Supreme PLC - vertically integrated and growing company at 3,5 x EV/EBITDA

Supremes largest business segment is threatened by stricter regulation. Market seems to be overestimating the impact of this and is ignoring the ongoing diversification into other segments.

First of all, the disclaimer: I am invested in Supreme PLC stock ($SUP.L). Nothing I write should be considered investment advice.

Sven Klass first brought this stock to my attention. Make sure to give him a follow.

Ticker: SUP.L

Price: GBX 120

Shares Outstanding: 116.52 million

Fully diluted: 124.04 million

Market Cap: GBP £140 million

Enterprise Value: GBP £ 130 million

The Company

Supreme PLC is an UK based company that went public in 2021 and sees itself as a leading manufacturer, supplier and brand owner of fast-moving consumer products. FY 2023 (ending 31 March) revenue from operating activities was mainly distributed across 4 business divisions.

The business divisions

Batteries: 25% of group revenue, 13% revenue growth YoY

Lighting: 10% of group revenue, 43% revenue decline YoY

Health and wellness: 11% of group revenue, 5% revenue growth YoY

Vaping: 49% of group revenue, 75% revenue growth YoY

At first glance, Supreme may appear to be an eBay seller offering all the goods it can get at a fair price, but in reality at least three of its business areas offer significant opportunities.

Through its Battery Division, the company distributes products from well-known manufacturers such as Energizer, Panasonic and Duracell. Supreme repeatedly stated that the division can be seen as the door opener and backbone of Supreme, as it enables it to build business relationships with various dealers and to cross-sell products from its other divisions.

Looking at Supreme's list of customers, this seems to be working well as there are some long standing relationships with the largest retail chains in the UK.

In addition to the traditional distribution of lighting, Supreme also acts as a producer and licensee that manufactures smart home products. Like many companies, the Lighting Division suffered from overstocking of its customers in FY 2023, but was still able to achieve a gross margin of 27%. According to the company, no customer relationships or listings were lost in this segment and a recovery is expected in FY 2024. I don't expect too much from this segment, although expansion into other markets has repeatedly been mentioned as a target.

The Health & Wellness Division consists mainly of sports nutrition and vitamin products, some of which were developed in-house, but also came under the Supreme umbrella through acquisitions (SCI-MX). It can be assumed that sales in this division will grow considerably in the foreseeable future, primarily through acquisitions. Supreme's distribution network offers considerable opportunities for the division.

The most relevant sector at the moment is vaping. Both in terms of sales and earnings, and this already provides a relevant part of the explanation as to why the stock is currently trading at 3 x EBITDA. As the topic of vaping in the UK cannot be covered in just a few sentences, I will come back to it later.

Vertically integrated

Supreme deserves the attribute "vertically integrated" more than many other companies. Not only do they sell their own developed brands to retailers and via their online stores, they also produce the majority of their products themselves. According to their company website, they have enough capacity to produce 4.5 million bottles of e-liquid per week. They manufacture their own brands such as "88 Vape" and "Liberty Flights" as well as offering private label solutions. With private label solutions, Supreme takes care of all relevant steps from development to packaging and labeling.

The same applies to the Health & Wellness Division. Both its own brands, such as SCI-MX and Battle Bites, and private labels are manufactured in Supreme's production facilities.

A large proportion of the products produced in this way are sold via traditional distribution channels, but the online presences are also recording growth, which is reflected in the registered accounts on end customer websites. In 2021, for example, they developed their own digital-only brand of vitamin fruit gums. From my conversation with the CEO, I concluded that the B2C share will probably continue to increase.

An M&A success story

While acquisitions usually only rarely bring the hoped-for synergies, especially for larger companies, and sometimes never pay off, Supreme PLC has been able to prove in the past that it is quite successful in integrating acquisitions into existing structures. Supreme applies four core criteria when making acquisitions:

The products must be in the fast moving consumer staples sector

Must have their own brands and complement Supreme's portfolio

The business operations must be transferable to Supreme's centralised platform

The products must be able to be produced by Supreme itself

Having our own production facilities makes it easier to achieve synergies, as each acquisition leads to higher capacity utilisation of the production facilities, particularly in the Sports Nutrition Division and the Vaping Division. For example, contrary to general trends, production was relocated from Asia to the UK following the acquisition of Liberty Flights.

