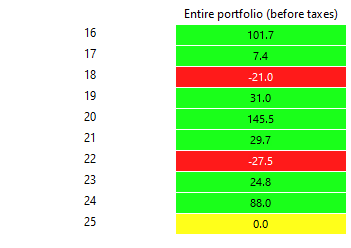

Portfolioupdate 2024 - 88,0%

2024 was the second-best year in my stock market history, but I feel it was the year I learned the most—lessons that will benefit me in the years to come.

Assume that I am actively trading or hold a position in all of the mentioned stocks. Nothing I say or write should be construed as investment advice.

Performance 2024: 88,0%

IRR since 01.01.2017: 33,79%

TTWROR since 01.01.2017: 502,35%

Stocks in my portfolio

Below are my current portfolio positions, in descending order of size.

$IVFH Innovative Food Holdings/Harvest Group Holdings

One of the biggest contributors to my performance in 2024, and I have to thank Sebastian Krog for sharing this idea with me. I remember clearly that when he pitched it to me, I was immediately hooked. The combination of a world-class management team, a then-low valuation, an asset-light business model, and low-hanging fruit ahead perfectly matched what I’m always searching for.

Things turned out differently than expected, but the management demonstrated an impressive ability to think outside the box in leveraging their platform. I didn’t anticipate the 'cheese business,' but it has now opened an entirely new business opportunity. This concept can easily be rolled out to more retailers, additional stores with the same retailer, and even new product categories.

The stock is no longer cheap, especially for someone like me who typically buys at a low to mid-single-digit multiple. However, the potential of the cheese business being just the beginning, with more opportunities to come, makes it easier to justify the current EBITDA multiple. That said, it’s important to recognize that this business likely operates with a significantly lower EBITDA margin compared to the dropshipping segment.

Still, we shouldn’t overlook the fact that they’ve also managed to add customers in dropshipping businesses. Additionally, their recent acquisition positions them to further leverage existing vendor relationships while also bringing new vendors onto the platform. Another example that could serve as a role model moving forward.

I increased my position in Q4 and will only sell shares if there’s a significant overvaluation in the stock price or if the stock once again exceeds 20% of my portfolio.

$KINO.L Kinovo PLC

If I had to name one stock that people most often ask me why I’m invested in, it would definitely be Kinovo. I can understand why. It’s not incredibly cheap, and the issues surrounding their former subsidiary, DCB, have been a persistent headache. The company's communication on that matter had its flaws, which was one of the reasons I sold part of my position.

Now that the DCB situation is finally resolved, and with a government likely to provide a tailwind for Kinovo through programs they could benefit from, the company seems poised to secure more contracts.

What I believe people continue to underestimate is Kinovo’s free cash flow (FCF) conversion. The main reason I’m inclined to maintain a larger position in this stock is that I believe it’s now in a relatively stable phase compared to some of the other stocks in my portfolio

I tried to buy more shares at the recent quarterly low, but as most of you know, that’s not really feasible with AIM stocks. However, I managed to increase my position after the results were published. Overall, I’ve slightly reduced my net position.

The next seven positions are very similar in terms of size, so don’t interpret their ranking as a reflection of conviction.

$SBBC.V Simply Better Brands

I recently did a write-up so there isn’t much new to add since then. I’ve been closely monitoring the sales rank on Amazon and haven’t seen anything concerning so far. I initiated my position immediately after the results were published, which made up roughly 5% of my portfolio at the time. With the recent run-up, it has now become my third-largest position.

$SUP.L Supreme PLC

Supreme’s acquisition strategy is performing as I expected. Acquiring brands out of administration and leveraging their distribution and dealer network aligns perfectly with how I’ve always viewed the company. They should be able to replicate this approach across different categories.

Regarding the latest results, I was somewhat surprised that their own vaping products didn’t perform better. However, let’s see how the disposable vape ban impacts this moving forward.

I expect to hold this stock longer than my average holding period, primarily because the company is highly diversified and its acquisition strategy offers low-hanging fruit in terms of integration and synergies.

I haven’t made any changes to my position.

$DSW.L DSW Capital PLC

A lot has changed since my last update. The recent acquisition has significantly transformed the company’s revenue profile—for the better, one could say. They are no longer heavily reliant on M&A, and the deal structure wasn’t excessively dilutive.

