Regis Corporation ($RGS) - Deleveraging play with activists trying to prevent further dilution

Deleveraging play with activists trying to prevent further dilution.

I first published this idea in the Micro Cap Club on January 16, 2024 and bought my first shares at USD 8.82. Keep this in mind as you read, as the numbers have changed since then.

First of all, the disclaimer: I/we have a beneficial long position in the shares of RGS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Ticker: RGS

Price: USD $9.08

Fully-diluted Shares Outstanding: 2.36 million

Market Cap: USD $20 million

Enterprise Value: USD $195.71 million

Investment thesis: Deleveraging play with activists trying to prevent further dilution

Summary

Regis Corp is a US-based operator of hair salons in North America that has been switching to a asset light franchise model since mid-2019. The company currently still operates 66 of its own hair salons, while a further 4745 salons are operated under the franchise model. The company trains its franchisees in business management, trains hairdressers and provides support with licensing procedures, lease negotiations and marketing.

In the midst of the transition to the franchise model, the coronavirus pandemic led to the complete closure of some salons and subsequently only under strict capacity restrictions. While they still had an adjusted EBITDA of 122.3 million in FY 2019 (Regis FY ends on June 30), the adjusted EBITDA fell to 19.5 million in the following year and to -79.23 million in 2021.

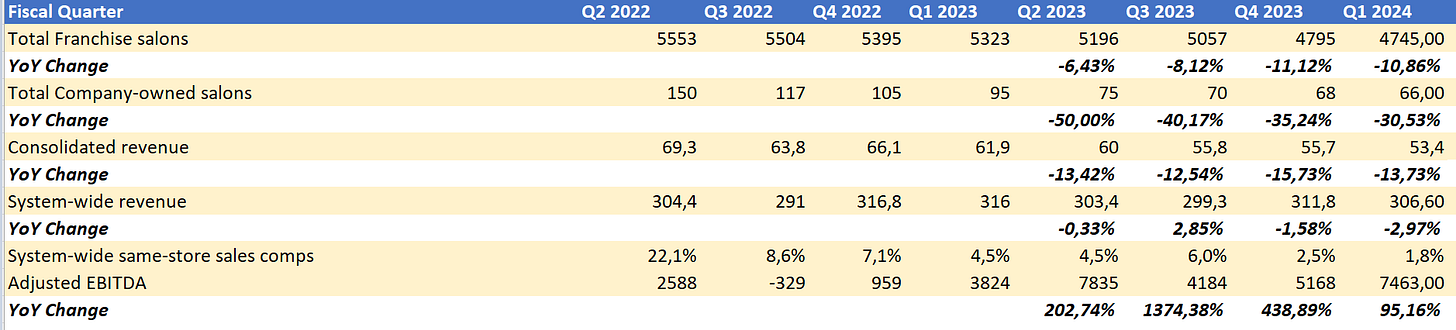

A new management team took over in December 2021 and implemented far-reaching changes. G&A spending was slashed, the company's own stores were closed more quickly and the much-delayed and cost-intensive POS system developed in-house was sold. The company subsequently achieved positive EBITDAs again and, in FY Q1 2024, positive net income for the first time since 2018.

While the company is still undergoing change and cost savings are continuing, one burden from the coronavirus years remains. Net debt of 170 million and an interest burden of almost 22 million for CY 2024, while TTM EBITDA was only 25 million. The threat of insolvency has caused the share price to plummet by 98% since October 2019. Despite a significant increase in profitability, the company announced a strategic review on November 1, 2023 in order to improve the balance sheet. This was followed by two activist 13d filings in December and January, which sought to prevent dilution and proposed alternatives.

