Supreme PLC ($SUP.L) Update - FY 2024

The stock has risen by 60% since the beginning of the year and yet there are still good prospects for a significantly higher upside. The outlook seems to me to be far too conservative.

First of all, the disclaimer: I am invested in Supreme PLC stock ($SUP.L). Nothing I write should be considered investment advice.

If you don't know the stock yet, you can read my write-up here. Sven Klass first brought it to my attention. Make sure to give him a follow.

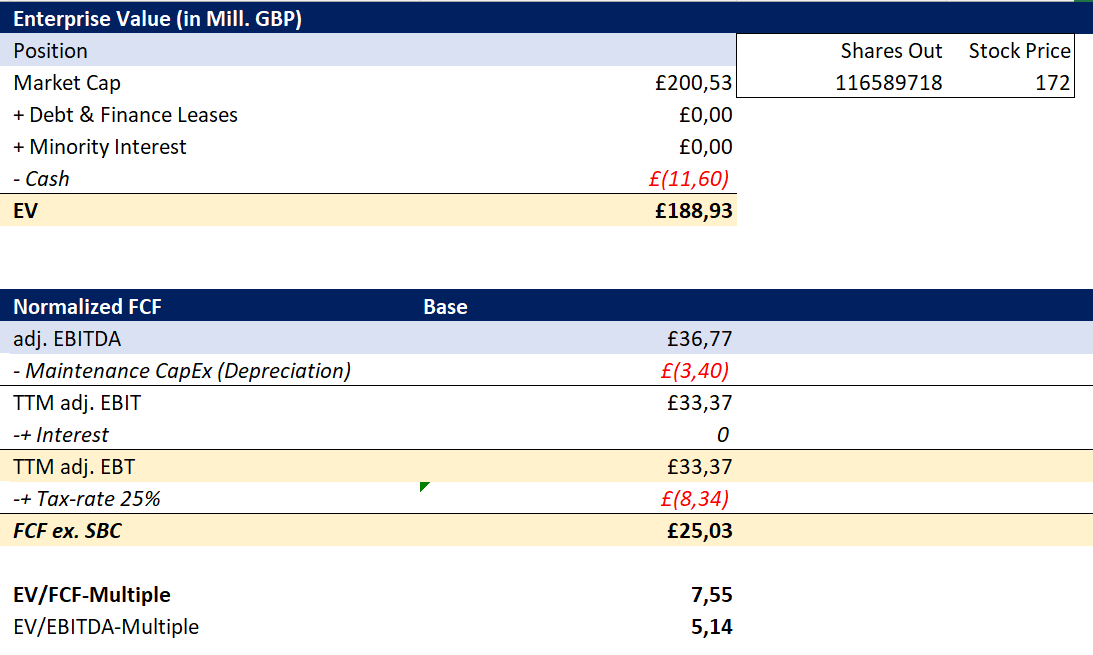

Ticker: SUP.L

Price: GBX 172

Market Cap: 200,53 Million GBP

EV: 188,93 Million GBP

Financials

At first glance at the earnings figures for FY 2024, we seem to be looking at an absolute growth company that also appears to be benefiting from considerable operating leverage. Mid double-digit sales growth with more than double the growth in adj. EBITDA.

At least the point about operating leverage is indisputable. When it comes to sales growth, however, I would again make myself aware of where this primarily comes from.

While 4 divisions only achieved single-digit growth, almost all of the growth is attributable to the "Branded Distribution" segment, which represents sales from the Master Distribution Agreement with ElfBar and LostMary. So far, disposables are still being sold under the two brand names, but these could be banned as early as April next year. In addition to the planned tax on vaping, this is the reason for the currently prevailing valuation discount, and not only in the opinion of investors.

Vaping

I have set out in detail in my write-up what is planned in regulatory terms and what the likely impact will be. The conditions have not changed significantly since then, even with Labor's election victory.

Gross profit from the company's own vaping brands improved by 28% despite only a slight increase in sales. In the earnings call, CEO Sandy Chadha and CFO Suzanne Smith reaffirmed that they do not currently expect the ban on disposables to have a negative impact on the business.

The reason for this is simple. The rechargeable pod system, which looks the same and delivers the same flavor, costs the same as the disposable. So, in theory, customers could buy the pod kit and throw it away after use. The margin is slightly lower on the kit than on the disposables, but higher if customers buy the pods, which can then simply be inserted into the rechargeable system. This applies not only to the company's own brands, but also to ElfBar and Lost Mary.

I still consider the disposable ban to be more of a non-event and think that the effects of the planned tax will be more negative.

Other Categories

In the other categories, significantly higher increases in gross profit can be seen and the picture that dominated sales is largely reversed, as "Branded Distribution" pulls down the average with a gross margin of 15%. The gross margin in the "Vaping" segment is better, as production has now been consolidated at a single location. Looking purely at sales growth can therefore lead to a false picture of Supreme, as its strength lies more in increasing efficiency and utilizing distribution opportunities, while overhead costs are only rising slightly.

