Simply Better Brands ($SBBC.V) - An emerging company still building momentum

A protein bar company with the potential to replicate Celsius’s trajectory.

First of all, the disclaimer: I am invested in Simply Better Brands stock ($SBBC.V). Nothing I write should be considered investment advice.

A warm thank you to @CuriosityInves, who was a tremendous help and contributed valuable context and insights to this thesis.

Ticker: SBBC.V

Price: USD 0,5546

Shares Outstanding: 93,77 million

Fully diluted: 120,7 million

Implied Market Cap: USD $67 million

Enterprise Value: USD $59 million

I’m sure you’ve come across countless pitches that name-dropped Celsius in the headline, promising that a particular brand could mirror its success—only for the stock to reveal itself as a disappointment a few quarters later. I’ve seen that happen many times myself. That said, here’s my perspective: while it’s entirely possible or even likely this could follow a similar path, I believe the odds are rather in our favor at this specific moment.

Today, I’m proving to myself that I can keep a write-up short and live with not including every piece of information—so don’t be surprised.

The Company

I first came across the stock in April while manually reviewing SEDAR filings. At first glance, the stock checked many of the boxes I consider essential for building a solid investment case.

I’ll keep this short and simple. It’s up to you if you want to dig deeper:

Management and board changes led to a board composed of seasoned industry veterans who had experience working for much larger companies.

A strong segment with steady growth, overshadowed by several underperforming ones

Numerous impairments and one-offs that skewed the financials

A completed strategic review that led to the underperforming segment being sent into insolvency

I particularly liked this because the management change served as a clear signal, and the outcome of the strategic review proved it wasn’t just noise. It resulted in a tangible outcome and removed $10.4 million in debt from the balance sheet.

The standout segment, both then and now, is the Trubar plant-based protein bar—soy-free, whey-free, and GMO-free—primarily targeting women, which just reported a 156% increase in revenue for the third quarter.