Apart from this, clear thinking and radical steps also seem to be the norm in acquisitions. According to the company, the Cuts Ice takeover involved closing two production sites within 12 weeks and transferring production to its own facilities, cutting SKUs from 3,000 to 300 and reducing overheads by 90%.

In addition, this acquisition also brought in expertise in flavour development, which was not previously part of Supreme's competencies. Part of the acquisition was the well-known European brand T-Juice, which was bought for GBP 1.2 million. This brand was sold just seven months later for GBP 4 million to a French vaping wholesaler. That in itself would be a success story, but Supreme has also secured the exclusive production rights for the brand for 5 years and at the same time opened up the possibility of cross-selling with the buyer LVP. At least GBP 15 million in sales over 5 years are expected from this business relationship. The deal is all the more impressive when you consider that the brand was bought out of insolvency. Of the 75% increase in sales to £76 million compared to the previous year, 40% was due to the acquisitions of Liberty Flights and Cuts Ice. Even though Supreme wouldn't sell protein powder, I'm reminded of FitLife Brands. At least in the vaping sector, the acquisitions appear to have been successful. However, as vaping remains controversial for the time being and has so far accounted for the majority of sales and EBITDA, it can be assumed that investors will primarily look at how successfully the other divisions are performing.

Health & Wellness divison

According to CEO Sandy Chadha, acquisitions in the near future will increasingly take place in the Health & Wellness Division. While the last acquisitions were still rather small, the company is now aiming for an acquisition in the £20-50 million turnover range. According to the latest results, this would at least double the division's sales. This acquisition involved taking over the assets of a protein producer for 175,000 pounds out of administration, which had built the factory only 18 months ago for 1.2 million pounds.

Sandy told me that they want to make acquisitions before synergies at 4 x profit and 2 x profit after synergies. Given that, like FitLife Brands, they seem to be primarily interested in the brands and their customers rather than the operating companies, this seems quite realistic to me. According to his comments in our last conversation, I actually assume that we will soon see an acquisition in a completely different sub-segment of "Health & Wellness" and not necessarily in the area of sports nutrition. He didn't want to say any more after I asked him, but it sounded as if the plans were already more specific. He just said that it would be a product that all their customers could add to the range and would complement the division well. If I had to speculate, I would guess energy drinks because we find them everywhere from kiosks to major retailers. However, in view of the recently acquired protein manufacturing business, I would be surprised if classic sports nutrition was no longer part of the potential acquisitions

While especially gross margins are often very attractive in the sport nutrition sector, SG&A costs often result in thin margins. Low barriers to entry, leading to high marketing and promotional spend, can make the business unattractive. Formerly well-known brand MusclePharm, which was acquired by FitLife Brands in 2023 out of insolvency, wrote this in its risk section just 8 months prior to insolvency:

Brands with little differentiation in terms of effectiveness and composition are competing for very limited shelf space at retailers. The management of SCI-MX, the brand acquired by Supreme in 2021, said on the announcement of the sale that the sports nutrition sector had changed significantly and that after several years of operating losses, they had come to the conclusion that the investment was too large to scale their brand in a way that made economic sense. Dayton Judd, the CEO of FitLife, also recently described this as the most difficult part of the business: building business relationships with retailers that lead to the placement of products on their shelves. To get your product on the shelf, another one has to disappear first. This is where I see a relevant advantage for Supreme. Supreme already has existing business relationships with all relevant chains in the UK. As I said, the company itself describes the battery division as a door opener to get other products to its customers, which of course also applies to its vaping brands. Certain brands have an advantage due to their brand awareness, but I believe that Supreme can at least put the budget brand on the shelf next to Optimum Nutrition. Sandy confirmed this to me and also that they are also very price-competitive due to their economies of scale.