Unsurprisingly, the battery division has only grown slightly, but it is growing. According to its own statements, Supreme currently has a market share of around 35%. The gross margin increase is mainly due to changes in the sales mix. The segment is also seen as a door opener through which the company gains access to customers in order to be able to offer additional products. According to the management, overhead costs are zero, which is why they want to hold on to the segment in the long term.

The margin increase is particularly evident in the Sports Nutrition & Wellness division. With only a 7% increase in sales, the gross margin rose from 16% to 29%. This was mainly due to the sales mix, which switched more to products produced in-house (protein powder). A breakdown of marketing expenditure would be particularly interesting in this segment, as Supreme recently switched to a classic marketing strategy for its premium brand SCI-MX. Frankly, I assume that the return is not yet too high, as my question to this effect was bypassed in the phone call with the CEO. According to Sandy's statements, acquisitions in this area in particular are to be expected in the coming year.

The Lighting division continues to lag behind pre-Covid levels in terms of revenue. However, Supreme did not lose any customers or shelf space. The higher gross margin is due to a reduced focus on FOB, but also better supply chain conditions.

How many of these changes, which have led to a higher gross profit, are sustainable is still questionable for me at the moment. The consolidation of vaping production seems to me to be the only reliable component at the moment. The consolidation of vaping production seems to me to be the only reliable component at the moment.

Acquisition of Clearly Drinks

In my view, the acquisition of Clearly Drinks offers very good opportunities. The manufacturer of beverages in cans and bottles with a highly automated factory was acquired by Supreme for 15 million. Sales amounted to 22.4 million and EBITDA to 3 million.

Clearly Drinks' own brands, which include water and energy drinks, can theoretically be sold by any of Supreme's customers. From kiosks to retail chains.There are also opportunities and synergy effects beyond this. For example, the Sci-Mx pre-workout drink can now be produced on the company's own production facilities.

Other Supreme own brands can add new products from this area. Acquisitions of other brands and integration into the company's own production facilities would lead to immediate synergies and margin improvements. According to management, 40% growth is possible without further CapEx. Further growth could come from the planned pilot plants, which are to produce small order quantities for other brands.

The acquisition seems like a very reasonable addition to the non-vaping business, which will now exceed 100 million sales, which is another important signal to the market.

Outlook

What may have caused the share price to slide slightly immediately after the results were published was the outlook.

Supreme forecasts FY25 to be another profitable and highly cash-generative year for the Group. Having made a positive start in Q1, the Group is trading comfortably in line with current market expectations

Supreme PLC - Audited Final Results for the Year Ended 31 March 2024

Market expectations currently amount to sales of 242 million and an adjusted EBITDA of 36.9 million. This would represent an increase in sales of around 10%, but a slight decline in EBITDA. However, there are signs that the outlook is clearly too conservative.

The strongest signal in this direction is the CEO himself. When asked why EBITDA is flat in the outlook, even though the company does not expect the plans of the old or new government to have a negative impact on the company, the CFO said: "Caution." Immediately afterwards, the CEO replied: "I think if I was CFO I think the numbers may be different." Suzanne Smith obviously wants to at least plan for the possible (short-term) effects of the disposable ban. After all, at some point the switch from disposable to rechargeable pods will have to be passed on to resellers.

We can therefore assume very cautious planning here, which is in line with FY 2024. The company originally assumed slightly higher than expected sales of 150.5 million and EBITDA of 22.2 million. The outlook was then increased in 4 steps over the course of the year.

In addition, all comments regarding the first quarter are very positive. Nevertheless, I welcome the cautious approach and also tend to take the conservative view.

Valuation

The following calculation refers to the balance sheet at the end of FY 2024. The company is currently debt-free and will apparently remain so after the acquisition of Clearly Drink, as it was stated in the call that none of the credit facilities are currently being used. I have not included the leases in the EV, but take the payments into account in the maintenance CapEx.

Based on the comments, I have made an estimate of 38 million EBITDA, which is only slightly above the consensus. I have deducted the stock based compensation from this and thus arrive at the 36.77 million EBITDA. The maintenance CapEx could be slightly off, as the effects of the consolidation of the warehouses into one and the consolidation of production have yet to be fully realized. However, the de facto CapEx was significantly elevated in the previous year.

With an EBITDA multiple of 5.14 and the obviously good cash conversion, which is already reflected in real terms in Supreme's balance sheet, I still consider Supreme to be undervalued.

Conclusion

Concerns about vaping now also seem to be gradually diminishing, as Supreme has announced further acquisitions in the non-vaping sector, which will presumably sell as well to the company's resellers as those of Clearly Drinks.

Gross profit is still heavily dependent on the company's own vaping products, but on the one hand I think the concerns about this division are exaggerated and on the other hand the company would generate a high double-digit cash amount from the division, which can be invested in M&A, even in the event of a complete ban (which is not currently being debated).

I therefore see a realistic short-term upside of 95% even in the conservative EBITDA estimates.

I was reading your post again due to the stock price falling to 145p. What is the reason for that from your point of view?