Mind Technology Q1 - 2025 Update

As a result of the adjournment of the special meeting, the situation surrounding the prefs remains unclear, while the potential operating leverage is now clearly visible.

First of all, the disclaimer: I am invested in MIND Technology preferred stock ($MINDP) and common stock ($MIND). Nothing I write should be considered investment advice.

As the latest quarterly results and the Special Meeting are two events that deserve our attention, it is time for an update.

Financials

The slight decline in sales is not unexpected and is due to the nature of Mind's business model, which will always lead to a shift in sales from one quarter to the next.

What is clearly noticeable, however, is the operating leverage.The gross profit margin has improved to 44% despite lower sales, which the company attributes not only to price increases but also to more efficient production.

At the same time, operating costs have fallen significantly. G&A fell by 17% compared to the same quarter of the previous year, which is a consequence of the headcount reduction following the sale of the sonar division "Klein". Based on the CEO's statements from the last call, it should be possible to reduce operating costs even further.

Yes. So I think you're right across -- Ross, sorry. There is some ability to do more obviously, as we've got it's allowed us to be a little more lean at the corporate structure at the corporate level.

And I think there are some more things we can do there, still be more focused. And I think there's still some benefits that haven't worked through the income segment yet. So I think we'll see some continued improvement there. But we are a public company, even though we're small. So that creates some challenges. There's a point where you just can't go below at some point.

Robert Capps - MIND Technology, Inc., Q1 2025 Earnings Call, Jun 11, 2024

If sales remain at this level or increase, the operating leverage will be even more noticeable, as the company is already clearly profitable. Both in terms of adj. EBITDA, EBIT and net income. With regard to the reported adj. EBITDA, however, it should be borne in mind that the company has not adjusted the non-operating other income of 0.47 million. I would therefore deduct this amount from EBITDA in addition to SBC.

What stands out negatively is the backlog.This has fallen from 38.4 million to 31 million compared to the previous quarter, although it has risen by 70% YoY. Judging by the statements in the earnings call, this was expected and is also partly due to the fact that existing customers only order again after an entire order has been fulfilled. At least that's how I interpret the CEO's statements.

We entered this quarter with a strong backlog of approximately $31 million. Our backlog is down a bit sequentially, this is to be expected at times as we execute and make deliveries. New orders don't necessarily arrive at a constant rate throughout the year.

Robert Capps - MIND Technology, Inc., Q1 2025 Earnings Call, Jun 11, 2024

Apart from the backlog, the outlook was consistently positive in terms of generating new orders. Both from old and new customers from existing business areas as well as business relationships that arise through the adaptation of technologies for new requirements. Based on these statements, I expect new orders to be announced soon.

What the company is also promising is that the entire backlog of 31 million is to be processed in the current financial year, i.e. by January 31, 2025.

In view of this, we can assume that at least 31 million in sales will be generated in the next three quarters. I expect a gross margin of at least 44%, which is in line with the previous quarters and in line with management's statement that sales should be at a sustainably high level and even increase over the course of the year. The lower gross margins of the past were mostly still characterized by the sold sonar division and had lower sales levels in the Seamap segment.

If one conservatively assumes the G&A and R&D expenses from Q1 and no further savings, one arrives at 4 million EBITDA for the remaining quarters and a total of approx. 5 million EBITDA for FY 2025. I would like to emphasize again that I consider this estimate to be a 'very' conservative estimate based on management's statements on sales and costs.

31 * 0,44 = 13,64 - 9,66 = 3,98 MM EBITDA

If we compare the balance sheet with that of the previous quarter, the significantly lower cash balance is particularly noticeable. This is primarily due to the significantly higher working capital requirement and the shift from cash to inventory and accounts receivable. According to management, this is also partly due to the fact that the lead times for certain inventory have increased significantly from 90 to 180 days. From a precautionary perspective, the company is therefore buying inventory more aggressively in order to remain able to deliver.

However, no additional capital will be required for further orders unless there is much stronger growth.

Like the Twitter user chaka correctly noted, the current sharp increase in inventory could also indicate that sales will be significantly higher in the coming quarter.