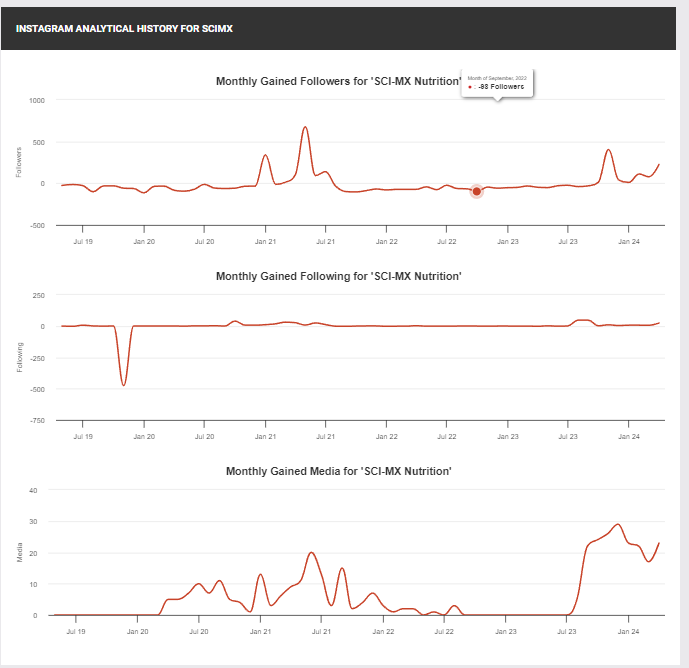

As a number of acquisitions have taken place in this area and more are still being made, it is difficult to measure the success of individual brands. Especially over longer periods of time and different distribution channels. However, the handling of the brands and subsequent results already show to some extent how much Supreme understands this industry and handles the acquired brands. The most relevant brands so far are the protein bar brand Battle Bites, acquired in 2020, and the protein powder brand SCI-MX, acquired in 2021 for £1.3 million. Battle Bites seems to be 'rather' neglected. Only a few new flavours have been published here and the Instagram account has been steadily losing followers since mid-2022, only a few new posts are published, the engagement rate is 0.09% (sports nutrition manufacturers rarely get above 0.3%) and the last cooperation appears to have been in May 2023. The Similarweb data for the online shop tends to show stagnation.

As Supreme, unlike FitLife, is still primarily focussing on traditional distribution and not on direct sales to customers, the Amazon sales ranks can only be seen as an indicator of the success of the products, but certainly as 'an' interesting indicator. Sales rankings of 61, 62 and 99 in the protein bar category mean that the products are not among the top sellers, but they tend to remain stable in the overall Amazon category "Health & Personal Care".

As I said, this does not mean that the products are not performing well with retailers, but experience shows that a neglected Instagram page and a product portfolio that hardly contains any newly launched products means that the return on such activities was probably too low. Based on the data available to me, I would categorise Battle-Bites as a current underperformer, even though the company's statements immediately after the takeover were very positive and a payback was stated after 2.5 years.

The picture is completely different at SCI-MX. An extensive rebranding, new products in the pre-workout, protein bar and clear protein area, an ongoing cooperation with a 1.5 million follower and many other small influencers, noticeably more posts on the Instagram page, rising follower numbers, an engagement rate of 0.26% and rising Similarweb figures for its own online shop. It is striking that activity increased significantly in July 2023 in particular and that the cooperation with Davide Sanclimenti was then announced in October 2023.

If we look at the impact of this, the effect actually seems to be visible in the sales figures. SCI-MX's products are actually moving up the sales rankings and one product is in 8th place among the protein bars and another in 12th place among protein blends. The products launched in December 2022, i.e. after the acquisition, such as a diet shake, are apparently doing particularly well, which suggests that Supreme can react relatively quickly and successfully to changing market conditions.

Nevertheless, my scepticism still prevails at the moment, as a rise in the sales ranks speaks for higher sales, but MusclePharm was able to achieve this before it went bankrupt. The sales were generated by high marketing expenditure, among other things.

The gross margin of Supreme's Health & Wellness Division was 27.08% in the last six months. A significant increase on the previous year (17.6%), but there is no breakdown of the individual marketing expenses.

