Asseco Poland SA ($ACP.WA) - Low IQ Bet-On-The-Jockey Case

After following the entire CSU playbook from the sidelines for a while, this is the first time I’m actually getting involved in this type of investment case

First of all, the disclaimer: I am invested in Asseco Poland ($ACP.WA). Nothing I write should be considered investment advice. I bought my first shares at PLN 117.

Paul Tschischik brought this stock to my attention, and I would also call him an expert on CSU-related topics, whose knowledge has been very helpful. Make sure to give him a follow.

Ticker: ACP.WA

Price: PLN 125,40

Shares Outstanding: 80.51 million

Fully diluted: 80.51 million

Market Cap: PLN 10.09 billion (USD 2.52 billion)

Adj. Market Cap: PLN 6.84 billion (USD 1.71 billion)

Enterprise Value: PLN 9.38 billion (USD 2.35 billion)

If you can’t imagine what a low IQ case is, you’ll probably understand by the end of this write-up. After following the cases of Bravura Solutions ($BVS.AX) and Sygnity SA ($SGN.WA) entirely from the sidelines, and missing out on most of the price action of Trubridge Inc. ($TBRG), I finally decided to build a full position in a stock that will likely benefit from the typical Constellation Software ($CSU.TO) playbook.

The Company

If you visit Asseco’s website, you might notice some similarities with CSU. The company describes itself as a federation of IT companies and highlights its M&A strategy right on the homepage. It also has a dedicated subpage aimed at attracting software business owners to sell their companies to them.

Talking too much about what the company does seems like a waste of time to me, as the investment case is structured much more simply than usual, and it is also almost impossible to get a comprehensive overview of the company's operations.

To give you a feel for the complexity of Asseco:

You should also know that the different entities themselves have many subsidiaries. If you want to dig deeper, take a look at the latest financial report.

They categorize their various entities into six different groups, each with clear differences in margin profile.

What's also interesting to note is that Asseco Poland (ACP) has a strong relationship with the Polish government, primarily through its work on public sector projects. It develops specialized solutions for central administration, including:

Integrated Administration and Control System (IACS) for the Agency for Restructuring and Modernization of Agriculture.

Central Register of Drivers and Vehicles for the Ministry of the Interior and Administration.

Collaborations with the Supreme Chamber of Control, the Central Statistical Office, the Ministry of National Education, and the Agency for Agricultural Market

I'll leave it at that regarding their operations.

The Financials

First, let me say that Asseco's current financials are, on one hand, rather irrelevant to the case, and on the other hand, quite complex due to the many non-controlling interests. I would even go so far as to say that it's nearly impossible to calculate normalized earnings for a company with such a federal structure.

Some of you might remember that it took me days to calculate the EBITDA for $DR.TO, which only had 5 hospitals with NCIs. This one is far more complex. So, I will only provide you with a view on the key metrics you should focus on, along with my assumption for the current adjusted market cap and EV.

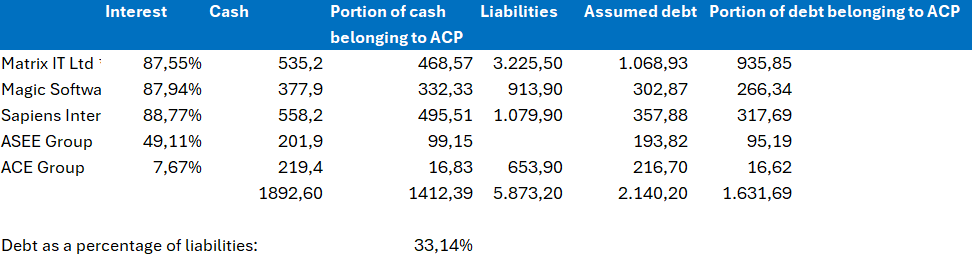

To give you a sense of the enterprise value, as well as debt and cash, that truly belongs to the company and not to the NCIs, I have attempted to approximate these figures based on the ownership stakes in the various entities. The company does not disclose debt for these entities separately (you may want to check the individual financial statements if you need an exact calculation, though I wouldn’t recommend it). Therefore, I have assumed that the debt in Asseco’s balance sheet is evenly distributed across all entities with one exemption as ASEE is a public company.

Keep in mind that they hold several stakes in other companies that are not fully consolidated. Again, this is complex.

The cash positions of the different entities are mentioned in their financial statements. If you multiply Asseco's ownership stake by these figures and include the cash from the sale of treasury shares (which I’ll discuss in a moment), you arrive at this EV:

