others have not. Some of these are under reconsideration and could possibly still be forgiven. As there is no certainty that these loans will be forgiven, all loans whose forgiveness has so far been denied 'or' are under review have been recognized as negative sales. This charge falls 100% to EBIT. To give a clean view of the 'really' generated revenues, the positive stimulus income of 2021 should be deducted and the negative income of 2022 should be added back on top of the revenues. This results in a year-on-year (YoY) revenue increase of 6.5%.

Further one-time effects are the "Impairment of goodwill" and "Impairment loss on loan receivable". However, the latter only has a negative effect on EBT. The goodwill impairment resulted from MFC Nueterra, the loan receivable impairment from the sale of the shares in Unity Medical and Surgical Hospital. Although there is still a high level of goodwill on the balance sheet, this is looking in the rear-view mirror and does not result in any cash costs. However, further impairments should be expected

If we take into account the aforementioned components, we get an adjusted EBIT of $61.65 million for 2022.

This still represents a decrease of 4% YoY and that with increased sales. In the same period, operating expenses increased by 8.5% even after deduction of the impairment. The most noticeable items here are "Drugs and supplies" and G&A. The former is mainly due to a different case mix, which was mainly characterized by severe spine surgeries. Management puts the impact of this at $12.5 million. The increased G&A costs are primarily due to the shift in-house of the Arkansas Surgical Hospital (ASH) anesthesia service and related billing ($5.2 million) and a reclassification of costs ($3.8 million) previously attributed to Drugs and supplies. This should also be considered when looking at D&S costs. In general, there were a number of other one-time effects in Op. Ex. that partially offset each other. I will go into more detail on individual aspects that should be taken into account elsewhere. In any case, after adjusting for these effects, Operating Expenses increased as % of sales less than it initially appears

Even if no special effects on the individual items of Op. Ex. at work, the adj. EBIT of $61.65 million is still remarkable and represents an EBIT margin of 14.52%. If we take the previously calculated enterprise value of 215.61 million, this results in an EV/EBIT ratio of 3.5. Measured against this, an investment in a rather non-cyclical stock would be a 'no-brainer'. However, it is not quite that easy.

What share of the cash flows is due to the shareholders?

A significant proportion of the income and cash flows generated is attributable to the NCIs. It is necessary to take this into account in order to not get distorted multiples. The same applies to the company's assets, but this is very detailed and not possible on the basis of the interim financial statements, as not all relevant items are separated between facility and corporate. Based on MFC's individual shares in the hospitals, I have therefore multiplied the items by an average value based on the distribution of cash flows between MFC and the NCIs. Discrepancies are likely to exist, but in my opinion are tolerable.

Taking into account the quite substantial cash flows for NCI, we get an EV/FCF multiple of 5.5 for 2021 and a multiple of 15.71 for 2022. This is a widely divergent value, but again partly attributable to one-offs.

