Regis Corp ($RGS) Q4-2024 Update

The euphoria about the refinancing was followed by disillusionment about the operational realities, but management continues to send out the right signals.

First of all, the disclaimer: I am invested in Regis Corp stock ($RGS). Nothing I write should be considered investment advice.

Everything as expected with one minor and one major exception

Much of what we saw in Q4 was to be expected, which is not to say that everything speaks for Regis, but it is at least an indicator of how predictable the further development will be and how reliable the management is. Let's start with the positive aspects.

As expected and positive

As expected, adjusted EBITDA YoY grew. However, a significant portion of the 7.4 million is due to a change in the regulations for gift card breakage. This resulted in a positive effect of 1.3 million, which was attributed to the company-owned stores. In my opinion, this effect should not be included in adjusted EBITDA. As I calculate the EBITDA myself in the end anyway, it plays a subordinate role for me. However, the more relevant franchise adjusted EBITDA has also risen from 5.5 to 6.1.

The positive income effect from the debt forgiveness was offset by the substantial NOLs, which meant that no tax was paid on the substantial profit, from which the company will continue to benefit as the remaining NOLs amounted to 490 million at the end of the FY.

The significant cost savings are a relevant factor for the rising EBITDA and the positive cash flows. In August, there was a major workforce reduction, which was not specified by the Executive Board, but is presumably not insignificant, as the G&A run-rate previously amounted to 43 to 46 million and is to be reduced to around 38 to 40 million by the end of the year. In FY 2025, G&A costs are expected to be between 40 and 42 million. Another aspect that I would see as a cost saving is the subletting of 3 out of 4 floors of their headquarters, which should result in 1.2 million rental income that will be allocated to “Other income”. These signals are exactly what I want to see and for me the management here is acting strictly according to the textbook in the most positive sense.

Based on these measures, it can be assumed that both EBITDA and cash flow will increase or be positive from here on. In Q4, the positive cash flow already amounted to 5 million. Q1 is traditionally cash flow negative, as insurance premiums, bonus payouts and prepayments for the January stylist event are due there. From Q2 onwards, management expects cash flow to be positive for the rest of the year.

As expected and negative

Store closures remain the most critical problem after refinancing. 404 franchise stores were closed in FY 2024. The fact that this is a lasting effect for the time being was discussed again in the last call. CFO Kersten Zupfer made it clear in this call that a similar number of closures can be expected in 2025. Most of them in Q3, as a large number of leases for SmartStyle franchises expire there.

We continue to see significant net store closures as we move towards a smaller, albeit healthier salon network from a sales and profitability perspective.

Matthew Doctor, Regis Corporation, Q4 2024 Earnings Call, Aug 28, 2024

This is a real problem and just because it was expected doesn't make it good. The stores may be underperforming on average and some of the franchisees are just waiting for their contracts to expire, but with each closed store not only the royalties decrease, which partially negates the cost savings, but also the contributions to the advertising fund. At the end, I will discuss the expected short-term impact of store closures on EBITDA in FY2025.

Nevertheless, there are aspects that suggest that we will return to growth after a transitional phase. The fact that Regis is no longer under immediate threat of bankruptcy alone could give franchisees who were previously reluctant to expand a nudge in the right direction.

Apart from that, I can see that the management has the right focus. The most urgent problem was refinancing and now it is a matter of uniform standards and checking compliance with them. I know that many people would like to see new stores springing up again now, but considering that Regis was a company that felt like it was stuck in the early 2000s, I think this approach is exactly right. You don't put the walls up before the foundations are in place. A strong franchise system is what attracts new franchisees. When these measures are implemented, a large overhang of poorly performing stores, which are repeatedly mentioned in the calls, will fall by the wayside.

As we enter this new chapter as franchisor with singular focus, I've mentioned on prior calls that we were starting with our first major initiative of defining, monitoring and enforcing the components that we believe make for the proper end-to-end customer experience that we call excellence standards.

Too many years have gone by without our finger on the pulse and eyes on salons, leading to the breeding of independent behaviors and an inability for us to take advantage of our size and our scale.[….] We know how important it is to have clean great-looking salons for our customers and our stylists, especially in this highly personalized services business. Our salon image and service offering form a key element to perceive value and is the tone-setter of the experience. So we will aim to make the most inroads here to start, and over time, we will shift our efforts more towards further influencing the behaviors at the salon level.