This is where I feel Supreme's approach differs slightly from FitLife Brands and I tend to favour the latter's approach. FitLife's acquisition of Mimis Rock Corp was a deliberate move to buy a company that was profitable but clearly overspent on marketing. After the acquisition, marketing spend was significantly reduced, while sales declined only slightly and profitability exploded. I think we are currently seeing the opposite approach with Supreme and SCI-MX. However, due to its large B2C share and Amazon direct sales, FitLIfe has much better and more quickly visible indicators for assessing the return on marketing activities. From my conversation, it became pretty clear that Supreme is pursuing a more long-term classic marketing strategy.

Investors who have been following Supreme for some time may also be wondering what happened to the previously acquired brands gonutrition and Protein Dynamix. Both websites have been down for months. I also asked the CEO about this and he told me that they have effectively turned both brands into private label products. Protein Dynamix is sold in Home Bargains and gonutrition in Poundland. According to the CEO they were weak brands and didn't have a big presence in the market. Given that Supreme's brands compete with each other at some point and you have to decide where marketing spend will bring the most return, this makes perfect sense. Nevertheless, I would like to mention that Supreme originally sounded much more optimistic about at least one of the brands.

In addition, there were obvious problems with production in at least two cases. One product had to be recalled in July 2023 due to high caffeine levels, while for another I found many negative reviews in the Amazon reviews from November 2023 to March 2024, which referred to the same quality problem and resulted in the product only having 2 out of 5 stars as of today. Obviously, according to the product reviews, there was also a production problem here.

I am very curious about the terms of the next acquisition and whether we will see more of the FitLife model here, which tends to buy companies that have their backs to the wall, which according to the former owner was also the case with SCI-MX, and integrate them successfully and profitably ‘without’ increasing marketing costs. However, it is also possible that the return on expenditure at SCI-MX was so attractive that they saw opportunities here that have remained hidden from me, at least until now.

Potential risks

In my opinion, there could be two aspects that are currently weighing on the share price. One is very obvious and short-term and the other is more difficult to assess and may ultimately prove to be an advantage.

Vaping regulation

The elephant in the room is obviously the stricter regulation of vaping, the consequences of which cannot yet be fully assessed and are therefore weighing on the share price. According to the latest half-year figures, 40.08% (previous year 49.19%) of sales of 105.07 million and 60.22% (previous year 66.76%) of gross profit of £28.53 million were generated in the vaping division with their own brands and 25,12% of sales came from the master distribution agreement with ElfBar. This explains why Supreme PLC is currently trading on a multiple of 3,5 x EV/EBITDA. To assess whether this is really an 'opportunity', there is no getting around the issue of vaping.

Firstly, it should be noted that the UK and its government have generally been seen as 'vaping friendly'. In April 2023, the UK Department of Health launched the world's first programme to encourage smokers to switch from cigarettes to vapes. This is part of the "smokefree 2030" initiative, which aims to achieve a tobacco-free England (health matters in the UK are the responsibility of the respective regions). As part of the programme, 1 in 5 smokers in England will be provided with a vaping starter kit. According to the Department of Health, there were 5.4 million smokers in England at the time. In a survey conducted since 2010, the Action on Smoking and Health (ASH) initiative found that the majority of vapers are former smokers. Of these, 31% of smokers stated that vaping would help them quit smoking and 22% that they vape to prevent a relapse to smoking.

In 2023, however, the Department of Health again identified an increase in children aged between 11 and 15 among vaping users. This is why shadow health secretary Wes Streeting (Labour party), whose de facto job is to oversee the Department of Health, said he would come down like a "tonne of bricks" on the vaping industry if the current ruling Conservative party did nothing to protect children. At the same time, he stressed that he had welcomed vaping as an alternative to smoking until the vaping industry "started marketing their vapes in brightly coloured packaging", thus encouraging children to vape. Given that the Labour Party could very likely emerge as the big winner in the 2025 General Election, scepticism at the very least is warranted regarding listed companies that generate most of their profits from vaping.

The Conservative Party announced a review of the vaping industry's business practices and on January 3, 2024, the House of Commons published a summary of current marketing practices and made proposals to restrict them. By this time, Supreme had already responded proactively and announced some changes to its own brands on October 18, 2023, that were in line with the proposals. These included a predominant avoidance of bright colours, a less appealing naming of flavours and stricter control of its customers with regard to age control and the location of products in shops. A change to this extent would therefore not affect Supremes own brands at least.