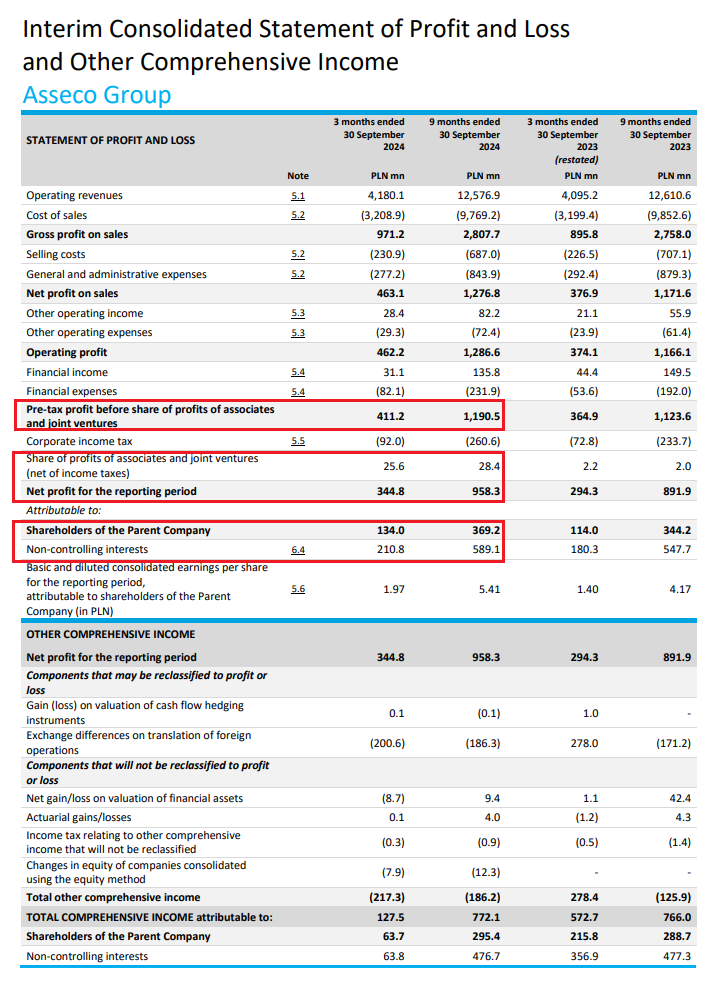

The usual next step would be to look at revenue, EBITDA, earnings, etc., to compare them to the EV, but in Asseco's case, that won't work for obvious reasons. If you look at their income statement, your first thought might be, '9 months ended with 12.5B in revenue and 1.2B in EBT? Where can I sign?' However, since Asseco fully consolidates companies without owning 100% of them, a portion of the earnings actually belongs to the non-controlling interests. On a 9-month basis, out of 960M in net profits, only 370M is attributable to the company, while 590M belongs to the NCIs.

Since net income attributable to shareholders is relatively stable on a quarterly basis, annualizing the 9-month figure can be reasonable. This results in an ANI of 492M, translating to a 20.5x P/E and a 14x adjusted P/E. However, one should keep in mind that a large portion of finance expenses and income is included in net income. A comprehensive normalized earnings calculation seems impossible to me, especially since they constantly change their equity stakes in entities.

14 P/E is not expensive for a software company, but also not incredibly cheap. So why did I invest? Because focusing on the current P/E is like focusing on the trees instead of the forest.

The Investment Case

Topicus.com, a spin-out of Constellation Software and essentially a miniature Constellation, acquired a 9.99% stake in Asseco at the end of January and then subsequently has signed an agreement to buy 12.3 million treasury shares that Asseco had repurchased in 2023. Upon completion, Topicus will own 24.84% of Asseco. Basically, that’s the investment case.

In general, Constellation has the nimbus of being the best software operator in the world. If you're as uninformed about the Constellation Software cosmos as I was three years ago, I'll provide some information to help you understand the typical playbook of CSU/TOI.V.

These are the key aspects of how Constellation operates:

Acquisition-Focused Growth

CSU consistently expands by purchasing small to mid-sized software companies, particularly those that serve niche markets. They prefer businesses with strong customer relationships and stable revenue but that may not be growing rapidly on their own.Decentralized Operations

Instead of fully integrating acquisitions, CSU allows them to function independently. Leadership teams remain in place, and decision-making is left to the acquired companies, fostering an entrepreneurial culture.Prioritization of Recurring Revenue

The company targets businesses with revenue streams that are predictable and contract-based, such as subscription models or long-term service agreements, ensuring steady cash flow.Optimizing Business Performance

After acquiring a company, CSU identifies areas for operational improvement, whether through cost reductions, restructuring, price increases, efficiency gains, or leveraging synergies across its portfolio. In some cases, it also finds ways to introduce additional products or services to existing customers. All of these efforts aim to improve ROI.Long-Term Perspective

Unlike private equity firms that often flip companies for quick returns, CSU takes a patient, long-term approach, focusing on sustainable value creation rather than short-term profitability.Financial Discipline

The company is known for its conservative approach to financial management. They avoid overpaying for acquisitions, maintain strong cash flow, and prefer companies with reliable earnings rather than speculative growth potential.Reinvesting for Continuous Expansion

Instead of distributing excess cash, CSU reinvests its profits into acquiring new businesses. This cycle of reinvesting and compounding returns has been a key driver of its growth over the years.

I want to emphasize the financial discipline aspect. From the face value financials of Asseco, one wouldn't think that this is a key aspect of CSU, but I recently spoke with two investors who are very familiar with the CSU playbook, or even worked for them. They are targeting a 20% IRR based on earnings, so they don’t include multiple expansion in this calculation. So what does this mean effectively? It means that, the moment they acquired the shares, they likely already had their sights set on a 5x P/E company after implementing their measures.

