MIND Technology ($MINDP) - Preferred Shares Special Situation

MIND has sold one unprofitable division in order to focus entirely on another and is now profitable. Management apparently wants to get rid of the preferred shares, which creates several scenarios.

First of all, the disclaimer: I am invested in MIND Technology preferred stock ($MINDP). Nothing I write should be considered investment advice.

PLEASE NOTE: Literally as I was about to publish this write-up, news came out that changed the picture considerably, as the conversion offer was significantly adjusted.

Ticker: $MIND, MINDP 0.00%↑

Price: $5.72, $11.50 (MINDP)

Shares Outstanding: 1.41 million, 1.62 million (MINDP)

Market Cap: 8,11 million, 19,35 million (MINDP)

Enterprise Value: 51.4 million

The Company

MIND Technology Inc. is a global provider of maritime technology products for three key markets: exploration, defense and survey.

Historically, they have divided their products and services into 3 segments. The “Leasing-busines”, a land-based seismic equipment leasing company, Klein Marine Products, which designs, manufactures and sells side scan sonar systems, and Seamap Marine Products, which designs, manufactures and sells energy source controls.

To make a long story short: After a dramatic drop in demand for seismic equipment leasing, which was probably due to the sharp fall in oil prices in 2016, the management decided in 2020 to sell the leasing assets after several years of losses and to discontinue the division. This was followed in 2023 by the sale of Klein Marine Products in order to focus entirely on the opportunities of the Seamap unit and allocate capital to it, according to management statements.

The remaining segment

As a result, only one segment was left. If the company says that it wanted to focus on the opportunities in this segment, then that is understandable, because at that time it was the only profitable segment and was able to win one order after another. This is probably not only due to the skills of the management, but above all to the fact that a larger (some say virtually the only) competitor discontinued its source controller division at the end of 2020. I couldn't find a press release stating the reason, but the competitor seems to have been Teledyne Technologies, although they still seem to be active in at least some part of the business.

Yes. As it relates to source controllers, that is definitely the case. We were pretty much the only game in town. We do have some competition for the positioning systems, BuoyLink, and we do have some competition for the streamer systems, but we are focused more on the high resolution, 3-dimensional applications used for survey purposes more than deepwater exploration. So we don't go head-to-head with the deepwater streamer systems.

So we do have some competition there, but it's pretty thin. It's fair to say.

Robert Caps - MIND Technology, Inc., Q2 2024 Earnings Call, Sep 14, 2023

The products in this segment, mainly seismic sensors, have historically benefited primarily from increased exploration activities in the oil and gas business, and this is still the case. However, the company now also generates income from other areas. Exploration is also relevant for renewable energies, such as offshore wind farms, in order to be able to assess risks due to ground conditions. In fact, we are not just talking about the company's intention to diversify its revenue streams. There are already relevant orders.

Additionally, our team continues to develop new and innovative ways to adapt and implement our technologies to meet the evolving needs of our customers. In addition to traditional energy-related opportunities, we are seeing new applications for our Seamap technologies. As an example, our backlog includes over $5 million related to one of our SeaLink ultra high-resolution 3D seismic streamer systems. This system is intended for use in surveys required for offshore wind farms and other green energy projects.

Robert Capps - MIND Technology, Inc., Q3 2024 Earnings Call, Dec 14, 2023

The company is therefore currently active in two sectors that are currently on the upswing. Both offshore wind and offshore oil production are currently on the rise.

Although the company also intends to use the products from the Seamap segment for the defense sector, no sales have been generated from them to date. However, the focus on the civil sector also makes the company more agile than before, as all orders in the defense sector were subject to approval.

Apart from that, they have entered into a collaboration agreement with the buyer of Klein, which provides them with a steady income for the use of their sonar software. They also expect to find other external customers for this. MIND also offers repair services, which account for a small proportion of sales but generate higher margins.

There's also a growing opportunity for MIND to provide seismic streamer and repair services, not only for SeaLink streamers, but also for products manufactured by others.

Robert Capps - MIND Technology, Inc., Q3 2024 Earnings Call, Dec 14, 2023

The Numbers

There are various aspects to consider when looking at MIND's current and past figures.

What is striking is that the backlog from even before the sale of Klein was predominantly characterized by Seamap. Given this, it is understandable that the management saw the greatest opportunities here. It is also obvious that Klein recently had a strong negative impact on the earnings figures.

The management also emphasizes in almost every earnings call that they have a strong fluctuation in sales per quarter. If you go back over the last few years, you will find these comments again and again. This is particularly relevant when looking at Q3 and Q4 2024, as the fulfillment of orders from Q3 has been pushed to the next quarter. It would therefore make sense to combine the two quarters. But this would also lead to an incorrect assessment, as orders were also delayed in Q4.