Preferred Shares Conversion

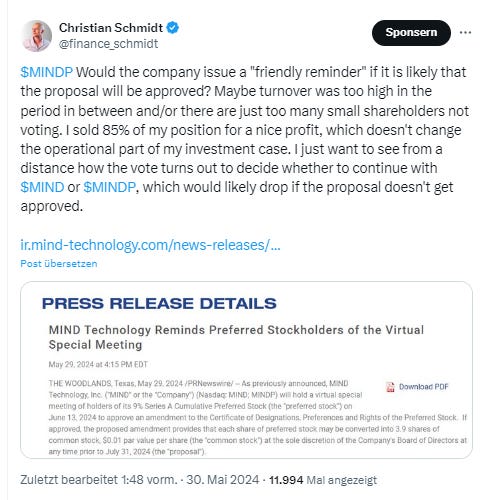

At the moment, it's actually more about the pref situation than the operating results. You can read about the special situation in my write-up. The special meeting on June 13 ended without a final result, as the votes submitted were not sufficient to complete the conversion of one preferred share into 3.9 common shares. The meeting was therefore postponed to June 27 to give the preferred holders the opportunity to still submit their votes. Previously, I had often read that Europeans like me in particular had considerable problems submitting their votes via their brokers, some of whom completely denied the opportunity to vote. On June 18, the company then published the letter again, which it had sent the day before to the pref holders who had not yet voted. Btw. quite embarrassing for the company to use the old name in the letterhead.

I believe that these attempts will not be very successful for the following reason. Although the company has not published the voting results for the conversion, it has published the number of votes cast as of June 13 and the number of votes cast in favor of postponing the meeting. Based on the total votes of 1.14 million present (67.6% of all shares) and the 0.79 million votes cast in favor of adjournment, 47% of all pref holders apparently wanted an adjournment, while 19.3% voted against.

In my view, this is an indicator of how many pref holders want the conversion, because I can't think of any comprehensible reason why one should vote for Proposal 1 but against Proposal 2, as it reduces the chances of conversion. Ultimately, we don't know what was going on in the individual minds, but as I said, it is an indicator and, in the absence of alternatives, it suggests that the conversion will not be carried out, as the two-thirds majority is still a long way off.

What does this mean for the case as a whole? According to my calculation, this worsens the picture a lot for both MIND 0.00%↑ and MINDP 0.00%↑. The upside calculated by me in the conversion scenario is invalid in the case of non-conversion, as the enterprise value is significantly higher.

Note: The multiple table refers to the upside in the case of a conversion.

As long as the Pref situation is not finally resolved, it makes little sense in my view to be a shareholder in MIND 0.00%↑, as the last income statement alone makes it clear that even with a good quarter with positive net income, the earnings after deduction of the preferred dividends are not sufficient for the common stock. Failure of the conversion may result in a short-term upside, as the dilution is off the table for the time being, but the fundamental problem remains.

MINDP 0.00%↑, on the other hand, has at least a short-term downside, as many investors originally entered the company in anticipation of the conversion. This is already reflected in the share price over the last few days. I still think that the downside is more limited with MINDP, while the potential upside is considerable in the scenario of a sale of the company and thus liquidation of the prefs or reinstatement of the dividend. The pref holders should in any case seek the appointment of two board members if the conversion fails.

In the current situation, I think it is best to do nothing and wait for the situation to clear up. I sold the majority of my position on May 30 and the remainder during the rise before the quarterly figures.

I am now invested in both stocks, but MIND 0.00%↑ is my smallest position with 0.26% of my portfolio and MINDP 0.00%↑ my second smallest with 0.71%. If the conversion fails, I would probably increase my position in MINDP slightly. If it goes through, it will be interesting to see what price the common stock ends up at.

Conclusion

Judging by my portfolio allocation, you can already see how promising I think the situation is at the moment. Think of it more as a tracking position. There are too many unknowns when assessing the current situation. Even if I am convinced of the company from an operational point of view, I don't need to hold a large proportion of either share in my portfolio at the moment. A clean start without prefs would be desirable, as we would then be looking at a debt-free company with an otherwise clean balance sheet. However, if the price of the prefs falls significantly if they are not converted, the risk/reward profile could also become attractive here.