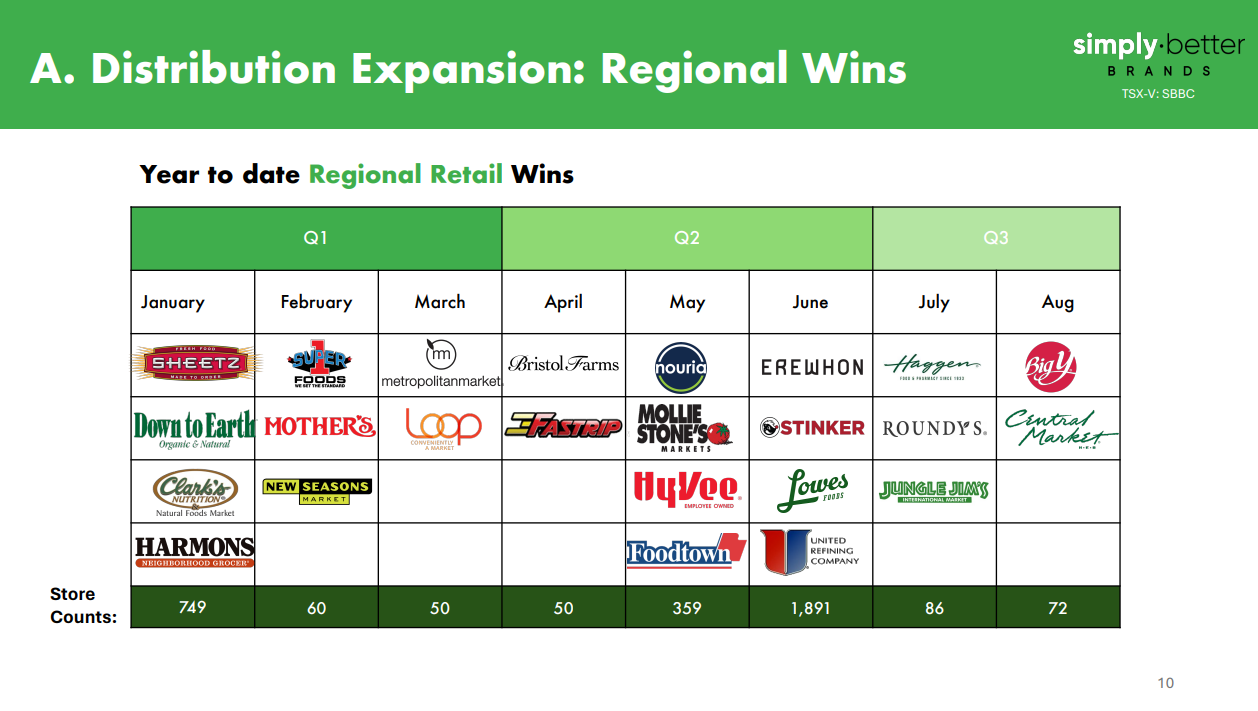

Although I didn’t invest back in April, I’ve followed every update since then. What particularly surprised me was the number of selling points they’ve secured. They’ve partnered with all the major retailers—Walmart, GNC, Costco, CVS, Whole Foods—and many more. They’re projecting 15,000 distribution points by the end of the year. While they’re currently only selling in North America, they’re also expanding into Mexico, the UK, and Australia.

I won’t talk about the other segments. The cannabis business divestiture is planned, and the other segment is very small. The CEO himself essentially calls it irrelevant.

The Financials

When reviewing SBBC's past financials, there’s a lot to consider. Particularly through the divestiture of PureKana, it seems like revenue was consistently dropping, even though TRUBAR performed very well, as shown by the LTM revenue in the corresponding quarters. What we see with TRUBAR’s revenues is a certain lumpiness. Q4 2023, in particular, stands out and was actually the reason I passed on the stock initially.

At that time, they explained that 3 million in orders were pushed to Q1 2024 due to a shipping delay. I wouldn’t say I didn’t believe them, but the revenue drop was massive, and even with the 3 million in deferred orders, it still wouldn’t have been as convincing as previous numbers. I underestimated how their customers build up inventories and order in bulk, and I also overlooked some other changes I’ll discuss later.

Regarding profitability, it makes sense to focus on adjusted EBITDA, particularly for the last three quarters, as the previous ones were distorted by several impairments and the performance of the other segments.

What immediately stands out is how asset-light the company is. They don’t own any PPE (relying on third-party manufacturers) and have very limited operating expenses, apart from marketing, thanks to their broker-based sales network. This structure could lead to improving operating leverage as they scale—something reminiscent of Celsius.

You can review most of the balance sheet items yourself, but I’ll highlight the most important ones here.

The notes were primarily issued to the company’s CEO, TRUBAR’s CEO, and a shareholder, carrying an interest rate of 15%

The stock has experienced dilution in the past and is expected to face more in the future. Warrants, options, and RSUs combined are set to add approximately 24.5 million shares to the current 93.77 million outstanding shares. At least, that’s what I found while reviewing their Q3 financial statements. In the Q2 presentation, they reported fully diluted shares of 120.7 million, but it’s possible they confused the shares outstanding as of June 30 with the shares outstanding at the presentation date. It’s not a significant difference, so I don’t consider it important.

Working capital shouldn’t be an issue moving forward, as they have a $10 million USD credit facility.

The Investment Case

Further growth seems likely, at least based on the management's comments. They reiterated their full-year TRUBAR guidance of $45–50 million in revenue. Year-to-date, TRUBAR has generated $30.9 million, leaving $14.1–19.1 million for Q4, which, as shown in my table, is traditionally weaker compared to other quarters.

Management states that we can expect TRUBAR to grow at historical rates—147% from 2022 to 2023 and 100% from 2023 to 2024 if they reach the upper end of their guidance. They explicitly mentioned in the last call that their next goal is to reach $100 million in revenue. So, where is the growth coming from? I think it’s a good sign that there’s more than one answer.

What’s very obvious is the store expansion. They massively grew their network in 2024, and it seems like this will continue to some degree, although they couldn’t answer the question during the call about what specific market penetration they are currently targeting. Based on the management's comments, they grew their revenue with the stores they already had before 2024, while also gaining market share.