Moreover, it’s now clear that the announced deals were signals, not noise, as evidenced by the much higher guidance provided. While significant forward effects came from the new budget, it seems the overall M&A environment has also improved considerably.

I remain bullish on the stock and see a clear path to a higher share price by 2025.

I tried to buy more shares during a temporary dip, but, as is often the case with AIM stocks, it wasn’t easy to do so.

$NOW.V NowVertical Group

Sven Klass did an excellent write-up of this stock, and I’m frequently discussing it with him and other relevant parties. Initially, I was skeptical because of the sector, but as is often the case with my investments, many factors now argue in favor of this one.

The company is at—or has already crossed—its inflection point. I recommend watching Paul Andreola's recent interview with the CEO to better understand the changes the company has made and why the term 'AI' shouldn’t deter you.

$KLNG Koil Energy Solutions

I believe the stock skyrocketed due to a combination of factors: strong results, increased public presentations, macro perspective, new contracts, and more knowledgeable people discussing it.

The offshore oil sector still appears to be on the rise, as evidenced by the results from other companies in the industry. Additionally, the management's strategy seems to be paying off, particularly considering the source of the latest contract.

I sold a third of my position because the stock had grown too large in my portfolio, especially given its cyclical nature. It’s no longer trading at an extremely low multiple and there is some room for disappointment due to the typical revenue recognition ‘challenges’ faced by project-based companies

Undisclosed Position 1

Another investor brought it to my attention. Since I’m unsure whether he plans to do a write-up and I want to see if the company actually delivers, I won’t discuss it further for now.

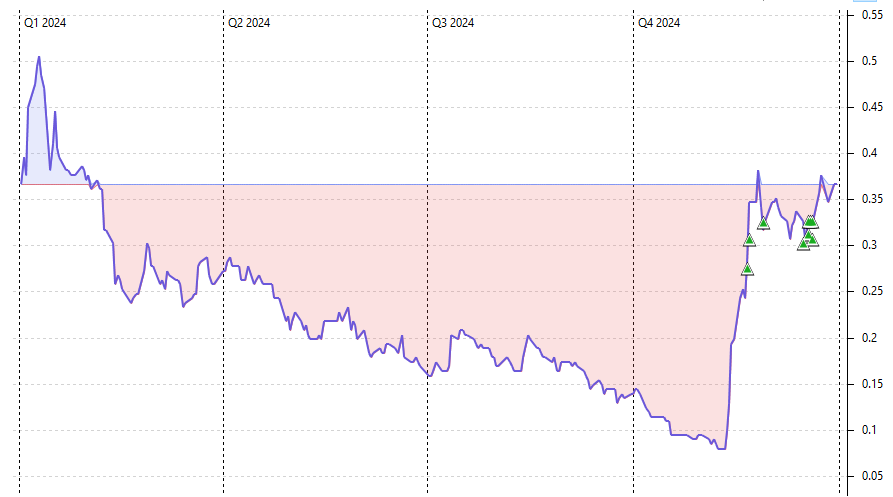

$IMB.AX Intelligent Monitoring Group

I wrote in detail about what seemingly went wrong here. Although the stock is still significantly up since my initial write-up, it feels like a failure on my part. I sensed it was time to sell a portion of my stake but held on, influenced by the company's comments regarding guidance, selling only 5% at the highs.

It took me a few days to gather enough information to determine whether the situation was as bad as the market seemed to believe. After assessing the situation, I decided to wait for a rebound and ultimately sold more than half of my position.

The recent news flow appears positive, but as I outlined in my update, the market no longer trusts management. This sentiment is also evident in Australian stock market forums. If everything management has recently stated is accurate, the stock is undervalued—but I’m not willing to bet on that. I reiterate my advice from my update: focus on what they actually deliver, not just on what they say, if you choose to remain invested.

Cash

I currently have a large amount of cash, which is rather unusual for me. From past experience, I know that I’ve made poor decisions when trying to reallocate a sudden cash position too quickly. This time, I’m trying to avoid that, even though I have some new ideas. I just want to take more time to evaluate them thoroughly.

Undisclosed Position 2

Since I got this idea from a paid Substack, I won’t mention it here, as it might be perceived as planned frontrunning given how frequently I discuss stocks with the author

$ZOMD.V Zoomd Technologies

In my last update, this company appeared under the section Stocks I Sold. The reason for this was that I had purchased it immediately after very strong quarterly results, without prior familiarity, leaving many of my questions unanswered. On top of that, the earnings call was one of the worst I’ve ever experienced.