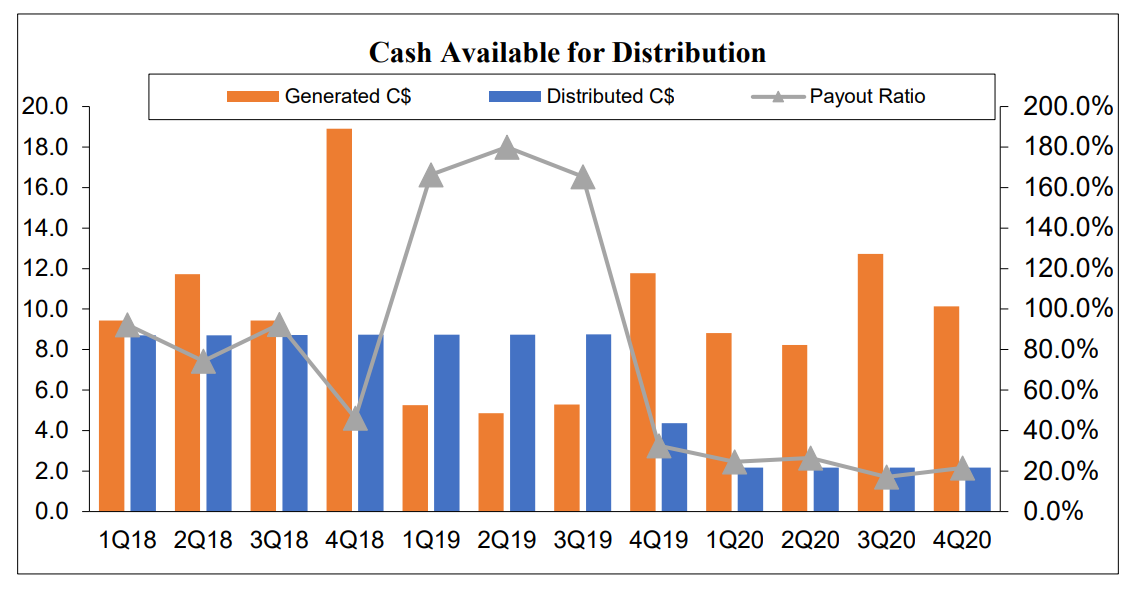

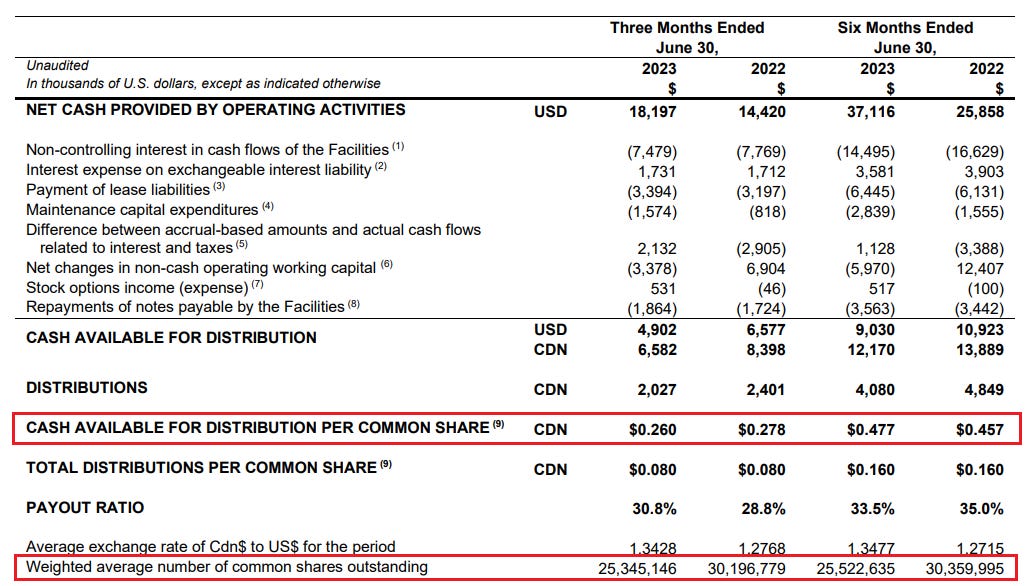

In order to provide a better picture of the cash flows available for distribution to the investors from the company's perspective, the company uses its own measure "cash available for distribution" (CAFD). The NCIs are entitled to a share of the cash flows of the hospitals in accordance with their shares in the hospitals. The basis for this is the "cash available for distribution at facility level" from which, for example, interest & amortization at facility level and maintenance cap ex have already been deducted. It could probably be described as cash flow after cash outflows, which are closely related to the respective hospitals.

After deducting the cash flows due to the NCIs, the costs incurred at the corporate level are deducted. These are interest, taxes and corporate expenses. The latter have so far accounted for the largest share of costs at USD 12 million

it should also be noted that the effects of negative stimulus income have been adjusted here by the company in order to establish better comparability with previous years.

Since the leases, principal payments, maintenance CapEx and interest have already been deducted from the CAFD, the 'correct' benchmark in my view is not EV, but market capitalization, since the CAFD is close to Levered Free Cash Flow. The payments for the credit line at the corporate level are excluded, but they are revolving, unlike the other debt. If we compare the CAFD of 2021 and 2022 with the market capitalization, we arrive at a value of 5.62 and 7.94 respectively. Here, the continuing high corporate expenses are noticeable in a year-on-year comparison. But here, too, the picture has changed considerably.

The investment case - focus on shareholder value

In September 2022, three relevant pieces of information were published by MFC:

- A change in corporate strategy

- The change of two Board members

- A buyback/tender offer of 34.5 million

This was preceded by a number of 'difficult years' which had a significant impact on the share price.

