Regis Corp ($RGS) Update - The refinancing of the year?

A much better refinancing was very well received by the market, and even after the 400% rise, I think Regis may still be too cheap. At least when certain aspects come to pass.

First of all, the disclaimer: I am invested in Regis Corp stock ($RGS). Nothing I write should be considered investment advice.

New Credit Facility

When I assumed a refinancing in my write-up on Regis, I expected a lot of things, but not what the company announced in its June 25 press release.

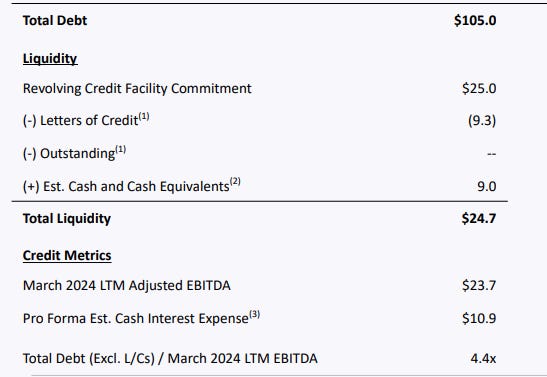

190 million of existing debt will be replaced by a new loan of 105 million, reducing the company's debt by more than 80 million. The two lending parties, TCW Asset Management Company LLC and Midcap Financial Trust, will also receive warrants equal to 15% of the fully diluted equity with a strike price of 7 dollars per share. Considering the apocalyptic fears that not only I but also the two activist groups had about dilution, the result is exceptionally good.

In addition to the term loan, the company receives a credit line of 25 million. The conditions of the credit line and the term loan are actually worse than those of the previous one. Whereas the previous interest rate was SOFR + 7.25% with 3.25% PIK, it is now SOFR + 9% with 4.5% PIK. There is also a cash flow sweep of 75%. Frankly, I don't put too much weight on it considering that the debt reduction results in a calculated interest savings of 7 million and Regis was close to the precipice before.

The side effect of the new financing is that Regis now has access to plenty of liquidity to implement operational improvements. The term until June 2029 also extends the time frame for changes.

Valuation

Regis shares have risen 400% since the news of the refinancing came out, so it is understandable that some voices on Twitter and in forums are assuming that this is an exaggeration. I would disagree, as it seems that the effect of the debt reduction is underestimated.

Based on the data from Regis' presentation, the EV currently amounts to 160 million.I have not implied the dilution in the market cap, but have included the expected dilution due to the warrants in the share count and thus arrive at 2.68 million shares.

For adj. EBITDA, I have assumed 25m, which differs from the assumption in my write-up of 29.8m.The TTM adj. EBITDA amounted to 23.7 million, but I think the assumption of 25 million is very justified. The reason for this is that the SG&A run-rate has constantly decreased and the closure of the last company owned stores alone should have a sufficiently positive effect to offset the current negative effects. In Q2 2023, the SG&A run-rate was still at 54 to 57 million, in Q1 2024 at 47 to 50 million and in Q3 2024 at 43 to 46 million. I therefore think it is fair to assume at least 25 million adj. EBITDA for NTM. This results in a current EV/EBITDA multiple of 6.4.

For interest, I have included the PIK interest in the CF calculation, as it would only make sense for me not to include it if liquidity could become a problem in the foreseeable future.

Due to the significant NOLS, I continue to assume 0% tax.

The lower part of the table is to be understood in such a way that I have assumed different EBITDA multiples of 6.5 to 10 and deducted the LT debts & leases from the respective EV and added cash, outstanding Zenoti payments and expected FCF to arrive at an equity value for the year. I put this in relation to the new share count, which results in the respective share price at the end of FY 2025 or Q3 2025.

If Regis is able to achieve EBITDA growth, the potential increases significantly. It should be noted that even an EBITDA of 10 for pure-play franchises is a rather low multiple 'if' the company demonstrates that it can increase sales and earnings and at least maintain the store count.

Bruce Galloway is probably 'at least' as biased as I am, but judging by his LinkedIn post he still sees great potential in the stock as well

Misconceptions and justified criticism

I read a lot of criticism on the day the press release about the refinancing was published. I consider much of it to be debatable.

What does Bank of America know about Regis accepting a 94 million payment on 190 million outstanding loan?