Balance Sheet: Better than it looks at first glance

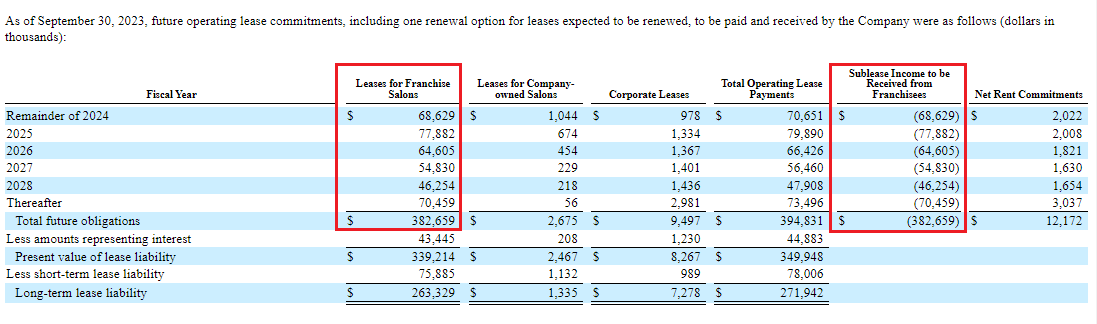

All the screeners I have looked at show both net debt and EV significantly higher than I have done here and that may be formally correct but de facto Regis Corp is not the obligor for the significant leases on the balance sheet. In fact, the leases are a transitory item that does not affect profit or loss. The company signs leases on behalf of the franchisees and then subleases them. If the franchisee goes bankrupt, Regis guarantees that the leases will be honored. If you look at the past 10-K, this does not seem to have been a problem so far. The typical duration is 5 years

The leases actually serviced by Regis amount to 10.7 million. The majority of these are corporate leases that will remain in place. The remainder is attributable to the company-owned stores. Two thirds of the latter will expire at the end of March and will not be renewed. By the end of June, only 15 company-owned stores will remain.

The more relevant part, however, are the LTDs, consisting of a term loan and a creditor facility, both of which mature in August 2025. The interest rate consists of the SOFR and an interest margin, which is increased annually and will be raised to the final 7.25% in March 2024. 3% of this is structured as PIK interest. This results in interest payments of approximately USD 21.8 million in CY 2024 (incl. PIK). The terms of the loans were negotiated by the new management in August 2022 and were one of the top priorities, as the loans were due to mature in March 2023. At the end of September, the company had total liquidity of 42.4 million, consisting of cash and available credit from the credit line of 33.1 million, and was in compliance with all covenants.

Another expected Cahs inflow is very likely to come from the sale of Opensalon software to Zenoti, which was developed in-house by Regis. 18 million has already been paid, with 2 million expected in December 2023. The remainder of the 39 million purchase price was linked to the transition of the Regis franchise stores to the Zenoti platform. The first 20 million is to be seen as an advance payment that covers a corresponding number of migrated stores. The remaining 19 million will be triggered gradually once the limit of migrated stores for the 20 million has been exceeded. The company has already communicated in an earnings call that the reduction in the number of system-wide stores since the sale of the software will also reduce payments by roughly the same amount. This means that Zenoti's payments would still amount to USD 16.24 million, as the total number of stores has been reduced from 5553 to 4745. At the time of the last earnings call on November 1, 2023, the company stated that 2000 stores were running under the new system and that they were confident that all stores would be migrated by the end of June.

A turnaround in full swing, but macro obstacles

While we are talking about system-wide declining stores, we should take a closer look at the causes and consequences. Reducing the number of company-owned stores to zero is a declared goal of the management and is understandable. The reduction of franchise salons, on the other hand, is not intended. According to the management, this is primarily due to labor constraints and changes in customer traffic. The closed stores had an average turnover of USD 122,000, while the last 4 quarters indicate a system-wide average turnover of 244,000. It can therefore be seen as an unintentional rationalization of business. Same-store sales also apparently continued to increase, which according to the company is due to price increases

The closure of the company's own stores will lead to a further increase in EBITDA. In FY Q1 2024, these stores had a negative effect of USD 0.5 million on adjusted EBITDA. In the previous year, the negative effect was USD 1.2 million.

If you look at the pure franchise margin, it becomes clear how positively the model has developed. In addition, the franchise turnover is distorted by two transitory items. The aforementioned rental income, which has no impact on earnings, and the advertising fund contributions, which also have no impact on earnings, as the royalties and fees are the only relevant figures

Several activists involved

Following the announcement of the strategic review, which was clearly focused on the capital structure, two activist investors published a 13d with specific proposals.

On December 28, Galloway Capital Partners, LLC, which according to the 13d had been invested in $RGS for over a year and held 4.9% of the outstanding shares at the time of filing. The clear focus was to prevent dilution and to include two candidates from Galloway on the board. In addition, it was pointed out that, in contrast to its competitors, the company was not focusing enough on ancillary services.