However, as has happened before, it was an interview with Andreola that tipped the scale. Although I initially formed a different opinion, the Chair addressed all my open questions in the interview. It became clear that the company was undergoing a familiar transformation: new management focusing on core activities, a strategic shift, and subsequent success.

This prompted me to buy back a position after the interview. I won’t say much more about the stock, other than that I plan to hold it at least until the next quarterly results. I remain cautious, as I still believe this sector is among the most challenging for establishing a durable competitive edge.

$COV.V Covalon Technologies

This was another stock with unanswered questions for a long time, even after multiple investors, including myself, engaged with the management. Sven Klass eventually managed to piece together part of the puzzle. It appeared that the exceptional quarterly results were driven less by Covalon's strength and more by Solventum's weakness at that specific point in time.

After realizing this, I closely monitored Solventum's quarterly results and press releases, as well as those of Paul Hartmann, to identify any indicators suggesting that the apparent weakness might persist. Since Solventum didn’t mention the segment in their latest quarterly results, I concluded that it likely had neither a positive nor a negative impact this time. This could imply that the temporary shift has ended.

Reflecting on the example of Gee Group from earlier this year—where I ignored a changing environment—I decided to significantly reduce my position. "I'll keep the remainder until the quarterly results.

$DR.TO Medical Facilities

This is a stock I wrote about in September 2023, and although I initially thought it might be a relatively boring idea, the performance has far exceeded my hurdle rate. The stock price nearly doubled, and what pleases me even more is that everything played out exactly as planned. The company sold all its smaller hospitals, completed more buybacks, recently sold a larger facility, and is now likely to proceed with a tender buyback.

With the potential upside now relatively limited, considering my hurdle rate, I’ve sold most of my position. I’ll likely sell the remainder if I need cash for a new opportunity.

Undisclosed Position 3

For the same reason as with Undisclosed Position 1 & 2.

Stocks I Sold

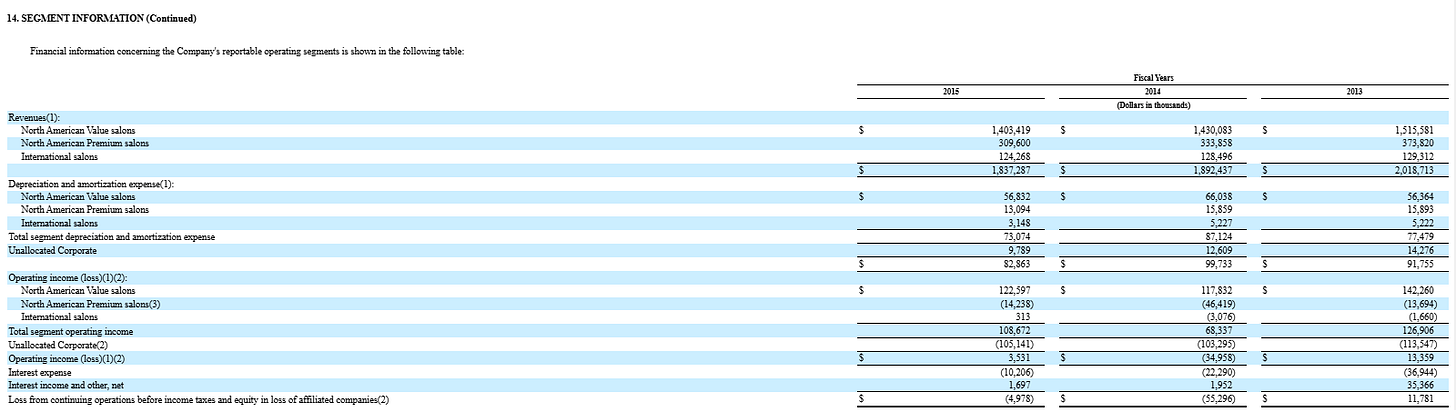

RGS 0.00%↑ Regis Corp

This was my write-up from the beginning of the year, and as most of you know, it initially played out even better than expected. In hindsight, it would have been a smart move to sell once the market had priced in most of the short-term potential. I did start selling early and consistently reduced my position whenever I needed cash or the stock showed temporary strength. However, I kept the majority of my position because I’ve always believed in this management team’s long-term consistency.