I have asked myself this question and discussed it with many people who know considerably more about this area than I do. It is very likely that the B of A already had the loan on its books for a much smaller amount given Regis' precarious position, so the 94 million payment was actually a markup on the value. For a bank with over 3 trillion in assets, such a loan is therefore more of a rounding error. And what would have been the alternative to selling the loan given the lack of refinancing? Chapter 11 and even more uncertainty about whether the loan would ever be repaid.

Rather, I would wonder what the two new lenders 'know' about Regis giving it a total of 130 million in funding. I would be surprised if the company shows a falling YoY EBITDA or negative outlook in the coming quarters.

The store count is constantly falling.

That is correct and the issue that concerns me the most. Although the absolute number of store closures has decreased proportionally, the trend is still clearly negative.

Based on the latest statements from the earnings call, management continues to expect a falling store count, but it is also relevant to look at which stores are closing:

On a year-to-date basis, we've had net closures of 268 versus 339 during the first 3 quarters of fiscal 2023. I've discussed on each of our calls that this is a dynamic that is ongoing and, unfortunately, one that is fairly unavoidable, with these closure salons averaging $131,000 in sales for the last 12 months of being open, which is less than half of the system average and 1/3 of the top quartile average of close to $400,000 for the last 12 months.

Matthew Doctor - Regis Corporation, Q3 2024 Earnings Call, May 01, 2024

This leads to an unwanted rationalization, which nevertheless has negative consequences for the company's operating leverage.

However, the management has always emphasized that they want to see the refinancing completed before they can concentrate on growth again. The new liquidity now gives them room to win new franchisees again. It would be conceivable, for example, to offer temporary discounts in order to increase the number of stores again.

Regis' operating results are disastrous.

Certainly not the case. I can only understand this assessment if you look at total sales rather than system-wide sales. Closing the company-owned stores reduces the company's Gaap sales. The relevant reference figure is the system-wide turnover and the SSS. Although system-wide sales also fall as a result of the store closures, same-store sales were positive in all past quarters under review, which is probably primarily due to price increases.

Irrespective of pure sales, earnings on an adj. EBITDA basis have risen sharply in almost all quarters, reflecting the considerable cost savings. As a soon-to-be franchise-only provider, the company has minimal maintenance CapEx, which means that net income, measured against lower interest payments and high NOLs, should be significantly higher in the coming quarters.

If the operating results have improved so much, why doesn't the management buy shares themselves?

A strategic review leads to a blackout period during which management is not 'allowed' to buy shares. Even if the strategic review is now formally completed, there is currently a blackout period until the quarterly results are published.

Why are you arguing with the Zenoti payments, although according to 10-Q these are no longer supposed to flow?

There was actually a sentence in the last 10-Q that also worried me a little.

First of all, it should be noted that FY 2025 only runs until June and the threshold for the additional payments has not yet been exceeded. In addition, the company made it clear in the last call when the payments can be expected:

As of Friday, April 26, we had close to 2,600 salons to migrate to the Zenoti platform. This is up from 1,600 salons in our last earnings call, and we are on track to completing our migrations this summer, likely with the last salons migrating in July. We have completed the transition of all SuperSalon users to Zenoti, so all that is left now are those on OpenSalon Pro. And from a migration payment perspective, we will likely cross that salon count payment threshold this fiscal Q4 and receive payments in Q1 and Q2 fiscal 2025. As a reminder, we have received $20 million in proceeds to date, which has gone towards servicing our debt.

Matthew Doctor - Regis Corporation, Q3 2024 Earnings Call, May 01, 2024

Due to the lower store count, I expect around 15 million in payments, as this roughly corresponds to the lower number of stores, but since further closures are to be expected, the payment could also be slightly lower.

Additional aspects

Apart from this, the company has recently taken the right steps in many respects. On May 2, a long-term risk was finally eliminated. EEG was finally sold:

In addition, the company seems to have finally arrived in the present with push notifications to remind users of new appointments and reviews after a visit, which has already had a very positive impact, as Jeff Moore's many tweets show.

Apart from this, many new attempts are currently being made to increase customer loyalty to Supercuts, for example.

Conclusion

I will hold the majority of my shares as I assume that the company will report at least the same EBITDA YoY and that this will be received positively by the market. In the medium term, the company now also has the time and resources to increase the store count again without the constant threat of bankruptcy.