Portfolioupdate Q3 - 2024 - 65,0% YTD

After a good third quarter, I am now actually on course for the second best year in my stock market history.

Assume that I am actively trading or hold a position in all of the mentioned stocks.

Performance YTD: 65,0%

IRR since 01.01.2017: 32,75%

TTWROR since 01.01.2017: 428,85%

Stocks in my portfolio

Below are my current portfolio positions, in descending order of size.

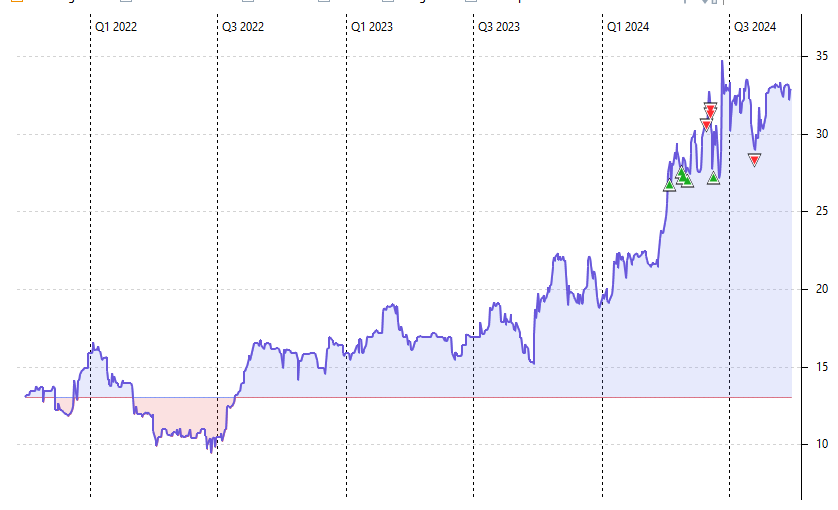

Intelligent Monitoring Group $IMB.AX

The stock that generated the most performance in the past quarter. My write-up on the stock can be read here, the latest update here. I increased my position by approx. 20% during the quarter

.

Despite the doubling of the share price, I am convinced that there are two major catalysts ahead of us that could lead to a significantly higher share price. The first is the publication of the new guidance at the AGM in October and the announcement of the refinancing by February at the latest.

The guidance should be significantly higher simply due to the stronger focus on business customers, which will drive organic growth in the medium term. According to the press release on the annual report, there are relevant discussions with larger customers. In terms of refinancing, I consider the interest rate to be almost halved according to all known parameters.

Regis Corp RGS 0.00%↑

Regis also made a very positive contribution to my performance in the second quarter.

Although the stock is still my second-largest position, I have reduced it significantly on a net basis for two reasons. On the one hand, I wanted to free up capital for other stocks and, on the other, I still don't consider the stock to be risk-free. I explained the reasons for this in detail in my update.

However, the risk is considerably lower than before the refinancing and, in my opinion, the management is taking all the right steps to strengthen the brands in the Group again and return to growth in the medium term. The textbook-like testing of measures in a small number of stores and the subsequent implementation on a broad scale alone gives me confidence that the management is acting in a strictly data-driven manner and is not impulsively implementing measures to return to growth.

Kinovo PLC $KINO.L

I have also reduced Kinovo slightly. However, I still hold the majority of my position.

I don't have much new to say about the stock. I still have a problem with the management's communication from time to time. I particularly needed clarification on the most recently announced award. Apparently they had included an award that had not yet been formally granted in the visible revenues, which according to my previous understanding should be ruled out. I wasn't the only one who felt this way, and I generally consider this to be a bad signal. Kinovo has a trust problem due to its DCB history. Whether this is deserved or not. I therefore believe it is necessary to cause the expected irritation among investors as rarely as possible.

Innovative Food Holdings $IVFH

True to the motto “If you panic, panic first”, I sold off part of my position immediately after the press release for Q2.

For me, the success of the 'new' management's initiatives is still open-ended and as the company does not publish any guidance, I am very sensitive to signals that the management 'apparently' sends us. After I was able to clarify the sentence below with the management, I increased my position to the former level.