Matthew Doctor, Regis Corporation, Q4 2024 Earnings Call, Aug 28, 2024

Considering that the management has consistently taken comprehensible steps since Matthew Doctor took over as CEO, which have been part of an overarching plan, I am willing to give the management the benefit of the doubt here too. Basically, we have no other choice here. Except to sell.

Not expected and negative

The migration to Zenoti's POS is now finally complete. In purely arithmetical terms, the outstanding payments from the software sale to Zenoti should have amounted to 13-14 million. According to the statements from the call, it is now more like 7-9 million. Contrary to Kersten Zupfer's statement, this is not solely due to the store closures. I can only speculate, as I don't know the details of the purchase agreement, but from a buyer's perspective, my willingness to pay the full amount would probably also be rather low, given the long migration phase and the expectation of the closure of a large number of other stores. The comment in the last 10-Q already pointed in this direction.

Another negative aspect, which in my opinion weighs more heavily in terms of the signal effect, is the negative same-store sales in Q4. There was no explanation of the reasons for this in the earnings call. My mail to the Management Board in this regard has so far remained unanswered. What is striking, however, is where the negative SSS predominantly originated.

Of the 146 store closures from Q3 to Q4, 90 were due to SmartStyle. If you look at how SSS is measured, this alone could have had an impact. Apart from that, however, it suggests that this brand in particular is the underperformer in the portfolio, which also corresponds with the CFO's statement that most closures will take place in Q3 and are attributable to SmartStlye. It is little consolation, but unlike Supercut, this has a slightly lower impact on royalties, as SmartStyle franchisees only pay 5% royalties, while Supercut and Costcutters pay 6%.

However, there are signs that same-store sales could soon improve. The mere fact that Zenoti is now available in every store opens up new opportunities in terms of personal marketing and is apparently already having a positive impact elsewhere, with significantly more and positive reviews in the Supercut stores.

In addition, the pilot tests with Supercut Rewards were successful, as demonstrated by the 3.4% increase in traffic, and will now be rolled out to all Supercuts first and then to the other brands. Again, I like the planned and calm approach of the management. They don't see anything as a no-brainer. They test first and 'then' implement across the board.

The new brand standards should also contribute to this.

And while we have strong belief in the merits of these programs, we can't emphasize enough that the key to retaining and driving new guests starts first and foremost with the operational and service excellence I mentioned above.

Matthew Doctor, Regis Corporation, Q4 2024 Earnings Call, Aug 28, 2024

As I myself am a person who predominantly uses what he can already see in the financials to judge, I understand that these aspects are marginalized, but we should not forget that Regis is a company with significant operational weaknesses, the causes of which need to be addressed before we can think about growth. A successful refinancing will not change that.

Valuation

At the valuation at the moment, I am deliberately taking a short-term view of one year, as we do not have any good long-term indicators and there is generally a lot of change going on at the company at the moment.