To emphasize this point, let me quote Mark Leonard, the CEO of CSU:

One of our directors has been calling me irresponsible for years. His thesis goes like this: CSI can invest capital more effectively than the vast majority of CSI's shareholders, hence we should stop paying dividends and invest all of the cash that we produce, even if it means lowering our hurdle rates.

I used to argue that we needed to maintain our hurdle rates because dropping them for a few marginal capital deployments would cause the returns on our entire portfolio to drop. The evidence supported my contention, so we kept the rates high for small and mid-sized vertical market software ("VMS") acquisitions and made very few exceptions for large VMS acquisitions. The by-product of that discipline has been a perennial inability to invest all of the cash that we generate.

Constellation Software Inc. 2021 President's Letter

So what does that mean from our perspective, if we believe that they acquired the shares at a 5x underlying P/E? They paid 85 PLN per share, and the stock price is currently at 125.4 PLN, which translates into a 7.4x P/E.

This would obviously be cheap for a company with mission-critical software. If CSU's measures are successful, we’ll likely see a multiple expansion.

The press release also outlined the specific measures that Topicus plans to implement:

One might argue that this sounds rather vague, but every time I’ve observed a case like this, the outcome has been the same.

Let me show you the three examples I followed closely but missed out on.

Since Pinetree Capital, whose CEO is Damien Leonard, Mark Leonard's son, acquired a stake in Bravura in March 2023, the stock has become an eight-bagger

Trubridge, which I actually pitched on a German YouTube channel, but without building up a large position. Since Pinetree acquired a stake in June 2024, the stock has risen 180%.

Since Topicus announced a public tender and subsequently acquired a 72.68% stake in Sygnity in March 2022, the stock has become a six-bagger.

And just to be clear, the rise in stock price was directly related to the involvement of Pinetree and Topicus, partly due to the impact of their measures and partly through anticipation of them. The increase in Asseco's stock price shows that the market is anticipating this again. Feel free to dig deeper into the three cases mentioned. I’ll only go into a bit more detail on one of them: Sygnity.

In the FY 2023 letter from the management board they explained the measures they implemented and their key areas of focus. Let me remind you that FY 2023 was the first full year since Topicus acquired its stake.

In terms of revenue, the Group focused on maintaining and developing, in consultation with customers, its own product solutions. Consequently, decisions were taken to cease operations and exit areas that were unprofitable, were not strategic from the Group's point of view and, in the opinion of the Management Board, did not show any chance of quickly and sustainably improving performance.

Letter from the Management Board of Sygnity 2023

This led to a write-down on one of the ongoing projects.

The second area of focus for the management team was cost control and optimisation. This was important, as the persistence of double-digit inflation during the reporting period had a direct impact on wage pressure. This issue, if left unaddressed, could lead to the loss of key Company employees and margin erosion. During this period, the Group implemented a number of measures to improve the productivity of all execution teams.

The third key area of focus for the Group in the past financial year was the reinvestment of financial surpluses in the acquisition of shares in product IT companies, in line with the announcements on the search for attractive acquisition targets. During the financial year, the Company made 21 non-binding purchase offers, resulting in two acquisitions after the balance sheet date with a total maximum value of approximately PLN 54.1 million

Letter from the Management Board of Sygnity 2023

This led to an significant increase in profits.

The annual report also included some interesting comments on price negotiations and operating costs, as well as Topicus' role in this regard.

A key factor that allows CSU or Pinetree to implement certain measures is the cooperation of the management teams or a controlling stake. In the case of Trubridge, I had to read between the lines after the announcement of a poison pill when I invested, and the cooperation agreement that was announced recently confirmed my assumption.

In the case of Asseco, there is no need to read between the lines. As Adam Góral, President of the Management Board, was quoted in the press release informing us of the sale of treasury shares to Topicus:

The offer from the Dutch-origin company TSS, operating within the Topicus.com and Constellation Software, was very well received not only by the majority of our investors but also by Asseco’s management and myself.

Adam Góral, CEO of Asseco Poland

The signed shareholder agreement also grants Topicus the right to appoint 3 out of 9 board members.

So, the usual steps to ensure that CSU can execute its playbook already seem to be in place—a stake, along with a cooperative management team and board.

Risks

CSU is arguably the best software operator in the world, but there is still execution risk—that’s what a bet on the jockey is all about: execution.

Another risk that is difficult to quantify is that the sale of treasury shares to Topicus is still subject to regulatory approval, meaning the transaction could still be blocked.

Since Asseco has a strong relationship not only with the Polish government, there could be concerns in this regard, but that’s purely speculative. I size this position accordingly as long as regulatory approval is still pending.

Conclusion

I know I left out many details, but a deep dive into Asseco is particularly difficult, as you may have realized. In the end, it all comes down to a bet on the jockey. Feel free to dig deeper—I’m available to exchange thoughts.

Special thanks to David for providing me with additional information on this case.

You had me at Low-IQ!

It was great to help in any way with your research! Hope it's the first of many :)