Our fourth quarter results benefited from a little over $5 million of orders that were delayed from the third quarter, but there were other orders pushed from the fourth quarter into fiscal 2025. The shifting of deliveries and the impact of that on quarterly revenues is just a fact of life for our business.

Robert Capps - MIND Technology, Inc., Q4 2024 Earnings Call, Dec 14, 2023

This will probably continue to be reflected in MIND's figures, so it makes sense to look at the bigger picture, which would lead to a positive EBITDA even if the earnings figures for the two quarters were simply added together, as well as generally rising earnings figures.

I assume that the trend in earnings figures will at least continue, even if sales from the Seamap segment remain the same. According to management's comments, I assume that most of the cost savings from the sale of Klein have yet to become visible, as operating expenses are currently still affected by non-recurring costs. This can serve as a strong indicator of how high the operating leverage 'actually' is.

The sale of Klein is allowing us to streamline our operations and thereby reduce some costs. We've recently taken some actions in this regard, including selected headcount reductions, reducing the size of our Board of Directors and reducing the compensation for the remaining members of the Board. […]We also believe that the more streamlined operations will result in lower professional fees and travel costs. We will begin to see the impact of these changes in the fourth quarter of this year, but will not recognize the full benefit until next fiscal year.[…]In the third quarter, the impact of cost reduction measures taken earlier this year was partially offset by severance costs and higher professional fees.

Robert Capps - MIND Technology, Inc., Q3 2024 Earnings Call, Dec 14, 2023

Balance Sheet - Preferred Shares

What the management repeatedly emphasizes in the calls and is also immediately apparent when looking at the balance sheet is that MIND has a very high working capital requirement. In view of this, it makes sense that the management wanted to focus on a business area in which they currently see more opportunities than the one they sold in order to free up capital.

By selling "Klein" for 11.5 million, MIND was able to pay off all its debts, is now debt-free and has a cash balance of 5.3 million. But there is still an outstanding matter from the past: a significant number of preferred shares.

The company issued them in 2016 at a price of $25 to reduce its then overwhelming debt burden of 45 million. According to the registration statement, the preferred shares have no end date, receive a dividend of 9% and can be bought back in part or in full by the company after 2021. In the years that followed, MIND repeatedly used prefs as a form of financing. The 600,000 shares issued became 1.68 million. The company has the right to defer the dividend on the prefs. However, as soon as they are 6 or more dividends in arrears, the pref holders have the right to nominate two board members.

Well, by now the dividends have been deferred for the seventh time.

The Investment Case

Although the dividend has been deferred several times and the price of the preferred shares is now trading well below the liquidation value, I currently see the much greater opportunity in the prefs.

The reason for this is that it is quite obvious that the company wants to get rid of them. At the beginning of March 2024, the company announced that it would be holding a virtual special meeting of the pref holders. The company wanted the consent of the pref holders for the prefs to be exchanged for 2.7 common stock each. At the time, this would have been a 110% premium on the Prefs share price, but also a 42% discount on the liquidation value ($25 + deferred divdidens = $28.38). More than two thirds of shareholders would have to approve the proposal.

The reason given by the management for the proposal was that the preferred shares represent an "overhang" for the company, which makes it more difficult for them to access new capital and makes M&A transactions and growth more difficult.

According to the wording in the presentation, it is quite obvious that the pref holders will continue to be treated rather neglected if they do not agree to the proposal.

While our liquidity and financial position are much improved, we do not believe that our current operations can generate the capital needed to exploit and grow our business and at the same time, pay ongoing or accumulated dividends on the preferred stock. Therefore, while no decisions have been made and circumstances can't change, we currently believe it unlikely that we will declare further dividends on our preferred stock for the foreseeable future.

Robert Capps - MIND Technology, Inc., Q3 2024 Earnings Call, Dec 14, 2023

The special meeting was originally scheduled for April 25, but was postponed by the company on April 24. However, a new date for the meeting and a new record date, which determines who may attend the meeting, are to be announced. One can only assume that the result that was probably on the horizon was not what was hoped for.

From today's perspective, however, the current situation allows for several scenarios from which shareholders can benefit, although I think that one scenario is the most likely to bring a return.

Scenario 1 - Proposal does not receive approval, but prefs are liquidated

Given that the management itself is already talking about a possible sale, we can at least consider this scenario, although mentioning the possibility is probably primarily of a tactical nature.