What I really like at the moment is how broadly the management is thinking about the approaches they want to use to generate revenue from their platform. The recently announced portioning of cheese for retailers does not have the same margin profile as dropshipping, but should at least enable a significant jump in revenue with a positive contribution margin. If this approach is successful, I assume that we will see more initiatives of this kind. If it does not deliver the expected returns, I expect the current management to have the courage to admit this and pull the plug. After all, the previous management also tried to leverage the existing platform with their e-commerce business, but didn't admit the mistake and burned money for years.

As the new contract will only make a significant contribution in Q4, I still see room for disappointment in Q3, which I will use opportunistically if possible

.

Covalon Technologies $COV.V (Undisclosed position from my previous update)

One positive quarter can be anything, two is already a trend. True to this motto, I increased my position in Covalon after the latest report.

In his write-up, my friend Sven Klass has finally shed some light on how the growth with existing customers can be explained. In a recent presentation, the management confirmed his assumptions. Covalon's strength is currently primarily due to the weakness of its competitors. This may change in the medium term, but it doesn't have to. For the time being, I remain invested, as I do not yet see any indicators that anything should change on the current path.

Supreme PLC $SUP.L

My assumption that the share price would trend higher in the long term after the UK election did not materialize. Although the vape flavor ban issue has been mentioned before as a possible consequence of regulatory efforts, the topic has recently been widely discussed. In my view, the concern about this is not unfounded, although it may be necessary to look at the actual implementation in order to assess the real impact.

The diversification efforts are still clearly visible, but I suspect that the regulation issue will continue to put pressure on the stock price. As I have seen a similar upside in other stocks without this immanent risk, I have reallocated part of my position. Should the share price fall back into irrational regions, I would add to it again.

DSW Capital PLC $DSW.L

As I have already mentioned, DSW should be viewed critically in terms of its communication with shareholders, as in the past there have been a few articles on the company website that conveyed a different image of the company than the guidance cut then actually presented.

Once again, there are many reports that would normally be described as bullish. Insider purchases by the CEO, many announced deals in the past quarter and the continuous announcement of the expansion of individual teams.

A negative indicator at the half-year mark was that DSW no longer appeared in the ranking of the most active financial advisers, but H1 was undoubtedly not a good one for the company and many deals were only closed in Q3.

I have reduced my position by around 10% to free up capital for other stocks.

Medical Facilities Corp $DR.TO

In the past quarter, I again significantly reduced Medical Facilities in order to free up capital for ideas with higher upside. At the moment I still have around 50% of my original position. The reason for this is quite simple: the low hanging fruits have been reached and the sale or partial sale scenario of the company is questionable.

Nevertheless, apart from this scenario, the company does not seem like a bad investment to me. It will soon be debt-free, buybacks will continue and dividends will be increased further. If this trend continues, it is not unlikely that the company will once again be perceived as a reliable dividend payer and attract a corresponding audience.

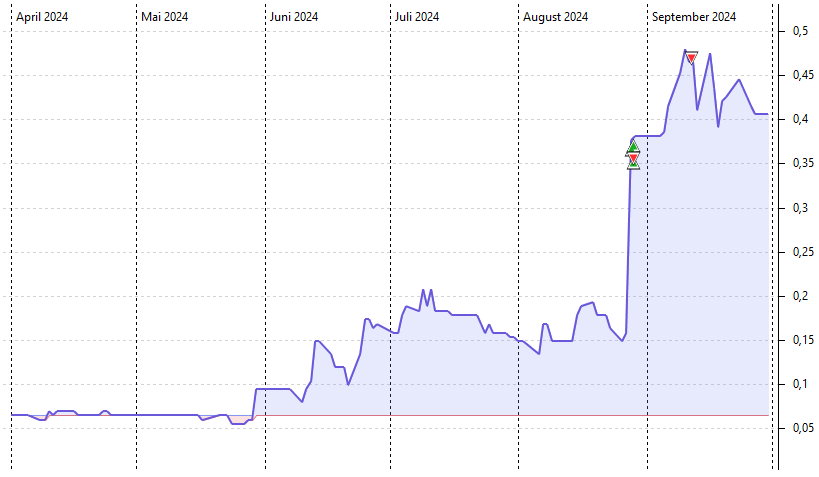

Koil Energy Solutions $KLNG (Undisclosed position from my previous update)

I have been following the company since January of this year. Through my investment in it, I looked at the other positions of another Regis investor and $KLNG was one of them. However, I could only understand the reasons for his investment from a macro perspective (offshore oil on the upswing), whereas until then the company was more of a reliable guarantee for burning money.