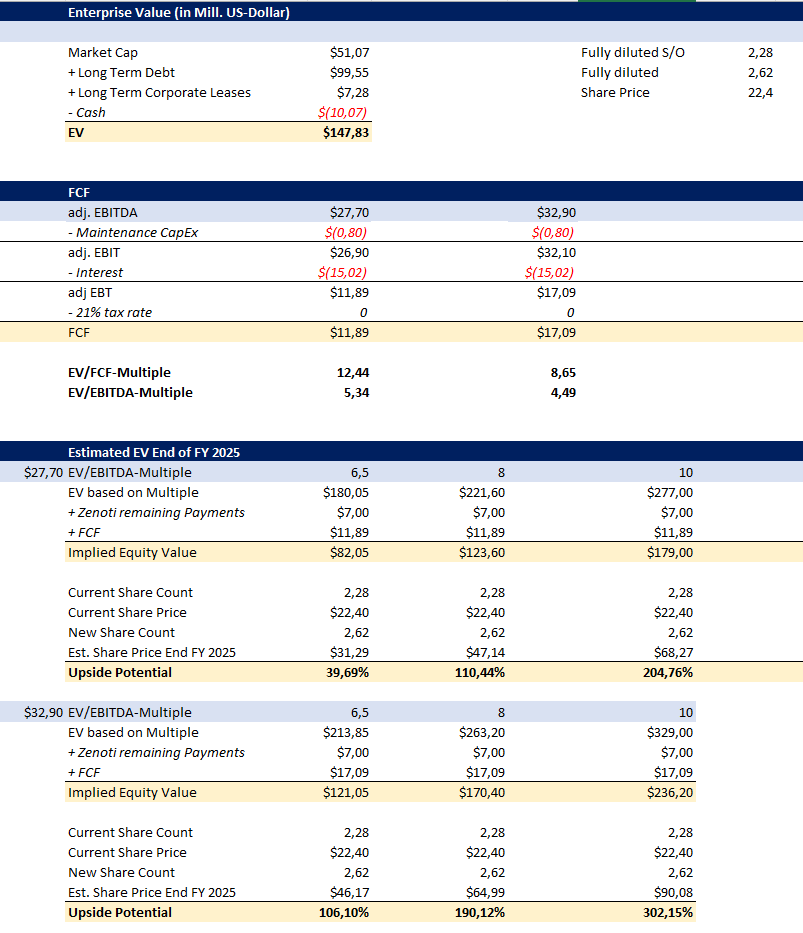

I illustrate here in two scenarios the effects of store closures, the development of SSS and cost savings.The result is to be understood as if the effects of the individual aspects occur immediately, which makes sense from my perspective, as they all take place continuously and partly negate each other. I have assumed several conservative aspects in scenario 2.

Scenario 1 assumes 0% SSS growth, the announced 400 store closures and average store sales of 150000 dollars. In the penultimate call, management said that the most recently closed stores had average sales of 131,000. For G&A, I have assumed the lower limit of the guidance and added the 1.2 forecast rental income to the difference with fees and royalties. This results in EBITDA of 32.9 million, which is significantly higher than TTM EBITDA.

Scenario 2 assumes a 1% decline in SSS, 500 store closures and average store sales of 200,000 dollars, which I consider to be very conservative compared to the average sales of all stores of approx. 260,000. I have assumed the upper limit for G&A and thus arrive at an EBITDA of 27.7 million.

I consider this range to be very realistic from the lower end to the midpoint of expectations.

If I apply the corresponding EBITDA to the current valuation and assume various multiples of 6.5 to 10, I get a significant upside from today's perspective.

How realistic is the upside?

I have seen many discussions on various platforms suggesting that the share price is currently far too low. It may surprise some people, but I don't see it that way. Any calculation based on the short-term EBITDA or FCF multiple is only meaningful if the company at least continues to achieve these on a sustainable basis. With a store count that is on its way to 0 purely from a chart perspective and falling SSS, this can be doubted purely on the basis of the information we have de facto, which is anticipated by the market accordingly.

Any calculation of the current multiples therefore only shows how significant the upside is if the management turns the company in the right direction on a sustained basis. If store closures were to fall significantly at some point and SSS were to rise, then the share price would reflect the trend reversal within a very short time, in my opinion. It should be noted that 10 x EBITDA is potentially a rather low multiple for a franchise model.

Regis remains a bet. A bet that store closures and SSS decline are only temporary problems. The odds of this are significantly higher than before the refinancing as the company has been given the financial room to make changes and improvements to the business model.

Conclusion

I remain invested in Regis. The management has acted along a common thread so far, which I can still see now. The potential to transform the Regis brands into successful and competitive franchises is there in my view, but this should not marginalize the current problems.

I think you need more staying power with the stock than many would like, which is reflected in the volatility. As many are sitting on high profits and the share price does not reflect what I feel are sometimes irrational assumptions, we will have to get used to it for the time being.

However, I also see some potential for positive surprises until the next figures. For the first time since Matthew Doctor has been CEO, the management can buy shares themselves, as they are no longer in a blackout period. Considering the nice cash injection of half a million that he has just deservedly received from the company, I don't see this as unlikely. Nevertheless, I believe that we need to think in terms of 1-2 years rather than quarters.