Change in corporate strategy - stop all acquisitions and transition to divestment

In order to understand the change in corporate strategy, we need to take a little look into the company's past. MFC had made two major acquisitions in the past. 2018 seven smaller ambulatory surgery centers for $46.5 million in a joint venture (In the Facilities Overview, "MFC Nueterra ASCs") and in 2016 two larger clinics for $27 million and $20 million. Of the latter, the controlling interest in the larger clinic was sold in early 2020 due to poor operating results. Nueterra also did not bring the hoped-for success, which was reflected in falling sales and a goodwill impairment.

Moreover, as the acquisitions were largely financed with debt, CAFD subsequently declined, while dividends remained at a high level, peaking at a payout ratio of around 180%

What followed was a massive dividend cut which sent the already depressed share price further down. From the high with prices above $17 in March 2019, it went to prices in the 2.X range within a year. The change in strategy announced in September put an end to acquisitions and the smaller acquisitions were gradually sold, with two loss-making hospitals closed. Of the seven smaller hospitals held in the joint venture, only one remains. The last two sales will not show up until Q3, as they were sold on July 1.

Change in Board and Management - Reduction of Overhead Costs

Announcements such as the one in September 2022 are usually written unemotionally, but anyone who can read between the lines will recognize that the relationship between the largest shareholders and management was strained. I have also had exchanges with individual larger shareholders who have confirmed to me that the mood was at boiling point because, in their view, management did not recognize the signs of the times and act in the interests of the shareholders.

Two Board members were already replaced in May 2022. One of them was part of the M&A Committee. Based on the information available to me, this already happened at the initiative of two larger shareholders. Who exactly was invested in MFC and when is not so easy to say, since ownership does not have to be disclosed under 10%. However, there is much to suggest that this was a coordinated action by 2-3 larger shareholders. Following the Annual General Meeting, no agreement could apparently be reached and it looked strongly as if a proxy fight might ensue. However, with the announcement in September, it was also announced at the same time that two more board members would be replaced. My understanding is that this was also at the instigation of the coalition of larger shareholders. Thus, 4 out of 7 board positions were held by the ctivists.

These removed the CEO on October 21, 2022. They chose Jason Redman to replace him as interim CEO, who replaced one of the previous board members in May of the same year. The previous CEO, Rob Horrar, also resigned his position on the board and it was not filled. There is no need to get the wrong idea here given the choice of words in the news. It's pretty obvious that the CEO was fired at the behest of the board. Thus, the key management positions and the board were filled by the largest shareholders.

This was not just about control, but also about reducing overhead costs, i.e. the previously mentioned corporate expenses. These had increased considerably in the previous years. Within 5 years, they had doubled from about 6-7 to 12 million. The compensation of the executives, whose salaries and bonuses increased from 1.65 million in 2016 to 4.4 million in 2021, played a major role in this. In previous years, the executives had granted themselves considerable stock options

Anyone who now makes comparisons with other companies and their respective compensation should bear in mind that corporate expenses of 12 million are considerable for a listed company of this type. Even in exchanges with other investors, I kept asking myself what the purpose of this company was, because if you look at the figures, it quickly becomes clear that the company did not benefit from economies of scale and mainly collects money at the corporate level, which is then distributed to the respective owners. Overhead costs, which swallow up a third to a quarter of the cash flow and are predominantly attributable to management, are completely inappropriate. There is much to indicate that value has been destroyed instead of created.

Not surprisingly, the salaries of the old management team were a thorn in the side of the new board and shareholders. Along with the CEO, the COO also had to leave, followed by the CDO in the current year. As a result of the departures, there are considerable savings compared to previous years. Most recently, costs were still impacted by considerable one-off effects such as severance payments. Savings were also made outside of this. For example, this year KPMG was replaced by Grant Thornton LLP..

Q3 should then provide the first clear view of Corp Ex. The current management recently spoke of savings in the range of 5 million. This alone would have a significant positive impact on the cash flows attributable to shareholders.

Substantial share buybacks

One can argue which of the September 2022 information was the most relevant, but the share buyback program was significant in any case. 3.05 million and thus 10.38% of the outstanding shares were repurchased under the "Substantial Issuer Bid" procedure. In addition they announced a repurchase program according to the "normal course issuer bid" procedure. In this context, 10% of the public float, i.e. 2.62 million, may be repurchased by November 30, 2023.