That seemed to come to an end with Q1 2024. However, since the information available was sparse and I didn’t feel confident enough to reliably predict the next few quarters, I acted in acted line with 'One good quarter could mean anything, two make a trend.' Unfortunately, this was particularly painful in this case, as the stock price more than doubled before I could bring myself to decide to increase my position. Nevertheless, I remain convinced that I will fare better in the long run with this approach when the open questions outweigh the answers already received

There are many things I like about the company. Beyond the fact that the entire industry is currently on the rise, Koil Energy seems to be benefiting disproportionately. Depending on how conservative you are with assumptions for the coming quarters, the stock is trading at a P/E ratio of 4 to 8. Calculating this can be somewhat difficult, as Koil often works on a project basis and doesn’t publish a backlog. However, operational developments, such as reducing operating costs and securing new orders, appear to be sustainable.

Apart from that, it is obvious that the company wants to communicate more with the market. Attendance at conferences and presentations was previously rare to non-existent. I can only assume that the activist intervention of an investor has something to do with this. In any case, the communicated growth strategy seems coherent.

Mind Technology MIND 0.00%↑

It may come as a surprise to many that a stock on which I myself did a write-up appears so far down in my list. The conversion of the preferred shares ($MINDP) has now been completed as originally expected, but orders have largely failed to materialize. Now there has been an order intake and generally more bullish language. However, as long as there are no signs that the backlog will at least be replenished, I am not convinced to make this a bigger position.

Positions sold

Centrotec SE $CEV.HM

Most won’t be particularly surprised that I decided to sell. The decision was based on a very simple analysis: which stocks carry the greatest risk relative to the upside. Centrotec was the first that came to mind. We are dependent on the whims of a single individual, and with every year that passes without seeing the squeeze-out, the IRR suffers significantly. In contrast, I saw more potential for short- to long-term performance in all my other holdings, and the risk seemed lower.

I ultimately made money with Centrotec, but it was well below my hurdle rate. It’s unlikely that I’ll invest in a squeeze-out scenario like this again.

Fitlife Brands FTLF 0.00%↑

I have a lot of confidence in the management, the company, and especially in their approach. At the moment, I’m hoping that not all current investors feel the same way, and that I might get the stock again at around $20. I don’t think it’s entirely out of the question, as the low-hanging fruit has already been picked, and now the question is whether they’ll be listed with larger retailers again, or if there will be new acquisitions, etc. Until then, some investors might lose interest as the YoY numbers won’t look quite as attractive, but admittedly, that’s rather unlikely since I believe the shareholder base is mostly well-informed.

New Undisclosed Position 1

I'm not done with the stock yet and sold just a few days before it jumped from 0.6 to 3.2. In my view, it did so for irrational reasons. It's now back down well below 2.0. I'm definitely keeping an eye on it

Zoomd Technologies $ZOMD.V

I was fairly successful with this stock as a trade, though unfortunately with a small position. From an uncritical valuation perspective, the stock appears very cheap, but everything else feels 'off' to me. After the earnings call, I already knew I wouldn’t stay invested for long, as there were more open questions than answers, combined with a few yellow flags that I personally saw as warning signs.

Conclusion

My focus on not always capturing the full upside and instead prioritizing risk reduction is relatively new for me. This includes not allowing more risky positions with high upside, such as Regis to grow beyond 20% of my portfolio. It also means not initially investing more than 5% in cases with open questions, like $COV.V and $KLNG, but rather waiting for confirmation of a trend. Although this approach has cost me some performance, particularly with the latter two, I believe that in the long run, I will fare better with this strategy.

I've just gone through another lengthy dry spell. Although I read filings every day, I haven't been able to find a stock in the last few months that has convinced me as much as $IMB.AX or $IVFH. However, this might also be a good sign, as it could simply mean that my standards have risen.

I would like to extend my special thanks to Sven, Sebastian, and Paul, with whom I had many discussions again in the last quarter. Just today, another investor, Sam, mentioned in a meeting that one advantage we Germans have when investing is that we are willing to speak up when someone has a completely wrong idea. 😉 Based on our recent conversations, this does indeed seem to be true.

Love your write ups. What tool do you use to create these sleek charts?

Congratulations on your performance!

How many holdings do you typically have?

And what is the largest you tend to size microcaps?