However, this is only one aspect that will have an impact on the industry. Among the young vapers, the use of disposables, i.e. vapes intended for single use, stood out in particular. On January 28, 2024, the UK government announced a ban on all disposables in Wales, England and Scotland. The ban would likely apply from April 1, 2025. On January 29, Supreme published a trading update and welcomed the clarity from the government in this regard. At that time, the company was forecasting £75 million revenue and £9 million adjusted EBITDA from disposables for FY 2024. However, as Supreme manufactures its own liquids suitable for refillable vaping kits, develops its own POD for the 88Vape brand and has many other refillable solutions in its range, they do not anticipate any loss of revenue as a result of the changes.

So if we consider the aspect of youth protection and disposables, I tend not to see a disadvantage for Supreme, but possibly an advantage, as disposables tend to be low-margin products and could be replaced by high-margin refill bottles from Supreme's own production. A large proportion of disposable sales also comes from a master distribution agreement with the Elf Bar and Lost Mary brands.

With regard to the vaping sector, however, there is another and more serious risk. A significant tax on vaping liquids that could potentially apply from October 2026. This would tax a 10ml liquid without nicotine at £1, a liquid with 0.1 to 10.9 mg at £2 and a liquid with more than 11 mg at £3. Supreme's 10ml liquids currently cost around £1 and, according to Sandy, around 80% of the sales volume would be subject to £2 tax, increasing the price by 200%. The company is therefore considering filling 8 ml liquids and selling them for £2.50 in order to at least visually reduce the effect. The fact is that all vaping products would become considerably more expensive if the tax is passed. However, this will affect all producers and sellers equally. A user of Supremes vaping products has several options in the event of such an increase in price:

1. stop consuming nicotine

2. Switch to another manufacturer that is even more expensive

3. Smoking cigarettes again

None of the three options seem to me to be realistic threats to Supreme. As the 'ASH' surveys show, vaping consumers value the aspect that vaping helps them not to relapse. Supreme's products are already predominantly at the lower end of the price range. In addition, the current plan is to increase tobacco duty in the same breath to ensure that vaping remains more attractive than smoking, which leads me to believe that the support for switching from tobacco to vaping will be maintained. In the UK, there is a clear scientific view that vaping is significantly healthier than smoking. NHS, the umbrella organisation of the publicly funded healthcare system in the UK, writes on its website that "Nicotine vaping is substantially less harmful than smoking. It's also one of the most effective tools for quitting smoking.". The extensive study documentation of peer-reviewed studies is also linked there. In addition, the first steps towards a complete ban on tobacco were only recently taken in the UK. This applies to all young people born after 2009. They will then never be allowed to buy tobacco legally for the rest of their lives if the law is passed.

Given this continued support for vaping over tobacco, I do not expect any tougher measures to be taken against vaping, at least not in the medium term. I cannot estimate how high the impact on sales will actually be, but for the reasons mentioned above, I do not consider the assumptions I read on Twitter, which assumed a 90% drop in sales, to be realistic.

From my conversation with Sandy, I actually think that they will take advantage of the current uncertainty and possibly buy up more assets in the segment in order to gain market share. At least if the return can be realized quickly enough. I think a acquisition similar to Liberty Flights is rather unlikely. This would also lead to further utilisation of their production capacity. The company currently states its capacity at around 230 million liquids per year, while 63 million were produced in FY 2023.

In line with all of the above, I assume that vaping will remain a relevant and lucrative part of Supreme in the medium term.

Ownership structure

I often start my research on a share by looking at the ownership structure, and that was one of the reasons why I initially wanted to pass on Supreme. A company that was handed over from father to son, who clearly identifies strongly with the company, talks about the employees as family and still holds 57.73% of the outstanding shares after the IPO. I am particularly familiar with this constellation from Germany and all too often the owners are less interested in the share price than in building a legacy. This was the main reason why I wanted to talk to Sandy. To get a feel for what his motivations are. After our conversation, I was convinced that he was not interested in building a legacy, but rather in the return on investment.