These buyback programs have a significant impact on the shares outstanding. At the end of June 2023, there were still 25.18 million shares. A further reduction can be assumed and although the CAFD has decreased by 12, 4% in a 6-month comparison, it has actually increased by 4.4% on a per-share basis.

Current figures

The fact that the CAFD has fallen in absolute terms on a YoY basis also gives cause for clarification as to whether this development is sustainable. As already mentioned, one-off effects such as severance payments are also partly responsible for this in the current year. Management holds the share-based compensation plans for the NCIs at corporate level primarily responsible for this, which is also quite conclusive. Last year, there was a significant decline in the share price in Q2 and thus a positive one-off effect on the reported corporate expenses

As the share price increased only slightly in the current quarter, the direct impact on the reported CAFD was only minor, but it makes the YoY comparison look uglier than it is. Since management put the impact at 2.1M, we can adjust the prior year CAFD for this, giving us an increase of about 9% YoY on a quasi-normalized basis. When this and other one-time effects are excluded, MFC was able to significantly increase its operating results. Measured against just eliminating the personnel-related one-offs, Q3 should look good in both real and visual terms, as the share price had recovered significantly in Q3 2022 and corporate expenses were still very high at that point. Even if we did not include any operational improvements and savings in the current year and annualized the 6-month CAFD, this would yield P/CAFD multiples of 8-9 for a non-cyclical stock that continues to buy back shares strongly and pay dividends. However, the potential for a better picture on an annualized basis is enormous.

In each of the first two quarters of this year, well over 1% of outstanding shares were repurchased. The pace has therefore not slowed down noticeably, although 9 million of the cash flow was used in Q2-2023 to reduce the credit line at corporate level from 36 to 27 million.

What can be expected in the near future? - Sale of the company

MFC is therefore priced absolutely cheap, but my actual speculation goes in a different direction. There is much to suggest that not only the sale of individual assets but of the entire company could be considered in the long term.

There is the larger shareholder Converium Capital, which is explicitly mentioned in the September news in last year and was apparently one of the driving forces behind the far-reaching changes. If you look at Converium's recent history, there is at least one case where they have recommended to management the sale of a company, and not in a friendly way. This is how we can read it to at least one open letter to the Board of Directors in March 2022 to Foxtons Group PLC. Previously Converium had bought shares in the company, has continued to do so to date and now holds over 5%. We don't know exactly how much stake Converium holds in MFC, but it must be a significant one, but still below 10%. Converium sees itself as a fund investing in "distressed and event-driven opportunities", apparently investing mostly in distressed debt. I can't for the life of me imagine that someone with this profile, who has already been openly activist, would want to let the company bob along and collect dividends permanently.

Interim CEO Jason Redman also has a past that is quite interesting. He is described on the corporate side as someone with a lot of experience in complex M&A transactions.. Based on his LinkedIn profile, unfortunately, it is not possible to trace his entire past, as it has not been maintained since 2018, but at least it was more common in his past that the companies in which he took a leadership role were acquired. However, this is merely correlation and need not be causally related. However, a well-informed market participant who knows Redman personally told me that Redman is the typical "turnaround guy" who probably has no interest in leading MFC for long

In addition, the company is trading well below value compared to many other similar companies. A sale of major assets with a corresponding multiple could reveal to others the value that has apparently remained hidden until now. It has never been concretely defined by the current management what is considered as "non-core assets". Questions in this regard were blocked. There is no question that the smaller clinics that were operated in the joint venture are among them. Likewise, there is no doubt in my mind that the interest in the small "Surgery Center of Newport Coast" is firmly planned. When the sale of the two remaining smaller clinics is completed, I think the sale of a larger one is also very likely. We need to keep in mind here that most of these clinics would very likely be better positioned on their own and the stock price has taken a massive slide due to past bad decisions. That being said, MFC is definitely one of those companies whose statements are hard to read. However, should a major sale take place, the value embedded in the individual assets could be unlocked