While they haven’t been great communicators regarding details, I couldn’t find any flaws in the operational measures they’ve taken. I also think it’s likely they will report same-store sales soon, given all the changes and programs they’ve implemented, along with the early positive signs.

That said, their recent decision to acquire a franchisee, after nearly completing their shift to a franchise-only model, feels inconsistent. In my view, it’s crucial to approach management’s stated rationale for specific steps with a healthy dose of skepticism.

The fact that they might need a testing ground and that their franchisee salons are somewhat unsuitable for their requirements is something they should have anticipated beforehand. This raises the question of whether that was the main reason for acquiring a franchisee.

Based on comments from one of the partners of the Alline Group, it seems they were actively searching for a buyer, and Regis stepped in. In my opinion, this makes it fairly obvious that the acquisition was more tactical than strategic in nature. I would guess it wasn’t easy to find a buyer for this type of asset. Otherwise, they likely would have sold it at a higher multiple to another party.

"Alline had nine partners, including CEO Mike Sarafa. The group was ready to leave the salon business after nearly seven years, Sarafa said. The group had been shopping for a buyer for about six months before Regis stepped in to purchase the salons and back-office operations.

“They were looking to get back into, in a modest way, the corporate operations of salons,” Sarafa said in an interview. “We have the back office set-up, a turnkey operation, ready to go with very good people in place. It will be an easy transition.”

Regis’ largest franchisee wanted out of the business, so the beauty business bought back 314 salons

Story by Patrick Kennedy, Star Tribune

However, I doubt the primary reason was their need for a testing ground, and I suspect the Alline Group initiated contact rather than the other way around. Of course, this is pure speculation and ultimately means very little. Still, let’s not pretend this is a masterpiece of operational strategy—someone wanted out, and Regis simply stepped in.

What I think some people also overlook is that they can’t simply add the EBITDA from the acquisition to their FCF calculation without making adjustments to maintenance CapEx. Regis paid 4.31x TTM EBITDA, but it’s a ‘worse’ EBITDA compared to franchise EBITDA, as maintenance CapEx must be allocated for all the stores.

While reviewing the Annual Reports before they switched to the franchise model, I concluded that they paid between $7,000 and $12,000 per year per store. Don’t quote me on that, as I simply divided the segment D&A by the store count at the end of the year, and the store count was already in decline. I reviewed the numbers prior to 2016, so also keep in mind that the average maintenance CapEx has likely worsened since then.

If we assume this range, then we need to deduct between $2.2 million and $3.7 million in maintenance CapEx from EBITDA. Alline Group had $5.8 million in EBITDA, and Regis is expecting $1 to $1.5 million in synergies by 2026. Let’s assume they achieve the upper end, meaning $7.3 million in EBITDA. Now, let’s deduct the midpoint of the D&A range, which is $2.95 million, and then subtract $2 million in interest on the facility, including the PIK debt, since we’re evaluating how good of a deal this was, and Regis will eventually need to pay the interest. That leaves us with $2.35 million in FCF. You can decide if you also want to normalize this and deduct taxes accordingly. I didn’t. So, essentially, Regis paid 10x FCF. I fail to see how this is a good deal, especially considering that I wasn’t even conservative in my assumptions from an investor’s perspective. If you are overly conservative in your assumptions, you will reach cash flow breakeven.

If you argue that this deal makes sense from a financial perspective, then you would also have to argue that they should buy all their franchisees under these conditions. That's not why I invested in this company. I was buying a company that seemed to have completed its transition to an asset-light, franchise-only model, thereby reducing the capital needed to run the business and, ultimately, lowering the risk after paying down debt. In my opinion, this whole situation makes a re-rating less likely, as the market could be skeptical that this is just the beginning of more franchisees wanting to exit. If their largest franchisee, based on own statements, wanted out, it raises questions about how successful the franchise currently is and whether this trend will continue. Additionally, keep in mind that Alline had nearly 400 stores in August 2020, but now only has 314. I expect this decline to continue, which will likely reduce EBITDA, while they paid for a larger store count.

To conclude, I see this as an inconsistency with the management's previous statements, even though they likely didn’t plan for it and had to react. This is a blow to my thesis that the majority of franchisees see the light at the end of the tunnel through the new POS and other initiatives. I can't say for sure whether it’s a real signal or just noise, but I've decided to accept less inconsistency in my investment cases, as I typically don’t stay invested for more than 3-4 quarters.