I look for factors that are easy to interpret and that at least provide me with indicators for assessing how the management is acting and whether it is allowing us to participate in the company's earnings. Firstly, there is the dividend, which was increased significantly for the half-year. In FY 2023 it was 3 pence per share. According to the company, it is currently aiming for a payout ratio of 25% of profit after tax.

In January, a buyback program of one million pounds was announced, which is certainly viewed with less enthusiasm than at other companies due to the ownership structure despite the low multiple, but which the company wants to be seen as a sign of confidence in the business model. 3 months earlier, the CEO made a substantial insider purchase of 390,000 of the 117 million outstanding shares. From talking to him, however, it became quite clear that buybacks are the least preferred use of the company’s capital in the near future.

In FY 2022, the CEO waived half of his salary in order to raise the lowest salaries in the company by 10% and make this decision more acceptable to the remaining shareholders.

I don't get too impressed by such things, but they are small indicators that he is at least not shamelessly exploiting his majority stake. Moreover, he will only receive his 5.8 million share options when the TSR since the IPO is 100 or 200%.

Based on the conversations with the CEO and his behavior so far, I don't see any obvious red flags for the minority shareholders.

Valuation

A company with 4 divisions, each with different margins and growth, usually screams out for a sum of the parts valuation, but I am not a fan of this as these values are usually never realized and in Supreme's case are subject to several dynamics that are difficult to reflect in such a valuation. My thoughts on Supreme were more about how realistic 'at least' the continuation of the status quo in earnings figures is and how high the impact of potential negative scenarios is, because that is what is currently weighing on the share price.

In my base assumption for normalized earnings, I assumed the 38 million adj. EBITDA that the company announced in the trading update of 24 April. Since the company adjusted the stock based compensation here, I subtracted it from EBITDA again. In FY 2023 it was 1.46 million, I assumed 1.5 million.

The company has borrowing facilities of 45 million, which are currently unused. According to the trading update, they are debt-free if IFRS leases are not taken into account. I have not included the leases in the Enterprise Value, but I have included them as a deduction in the FCF calculation. Based on the EBITDA since the last half-year report and the fact that the CapEX intensive measures took place in the first half of the year, I assume that they currently have around 10 million in cash. Based on this, the valuation is currently 3.6 x EV/EBITDA.

I assume the amortization of the rights of use assets as maintenance CapEx. I am making what I consider to be a conservative assumption of 3.4 million per year. Supreme has just moved into a larger distribution center and the acquisition of Food IQ should also be reflected in slightly higher Maintenance CapEx, which is why a YoY increase must be assumed.

With regard to the tax component, it should be taken into account that there was a tax increase in corporate taxes in April 2023. I therefore assume 25% on a normalized basis.

This gives us a free cash flow of 24.68 million and an EV/FCF multiple of 5.33. If you look at the company's cash flow statement, keep in mind that the company had one-time effects on CapEx for the new distribution center and very high one-time effects on working capital for the distribution of Elfbar and Lost Mary

I have argued at length why I do not think it likely that sales in the vaping sector will collapse as a result of the ban on disposables and the tax. The bigger threat is certainly the tax, but that is still 2-3 years away. Judging by the latest statements from the company, it is likely that around 30 million of adj. EBITDA currently comes from the vaping business. Until the tax comes, the company will most likely generate more than 70 million in cash without integrating further acquisitions, as I assume that there will be extraordinary effects on sales, as both the tax and the disposable ban are anticipated by customers. I think I am being 'very' conservative here. The assumption that vaping sales will collapse completely afterwards is completely irrational in my opinion, although there will certainly be a sharp drop in the short term for the reasons mentioned. As soon as the fear of further regulation disappears 'or' the company shows that it can also grow organically outside of vaping, which is the goal according to the latest trading update, the multiple will also reach an appropriate level.

Conclusion

I tend not to buy stocks that are dependent on political decisions, but I don't expect a complete collapse in revenue either, as the government still supports vaping as an alternative to tobacco. Nor do I believe that Supreme is solely reliant on that in the worst-case scenario. From today's perspective, an investment in Supreme seems like a very asymmetric bet to me, given the low multiple, lack of debt, and the still increasing earnings numbers.

Thanks Smitty for this superb write-up.

Bravo!