Valuation

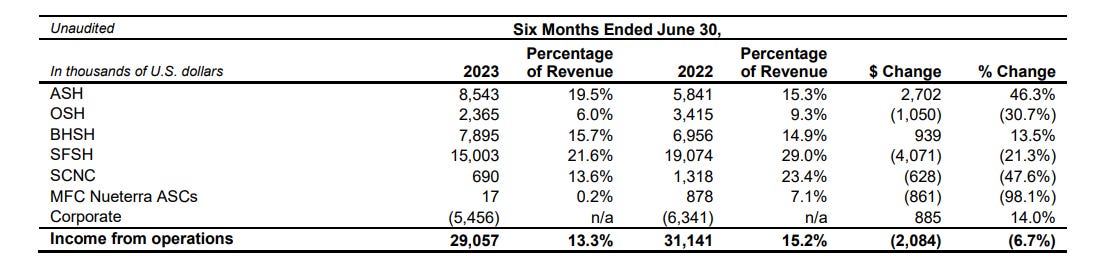

Speaking to unlocking value, we come to the interesting question of what the potential value is. I have already shown that MFC is cheap on an absolute basis, i.e. P/CAFD, and also offers the opportunity for significant operational improvements. However, if we want to value the company on a relative basis, it becomes more difficult, as here a comparison based on the EBITDA multiple is usually more appropriate. I talked in advance with two very smart people and good investors who are also very deep into this case. One told me that according to his calculation MFC trades at 3.5 times EBITDA, the other at 6.5 times. How do such big differences come about?

First of all, it is relevant what the person considers normalized EBITDA to be in each case and how conservatively he approaches this. Does the person also include leases in the calculation or not? In my opinion, however, what weighs more heavily is the two- or three-way split of the payment flows between Facilities, Corporation and Shareholders. The problem is that the payments to NCI have not yet been deducted from the reported EBITDA. In the event of a potential sale, however, only the portion of the sale sum that is actually attributable to MFC's share would be due to the investors. Consequently, we would either have to look at EBITDA for each clinic individually, which is not possible, however, as only EBIT is reported, or deduct the payments to NCI already at EBITDA level

However, this is also difficult with the available data, since although EBIDA (i.e., excluding taxes) is published at facility level, parts of the costs at facility level are also attributable to the NCIs and thus reduce the portion of EBITDA to which they are entitled, without a breakdown of the individual clinics at facility level. In addition, MFC has different interests in the clinics. It therefore seems wrong to me to simply deduct the cash flows attributable to the NCIs from EBIDA. I have also sent a question to the IR in this regard, but have not yet received an answer

As a solution that seems to me to be very adequate when measured against the alternatives, one can multiply the percentage share of the NCIs in the CAFD by the EBITDA, as was done previously in the calculation of the EV, in order to at least come very close to the EBITDA to which the company is entitled. This calculation assumes that the costs at the level of the individual hospitals are distributed in a similar way to EBITDA and that the different shares at the individual hospitals are thus of only minor relevance.

We then deduct the costs at corporate level and the share of lease payments from the value obtained in this way. For 2023, we take the half-year figures and annualize them. This therefore does not take into account further savings or operational improvements in the second half of the year. This gives us a current EV/EBITDA multiple of 6.31.

There are some publicly traded hospital operators that can serve as potential peers, but these also have significant NCIs. Consequently, simple comparisons are not possible and EV, FCF and EBITDA have to be adjusted as well. The fact that these are usually much more complex companies makes breaking down the individual figures even more complicated. Apart from that, some of the apparent peers are significantly larger, have a different focus and therefore margins. On an unadjusted EV/EBITDA basis, the multiples range from 9.2 ($HCA) to 18.5 ($SRGY), while MFC trades on an unadjusted multiple of 3.5. On an adjusted basis, almost all peers would also have to trade on a higher multiple. In any case, on an EV/Sales basis, MFC is trading at 0.69, well below peers trading in the 1.9 to 3.2 range. As I said, this is all to be viewed with a critical eye. $SRGY, for example, has 152 clinics as of this writing, of which they have a majority stake in 92 clinics and consolidate 119. That may give you an idea of how difficult it is to compare in this way.

However, one can also look at the multiples at which comparable hospitals were recently sold, as this is more relevant in the case of an asset sale and the corporate expenses would not be taken into account here. I have looked at several reports that have evaluated current multiples for acquisitions. The EBITDA multiples range on average from 7.4 in the first quartile to 8,0 in the 4th quartile. Larger clinics with 5-10 million EBITDA, which include all 4 of MFC's large clinics, were bought at 9.9 times EBITDA . Two of the clinics of MFC (Black Hills and Sioux Falls) even achieve significantly higher EBITDA, which tends to lead to higher M&A multiples.