In the event of a sale, the terms of the prefs provide for them to be liquidated. According to the PRE 14A, this would result in gross proceeds for the pref holders of 28.38 dollars. Since the last dividend was also deferred, I assume proceeds of 28.94 dollars in the event of a sale

One could also argue that the company itself could buy back the prefs in whole or in part. They have a cash balance of 5.3 million, currently no debt, will probably generate free cash flow and have unencumbered real estate worth 5 million that they could use accordingly.

But that would be very surprising from my point of view as it is unlikely that the company could get much better debt than one at 9%, so it would make little sense to replace prefs at 9% with a loan and they have already sent signals that they want to buy back below par. Not to mention the fact that the cash is needed for working capital.

Anyone now thinking in a sale scenario that the common stock might 'profit' more than the prefs is of course right. If you consider the liquidation value as a loan, then you get 48.7 million in debt, consequently with 8 million market capitalization and 5.3 million in cash an EV of 51.4 million. If the total sale price were significantly higher, the prefs would only receive the liquidation value, while the common stock would benefit from the entire upside. I still bought the prefs as they trade significantly below par and rank senior to the common stock. The company could therefore virtually go bankrupt now and I would still get my money back.

In general, however, one should ask the question of how much of a hurry a board is in to sell a company if it owns only 5.67% of the outstanding shares. The Non-Executive Chairman owns 5.07% of the OS and 1.3% of the prefs. However, if the prefs were to bring two new members onto the board, that might change the situation somewhat.