What's interesting is that the IR started reaching out to investors to initiate conversations, rather than the other way around. Based on my purely anecdotal evidence, that’s not a good sign. However, you can look at this from two perspectives. Sometimes, I also view it less critically, interpreting it as the start of telling the story and Regis was rather quiet so far

I sold all my shares in Q4 but will likely buy back a position if my concerns about same-store sales prove to be unfounded after the quarterly results.

MIND 0.00%↑ Mind Technology

As some of you might have expected, I have mixed feelings about the success of MIND. I did a write-up in May, but sold most of my MINDP shares after the first run-up and sold the MIND shares before the stock skyrocketed. However, I can assure you that I'm very happy this case worked out as initially planned, and many people I know benefited from the gains.

For me, this has always been a special situation around the preferred shares, as I didn’t have trust in the management that led the company for such a long time without gaining traction. Since I needed cash to purchase another position, I sold all my shares.

That was the main reason I sold, in addition to not expecting the backlog to be replenished, especially since the news flow had dried up. The quarterly results turned out exactly as I calculated them based on the management's comments about revenue recognition and SG&A. I can only guess why the market reacted so positively. Maybe it was simply that no one else did the math (I doubt that), or maybe investors were hoping the backlog would at least remain at the same level. But there’s no need to discuss this further. I wasn’t expecting this, and that’s it. Congrats to all of you who are still invested.

Overall Reflections

When I look back at 2024, several changes stand out.

I held significantly more stocks compared to before. In 2023, I maintained a very concentrated portfolio, but the start of this year with $KINO.L and $JOB taught me that I don’t want to be that concentrated again.

This was also my first full year as a full-time investor, which gave me plenty of time to research stocks. As a result, I was able to stay updated on more developments within companies and explore a wider range of new stocks.

I expect to stick with this approach in 2025, and it will likely take time before any single stock becomes a large part of my portfolio.

I had a very high portfolio turnover this year. One reason for this was that I frequently traded premarket to capitalize on news flow. Regis was a prime example—I sold all the positions I could premarket when news of the refinancing broke and then bought Regis. That alone significantly contributed to the high turnover.

In general, I tried to anticipate stock price movements for several stocks I never mentioned here, as I felt they were not, and likely never would be, worth discussing. On average, this approach worked well. However, my last trade went wrong and resulted in a 10% loss.

As a result, I’ve decided to use this approach more selectively in the future, focusing only on anticipating movements in stocks I already know well and that meet certain quality criteria.

As this was my first full year as a full-time investor, I found myself facing challenges similar to those that investment funds encounter. Specifically, I had to allocate funds from my portfolio to cover certain private expenses and to fund new investment ideas. This is a dynamic you can only fully understand when you're in the situation yourself.

It didn’t feel bad, but it did make me scrutinize every position more closely, knowing that my capital is finite. That said, this didn’t lead me to cut back on personal spending. In fact, the opposite was true—I bought a new car, had my house painted, and installed solar panels on the roof.

I should note that I’ve always been mindful of private spending, and I still am. However, it took me a long time to reach a point where I felt confident that I had enough capital and knowledge to pursue this full-time. During that process, one could argue that I underspent in certain areas of my life.

And yet, I felt the urge to start something new in addition. A friend of mine once said that once the 'self-employment virus' takes hold of you, it’s impossible to shake off (I’m not sure if this phrase works as well in English as it does in German, but that’s what he said! 😄).

With that in mind, I decided to start another venture, but in a sector that aligns closely with my investments. It’s likely you’ll hear more from me about this soon, as it’s deeply connected to the way I invest and conduct research.

In general, I want to say that this year was outstanding in terms of performance and how I refined my investment process. A large part of that improvement is thanks to the discussions I’ve had with my friends Sebastian, Sven, and Paul. I’m 100% certain my performance would have been significantly worse without the extensive conversations we’ve had about stocks and your investment cases in general.

I truly hope to begin 2025—and every year that follows—with more humility than I did in 2024, as I believe humility is a quality often underestimated in investors. It allows you to embrace uncertainty, avoid overconfidence, remain open to learning, appreciate collaboration, and keep your ego in check.

Congratulations on the great result. I like the podcasts, reading the reports on X and here. I wish you all the best for the new year and look forward to the upcoming news. Thanks.

Excellent article. Thank you...