The individual hospitals are only shown with their EBIT in the reports. However, based on the reported lease liabilities and assets from 2022, we can at least conclude that D&A is almost entirely attributable to Facilities and not to Corporation. As a makeshift, I allocate the incurred D&A costs to the individual hospitals based on their share of revenue. I also take the annualized 2023 half-year figures as the basis, since the 2020-2022 figures are distorted by stimulus income, which is also not broken down precisely

In order to show a valuation corridor and to be conservative in doing so, I show two possible valuation multiples for the entire clinics. One is 7 x EBITDA and the other is 9.9 x EBITDA. 7 x EBITDA is below what was paid in terms of absolute EBITDA size for comparable clinics and does not make a qualitative valuation about the MFC clinics. I value the Newport clinic and the Nueterra JV at 0 to be more conservative here as well.

From the potential sales proceeds, I subtract the NCI's 'current' shares to determine the share due to the shareholders. The NCIs do have the option to exchange a portion of their shares for shares of MFC, as noted earlier, but not more than 3% per quarter. It is likely that they will do so in part at some point during the course, but that would also increase the invested's share of the sales proceeds. As of now, it makes little sense for me to map these possible scenarios, as there are too many effects working against each other here, so I am showing the status quo. Taking into account the current number of shares, this results in a value of 14.41 and 21.73 CAD as equity value when considering the market capitalization. Taxes were not considered in this scenario, as the individual clinics would likely generate partial sales losses (Oklahoma) upon sale, and other sales gains (Black Hills) that would offset each other. In any case, keep this aspect in mind anyway. In addition, all other liabilities are considered ordinary, which are already reflected in the EV/EBITDA multiples taken as a basis. The costs at corporate level were also not taken into account, as in the event of a sale it can be assumed that the buyer would reduce them to almost 0.

Assuming a 24-month scenario in which 4% of outstanding shares continue to be repurchased annually and the remaining cash flow is used to reduce the Corporation-level credit facility, we obtain an equity value of CAD17.21 and CAD25.15, respectively.

The 24-month scenario also illustrates very clearly what a significant effect the sale of individual hospitals with subsequent tender buybacks could have. However, it should also be borne in mind that in the event of a sale of the company as a whole, it is very unlikely that the proceeds shown will be realized.

Downside

I consider the downside at MFC to be very limited for the following reasons:

- Management is clearly focused on increasing shareholder value

- The current dividend yield is approximately 3.5% and this with a current payout ratio of 33.5%. Cash per share available for distribution continues to increase due to buybacks. Increases in CAFD are also not unlikely on an absolute basis

- One-offs (impairments, stimulus income, severance pay) are eliminated in subsequent quarters and YoY comparisons should clearly show the development due to the savings

- Cheap on both a relative and absolute basis in terms of EV/EBITDA, EV/FCF

In addition, there is still considerable room for improvement compared with previous years. While management was rather critical of developments on the labor market in previous years in the earnings calls, the tenor has been more positive again in recent quarters. The issue of the lack of nursing staff in the USA in particular has been dragging on for years. According to the latest statements by management, however, bonuses now have to be paid much less frequently in order to attract and retain staff.

Why does this opportunity exist?

If I had to give an answer as to why this opportunity exists, several aspects would immediately come to mind:

- The financials are in USD, the price is quoted in CAD. Many screening tools seem to have problems here and show the multiples too high

- In some cases, screening tools have classified the exchangeable interest liability as debt, although it is clearly not. As a result, the EV and thus also the multiple were overstated.

- The NCI aspect makes this case very complicated. It was also difficult for me to split the payment flows as accurately as possible

- The cut of dividends in the past led to a massive slide in the share price and wiped out many of the former shareholders

- The scenario of a complete sale is not sufficiently recognized by the market and management is silent in this respect.

If there really is a sale of the assets and the multiple is even close to the range I assumed, the potential should be recognized by the market.

Conclusion

Medical Facilities is definitely one of the cases with the most complicated numbers I have seen so far, but this creates opportunities for shareholders. The potential return from a sale, combined with the very limited downside and short-term catalysts, offers a very attractive opportunity in my view.

As of this writing, Medical Facilities Corp has a portfolio holding of 14.80% and I got in at an average of 8.91 CAD. I first read about this stock in the 2023 SCM Mid-Year Letter by Danial Smoak.