Scenario 2 - Proposal does receive approval

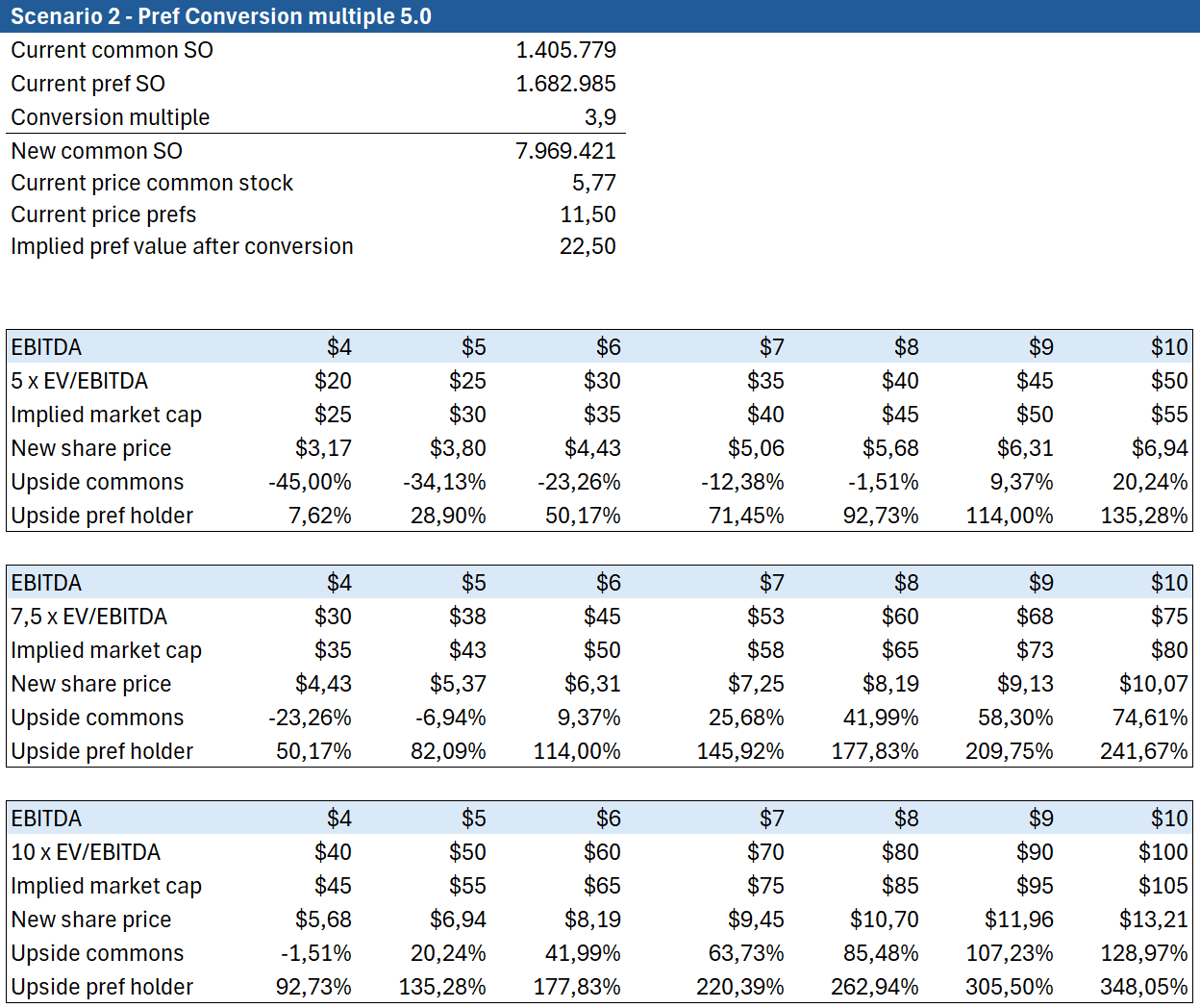

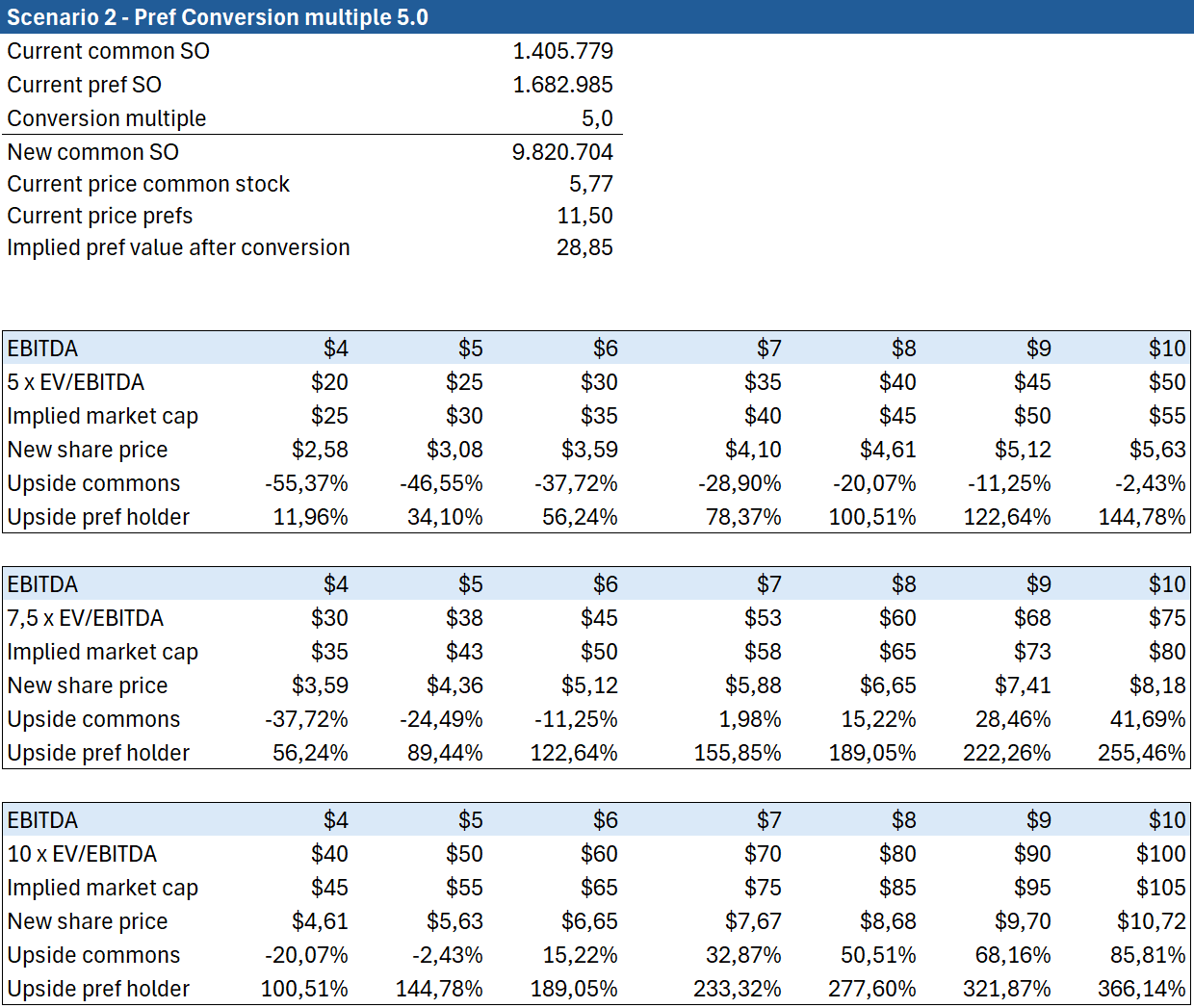

There was a relevant change in this scenario today. The offer was increased to 3.9 common stock. If we assume that the new offer of 3.9 ordinary shares for one preferred share remains in place and that this offer is accepted, a possible scenario can also be considered from the perspective of the preferred shareholders.