I wouldn’t say that their Amazon sales convinced me even more, but I really like that they’re performing extraordinarily well there, as we can track their success ourselves. They’ve seen massive growth here. Starting with just $50,000 in revenue in January, they are now, according to comments in the call, at $600,000 in monthly revenue. They’re aiming for a run rate of $10 million by January. One has to note that this isn’t a perfect indicator of organic demand, as they also use sponsored advertising. However, I’ve experienced firsthand that it’s not a no-brainer—you need to have a convincing product.

When I looked at the stock in April, this listing was ranked #53 in the category. Now it’s at #16, which particularly reminded me of Celsius, which at one point reached #1 in the energy drink category.

What also now speaks in favor of TRUBAR is that, allegedly, the previous CEO deliberately allocated marketing dollars to PureKana while essentially starving TRUBAR of resources. Based on comments from SBBC CEO Ward and TRUBAR CEO Groussman, her spending was described as 'excessive,' whereas the spending on TRUBAR was very low. The new management, however, sees TRUBAR as the true standout in the portfolio and allocates marketing dollars accordingly.

And as many might still have the shock of $SOWG in mind, especially since $SBBC was compared to it, let me point out the key difference here. $SOWG essentially created a new category, or at least was one of the first movers, but now it seems like that category is losing relevance (Don't quote me on that). Celsius and TRUBAR have something in common: they didn’t create a new category. Neither energy drinks, protein bars, nor plant-based protein bars are new categories. However, Celsius was able to gain market share from its competitors, and it seems TRUBAR is doing the same. That's what I find particularly convincing: TRUBAR's success isn't driven by a potentially short-lived trend but by its ability to gain market share in a category that has been steadily growing for years

As we’re discussing $SOWG and how most investors blame the management team for the recent disaster, it’s worth taking a look at $SBBC’s board. Many of you might recall that one of the initial points of attention for $SOWG was their seasoned management team and board members, who had experience working for much larger companies. So, I won’t use this as a strong argument in favor of $SBBC, there’s undoubtedly a significant difference here.

While $SOWG lacked significant experience in consumer packaged goods, the new management team at $SBBC has brought in new board members and industry veterans.

Paul Norman, who worked for Kellogg for 30 years and most recently served as President of North America, joined the team.

St. John is a seasoned marketing expert with decades of leadership experience. As former CEO of BBDO Americas and a member of Omnicom's European Board, he oversaw top agencies and global client relationships, including Mars Inc. He pioneered initiatives like Omnicom's e-commerce practice and BBDO's social platform agency.

Additionally, Richard Kellam, who became a board member in 2023, spent 14 years at Mars, where he served as Global Chief Customer Officer for nearly six years, overseeing sales and marketing for various brands. All of this somewhat reminded me of the situation at $IVFH.

What I also want to see from management is consistency, and that's been the case for the very short period we're evaluating. They outlined a strategy during their special call that sounded optimistic and have actually overdelivered.