On January 9, an investor group representing 7,6% then published another 13d. The wording was much harsher than Galloway's and the proposals much more specific. The biggest concern was also the threat of dilution. They also wanted two candidates from the Group to be included on the board. In their view, dilution is unnecessary and the time for more aggressive cost savings is now. I won't go into detail about the proposals, but find it noteworthy that they criticize the spending on some things that current management see as important changes since the management switch to maintain the relationship between franchisor and franchisee. Honoring the best stylists in Las Vegas and personal training for stylists. I do not have the confidence to make a final judgment on this. In total, the savings assumed by the investor group account for more than USD 13 million in potential savings on the existing SG&A costs of USD 47 million. The most likely changes they could get through are restructuring the board and tying CEO compensation to EBITDA increases and higher stock-based compensation instead of cash.

My main focus with the activists is not so much to assess how realistic the assumptions are, but rather that relevant shareholder groups are trying to prevent significant dilution and the board sees what may be coming their way. This makes reckless dilution less likely and thorough consideration of all alternatives more likely. If you take a look at the current ownership structure, you will also discover other shareholders who have been activists in the past. Furthermore, there are no more company insiders with a relevant stake in the company.

Valuation

The activists have in common that they consider the current earnings figures and ongoing improvement in cost savings to be sufficient to cover the debt. The TTM EBITDA amounts to USD 25 million. If you annualize the EBITDA achieved in the last quarter, you would get an EBITDA of USD 30 million. I consider the latter figure to be the more realistic and therefore use it as the basis for my assumption.

First of all, it is true that G&A costs in FY Q1 are generally lower than in the rest of the year and may therefore seem unsuitable for annualization. However, the expiry of the majority of leases at the end of March alone results in an annual savings effect of around 2 million. It can be seen that the cost savings go beyond this. While the annual run rate at G&A was still between 54 and 57 million in Q2 2023, it was already between 47 and 50 million in Q1 2024. This will be reflected in the YoY comps. In addition, the closing of franchise stores has also declined recently. While 150 and 250 stores were closed in the previous quarters, only 50 stores were closed in the last quarter, while EBITDA increased significantly YoY. The involvement of the activists also makes it more likely that further savings will be made. In my opinion, nobody can want a proxy fight at this point in time.

My valuation is based on the following assumptions. I assume that the 30 million EBITDA will be converted into FCF of USD 7.18 million, which will be fully invested in debt reduction. Due to the large losses in the Corona years, there should be enough NOLs to avoid tax payments. The interest payments already reflect the increase in the interest margin next March. I have not deducted the SBC from the FCF, but have taken the higher share count into account in my assumptions.

According to management, the outstanding Zenoti payments are to be used in full to reduce debt and will be received by the end of June, provided that the migration of the remaining stores is completed.

I have not based the assumed multiples on the potential peers. This case is about make or break. It therefore seems nonsensical to me to hold out the possibility of multiples of 15 or higher at which comparable franchises are trading. If the risk of dilution is off the table and the company actually succeeds in reducing its debt, the market will reward it accordingly. EBITDA multiples of 6.5, at which Regis is currently trading on an annualized basis, to 10 adequately reflect this. No need to talk about resuming buybacks, renewed growth, etc. just yet

Biggest Risks

- Obviously: an overwhelming debt burden and insolvency. Past improvements in profitability are no guarantee for the future.

- A considerable dilution of existing shareholders. Refinancing via equity can be accompanied by a considerable drop in the share price.

- Rising interest rates. Even if the debt reduction occurs by the end of CY 2024 as expected, there are only 8 months to maturity. Refinancing the debt at an earlier date is not unlikely. If the interest rate environment looks worse by then, the effect of the potential debt reduction could be offset by higher interest rates.

- A proxy fight between activists and management

Potential near-term catalysts

- An improvement in labor constraints and thus a stop to store closures

- A further reduction in costs and improvement in profitability

- A payout of the outstanding Zenoti payments

- Falling interest rates

- A success for the Supercut brand franchise in India. The company recently signed a master franchise agreement with an existing franchisee. The first store is due to open there at the end of March 2024.

Why this opportunity exists

- The risk of insolvency is obvious

- All known screening tools report the multiple as too high because the leases, which are actually serviced by the franchisees, are reported as the company's liability

- The recent reverse stock split is not recognized by all screening tools. Yahoo Finance, for example, shows a market capitalization of over USD 400 million.

- The outstanding payments from Zenoti could contribute significantly to deleveraging, but are not included in the balance sheet

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I hold an investment in the issuer's securities.

Great work!