If we assume that the backlog will continue to be at least replenished in view of the increasing demand for offshore oil production and offshore wind farms, that the backlog continues to convert well into sales and that the announced cost savings are included, I believe that a range of 4 to 10 million EBITDA is realistic.

Finding a suitable peer for an appropriate multiple is a task I don't particularly like, as there is justifiable criticism of every pick. Kraken Robotics, for example, has potentially similar customers to MIND and trades at 15x EV/EBITDA, but is currently growing much faster and is presumably active in the segment that MIND has just sold. Teledyne is too diversified to serve as an appropriate peer. For this reason, I have considered a range of 5 to 10 x EV/EBITDA, which seems appropriate to me in line with the aforementioned aspects.

Based on the current pref price of 11.50 dollars, the conversion to 3.9 common stock at 5.77 results in an implied value of the prefs of 22.50 dollars per share (However, the price of the common stock is very likely to fall today, as the dilution will be greater). The respective share prices in the three different calculations result from the new number of common stock in relation to the calculated market capitalization.

Based on this, the conversion would lead to an upside from the perspective of the pref holder even under rather pessimistic EBITDA and EV/EBITDA assumptions. I suspect, nevertheless, that it will be difficult to persuade shareholders who were expecting to buy a share that would give them a reliable 9% dividend and allow them to sell at 25 dollars that they should refrain from the upside in scenario 1 and rather take the risk of participating in the conversion at a significant discount.

This is probably the reason why the special meeting was postponed. It probably became clear that there would be no approval. I think there is a possibility that the management wanted to allow a higher turnover in the prefs. With a new registration and voting date, more investors could buy, simply seeing the opportunity for a quick and potentially beneficial conversion into ordinary shares. The new record date is April 26 and the Special Meeting is on June 13.

However, I would be surprised if the management were to come to the pref holders with the same offer again (I was right ;-)), as this would certainly not make approval any more likely and the quarterly figures from April 29 were undoubtedly very good. Due to the good results, many pref holders now expect to receive the dividend again at some point, although the company is aggressively suggesting the opposite. But at this point you have to suspect a tactical component in any communication from the management. This can be assumed simply by the fact that the special meeting was scheduled 4 days before the company posted its best numbers in a decade.

Without Mitsubishi's approval, a positive outcome could be hard to achieve, as a non-vote effectively means a no vote. Mitsubishi's 10.3% voting rights along with its public approval could provide a nudge in the right direction.

However, if you expect a higher conversion multiple, you should be aware that the additional upside from the perspective of the pref holders is rather small, while the dilution effect from the perspective of the common stock is much higher.

Scenario 3 - Nothing happens or worse

Even if the management believes that the prefs are a considerable burden for the company, there is no urgent rush to eliminate them. I am open to other opinions here, but according to the terms of the prefs, which have no stated maturity, I cannot find any aspect that necessarily suggests that the prefs will have to be bought back soon or that dividends can be paid out again.

Instead of doing nothing, the company could also consider another form of financing for the company that would rank senior to the prefs, which would also negatively impact the price of the prefs.

There is no question that the existence of the prefs makes it difficult for the company to access new capital, so it is understandable that they are trying to convert them at a lower price, but the prefs being bought back at liquidation value makes absolutely no sense. They have a comparatively favorable interest rate of 9% and no maturity date. Name me a better form of financing for this company. I therefore assume that they are more likely to look for other ways of financing, which then potentially rank senior to the preferred shares. The common shareholders will not be happy about this either, as a dividend will be much further away for them than before. Sounds like a target for activism *cough* *cough*.

The least the pref holders should do now is to bring the two members on board.

Conclusion

Neither the common stock nor the preferred shares are a bet the farm investment. That is pretty obvious. It would be illusory to think that as a pref holder you have the upper hand under the current conditions. As someone who doesn't carry the psychological burden of a high entry price into the prefs, I'm in favor of the conversion of the prefs ( unfortunately I can't vote due to the record date), but I’m open to arguments in this regard and have already had good discussions with investors who see things differently. At least that was the case until today's offer came in.

For me, it is my second smallest position in the portfolio with a 3% share. Make of it what you will. I am following the further development with interest, but do not want to be part of another “one-day-squeeze-out-scenario” with a relevant share of my portfolio. I still can't fully assess how the pref holders will vote.

Are there large prefs holders? Are you shorting the common as a hedge? Assume the common may slump, once prefs sell their shares.

Is the conversion offer only for pref holders as of a certain date?