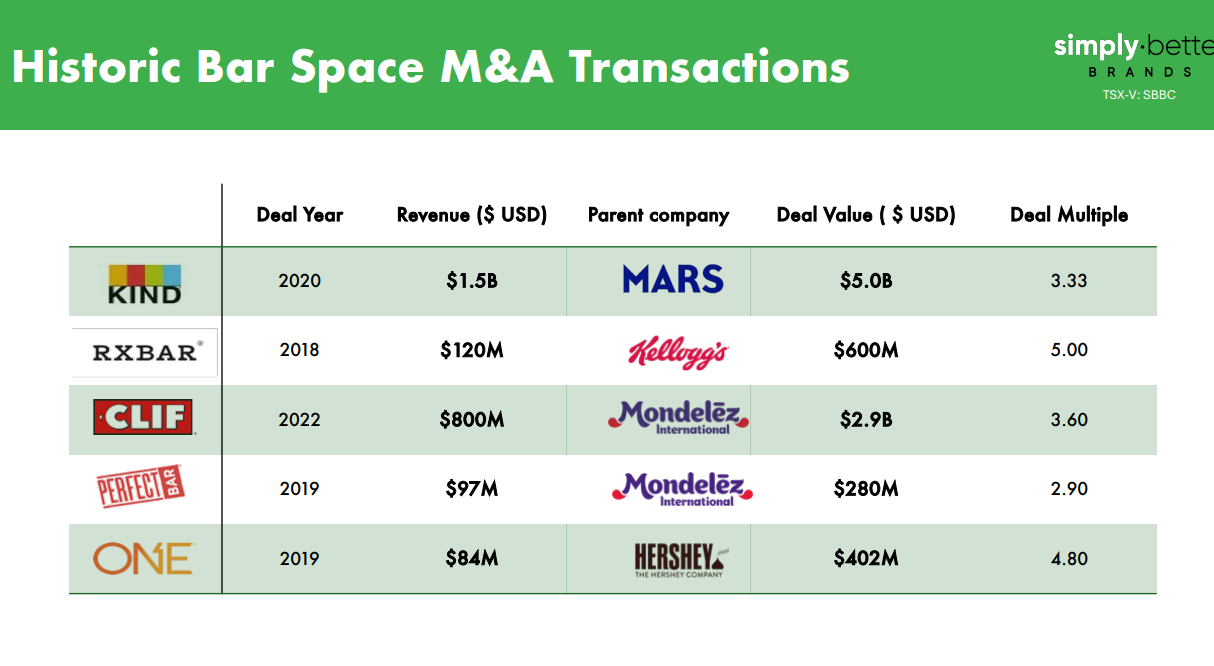

CEO and Chairman Kingsley Ward also brings at least 30 years of experience in founding, monetizing, and selling startups. I’ve been hesitant to hint at a potential acquisition, but in this case, I think it’s fair, as the management themselves mention it in their presentations and have plans to sell the company in the future. Fun fact: Board member Paul Norman was responsible for overseeing the RXBAR acquisition during his tenure at Kellogg.

What also struck me when I looked at Celsius in 2019 was the engagement rate on their Instagram account and the steady growth in followers. As far as I know, Celsius is still the GOAT with respect to engagement.

TRUBAR also has a steadily growing follower base, but it’s far below the rate of Celsius back then, with an engagement rate of 0.25%, while Celsius had over 3%.

I don’t consider this to be a massive issue, but there is definitely a difference in brand awareness, where TRUBAR could improve. So, it makes sense that they are now collaborating with Dobbino/BBDO, where board member St. John previously served as CEO.

Valuation

A lot of things to mention here.

Although I calculated a lower number of shares, I am using the count from their presentation, as I likely overlooked something. Based on the U.S. listing’s closing price of $0.55, we get an implied market cap of $67M. After deducting cash, amortizations from brand, customer contracts, etc., and the NOLs, multiplied by the corresponding tax rate, I get an adjusted market cap of $53M and an EV of $59M.

Feel free to readjust the NOLs, as this topic is always a bit tricky. I used the numbers from the Annual Report (AR), as they don't mention them in the quarterly statements. If they can really use the NOLs, that is questionable and something management can answer better. I just didn’t want to completely ignore them.

The CFO mentioned in the last earnings call that they will likely achieve a 9% EBITDA margin in FY2025 and in the 20s if they achieve more scale, so I used those numbers to calculate the multiples at the end of FY2024 and based on their near-term growth target. 'If'—and that's something I still consider optimistic— they achieve this level of revenue and profitability, the stock wouldn't be expensive.

Based on their presentation, the company considers a revenue multiple more relevant for valuation, as they aim to sell the business. For an asset-light company like this, it makes sense to focus on revenue since an acquiring company would likely eliminate corporate expenses entirely on day one.

Conclusion

Although I might sound convinced, this is a rather small position in my portfolio. While I like what I see, I’ve experienced too often what happens with these kinds of success stories. I think I’ve explained at length what speaks in favor of $SBBC not landing in this graveyard of stocks, but I currently don’t have the conviction to make it a bigger position.

The management and board appear to have taken all the right steps, leveraging their sector expertise and demonstrating remarkable consistency and success in a short time. Given this track record, I believe there’s a strong likelihood that this time, it truly is different.

Thanks for the writeup! Do you have any insights into their product velocity at the different retailers? I'm worried that their growth is mainly driven by stocking orders, since they're opening so many new locations. Now they need the products to perform well and sell through to get reorders, which I feel like we have no visibility into. Thoughts?

Thanks for the great write-up. Just question on your valuation: why are you not factoring in the acquisition case that the management is so clearly targeting e.g. a 4x revenue multiple on the 100m revenue target?